There are many tools to increase traders’ profit potential. For example, leveraged trading on Binance allows investors to increase their capital by using borrowed funds. The article discusses how this financial instrument works, its advantages and risks.

What is leverage on Binance

This tool provides traders with the opportunity to manage amounts that exceed account balances. Investors can open large positions by investing a smaller amount of capital.

Leverage allows traders to strengthen their buying power and potentially increase profits.

Princip činnosti

Traders can use trading capital that exceeds the account balance by tens or hundreds of times. The leverage ratio determines the amount of leverage. For example, if the ratio of 1:10 (10x) is set, the user will trade with an amount 10 times higher than his balance.

When using the tool, the position will be automatically closed if the asset price changes by a certain percentage. It depends on the set coefficient. If a trader wants to open a $100 dollar long on BTC/USDT with a margin increase of 10x, the cost of entering the transaction will be $1000. Bitcoin only needs to fall by 5% for the position to be forcibly closed.

5020 $

bonus pro nové uživatele!

ByBit poskytuje pohodlné a bezpečné podmínky pro obchodování s kryptoměnami, nabízí nízké poplatky, vysokou úroveň likvidity a moderní nástroje pro analýzu trhu. Podporuje spotové i pákové obchodování a pomáhá začátečníkům i profesionálním obchodníkům díky intuitivnímu rozhraní a výukovým lekcím.

Získejte bonus 100 $

pro nové uživatele!

Největší kryptoměnová burza, kde můžete rychle a bezpečně začít svou cestu světem kryptoměn. Platforma nabízí stovky oblíbených aktiv, nízké poplatky a pokročilé nástroje pro obchodování a investování. Díky snadné registraci, vysoké rychlosti transakcí a spolehlivé ochraně finančních prostředků je Binance skvělou volbou pro obchodníky na jakékoli úrovni!

Before liquidation, the trader receives a margin call. This is an exchange warning when the level of margin or collateral in the client’s trading account falls below the minimum value.

It is necessary to have a clear understanding of how leverage works on Binance. The tool can become a reason for increasing losses.

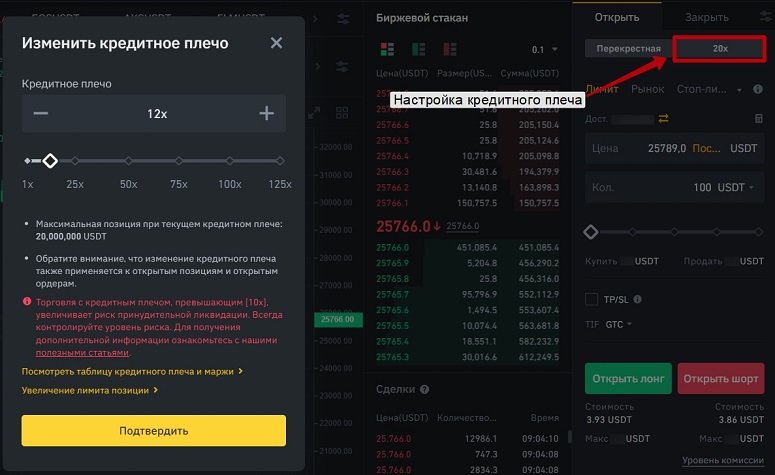

Setting

Traders set the coefficient manually. It is different for each trading pair. Instructions:

- Go to the “Futures” section in the site’s header.

- In the trading terminal, click on 20x on the right and set the coefficient. The minimum value is 1x. The maximum depends on the selected asset. For example, for BTC/USDT there is a limit of 125x.

- Click on the “Confirm” button.

- Specify the purchase price and the amount in USDT.

- Open long or short.

Before creating a position, it is important to make sure that the leverage is set correctly. For new users (account registered less than 60 days ago) there is a maximum limit of 20x.

How to start trading on Binance

Leverage is an important tool that allows you to effectively utilize the available capital. It helps traders maximize their opportunities in the futures market and margin trading. To utilize this tool on Binance, you need to take a few steps:

- Register an account on the platform and confirm your identity. The loan rate and the loan limit depend on the level of verification.

- Deposit cryptocurrency to the balance of the exchange. This can be done by transfer from a non-custodial wallet or with a bank card on the P2P platform.

- Now it is necessary to replenish the futures account. To do this, you need to open the “Wallet” section on the Binance website.

- Click on the “Transfer” button.

- In the upper line, specify “Fiat and spot”, in the lower line – “Futures”.

- Select a coin and enter the amount.

- Click on the “Confirm” button.

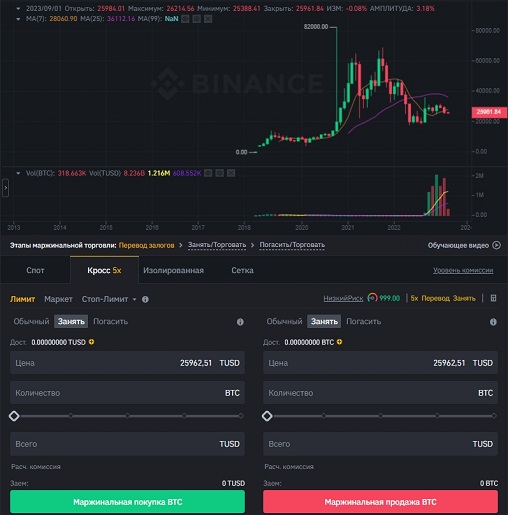

Opening a margin account

Before you can start trading with borrowed funds, you need to set up an account. Here is a simple 3-step guide to opening a margin account on Binance:

- Register or log in to your account on the exchange.

- In the top horizontal menu, open the “Trading” section and go to the “Margin” section.

- Take a test by answering 6 questions. This way the administration will make sure that the user knows what he is dealing with.

Coins in the account will be used as collateral. Their number determines how many tokens the trader is allowed to borrow. Binance offers 5x leverage by default. A user can get a maximum of 4 times the amount they have on their balance. After funding the account, assets can be requested:

- Go to the margin trading terminal.

- Select a token pair.

- Specify the type of margin. Cross (the entire account balance is used as collateral) and isolated (you can allocate a certain amount for one position and thus minimize risks) are available.

- Open the “Borrow” tab.

- Specify the amount of the transaction.

- Confirm the transaction. The borrowed assets will be transferred to the margin account.

Now a rate is applied to the position. It is calculated every hour. When repaying the loan, users first of all pay the interest.

Assets earned from further trading will automatically be used to repay the debt. To close it, you need to go to the margin wallet. Then you should click on the “Repay” button in the upper right corner.

You can close the debt in installments.

Provize

Binance charges transaction fees for deals with borrowed funds. More details – in the table.

| Type of trade | Commission amount | Discount when using BNB |

|---|---|---|

Each position is also subject to an interest rate that depends on market conditions, supply and demand for the trading pair.

Tactics for leveraged trading

Trading with leveraged funds can bring big profits, but it also increases losses. Here are a few tactics that can minimize the risks:

- Set a strict limit on the leverage ratio. The location of the liquidation price depends on its value.

- It is not recommended to invest all available money. Experienced investors increase the position size gradually. This allows you to evaluate the market and make sure that the deal is really profitable. It is necessary to leave a reserve in case of a sharp jump in the price of the asset.

- Place orders. Stop-loss will close the position if the market starts moving in the opposite direction. This will minimize losses and protect investments. Take profit helps to lock in profits as soon as the price reaches the set mark. This maximizes gains and limits potential losses.

- Avoid making decisions based on emotions. You need to stick to your trading plan and strategy even if the market starts moving in the other direction.

- Monitor your trades regularly and analyze the results. Investors should be willing to make changes in strategy to reduce potential risks.

- Leveraged trading on Binance needs to be done with some knowledge. Traders need to apply technical analysis, study price charts and use indicators.

Risks and Pros of Leveraged Trading on Binance

With leveraged funds, users can make potentially high profits. Margin trading is useful for diversification. Among the pros are also a large number of coins, securing the loan with different assets, voluntary locking and insurance. However, you need to examine all the risks before you start trading:

- Potential loss of funds. If the market starts moving against the trader’s expectations, his position will be liquidated.

- Leverage requires obligations to repay debt and pay interest. If the user is unable to repay the money, he or she will face financial problems.

- Trh s kryptoměnami je velmi volatilní. Unpredictable price movements can lead to losses.

A large selection of pairs for trading

There are many coins represented on Binance. More than 600 pairs are available for trading with borrowed money. The table lists some of them.

Users can choose cryptocurrencies that suit their investment strategies and goals. Binance regularly updates the list of available assets.

Trading pairs have their own peculiarities in terms of volatility and liquidity. Analyzing coins will help optimize profitability.

Provision of different assets

This is another advantage of the platform. Traders can deposit different coins as collateral using the cross margin mode. For example, the exchange allows you to borrow ETH and add collateral in BTC, BUSD, DAI, RUB, EUR and other assets. This gives users more flexibility in the process of trading and owning tokens.

Voluntary lock-in

Leveraged trading is a risky endeavor. Inexperienced traders try to “recoup” their losses after a failed trade by entering a new one with a higher ratio. This usually results in the loss of all funds.

Voluntary lockout disables a trader’s access to margin trading for a certain period of time. The function can be set for 1 or 3 days, 1 week.

The investor will not be able to disable the voluntary blocking until the specified period expires.

The function can be activated in margin trading. To do this, you need to:

- Go to “Wallet” and then to the “Margin Account” section.

- Click on the “More details” button in the upper right corner.

- Click on the caption “Voluntary borrowing freeze”.

- Set the account freeze period.

- Click on the “Confirm” button.

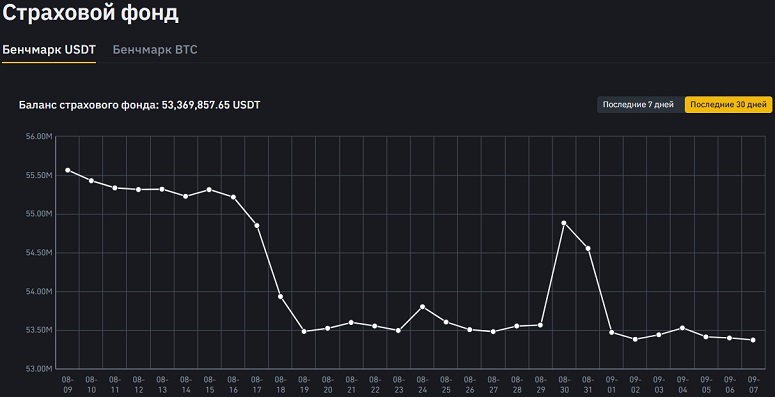

Insurance

The Binance Margin fund compensates for losses on accounts that face liquidation or do not have sufficient collateral to repay the debt. The insurance is generated from commissions earned from margin transactions. As of September 2023, the size of the Binance Margin fund is over $50 million.

Často kladené otázky

📌 Can commissions be lowered?

Binance uses a tiered structure when charging fees. Their amount depends on the status of the client. Large traders at VIP 1 level (monthly trading volume over 15 million BUSD) pay 0.008% for placing leveraged orders, while VIP 3 (25 billion BUSD and above) pay 0.0030%.

📢 What should I do if I receive a margin call notice?

It is necessary to deposit additional funds into the futures account. If the user does not replenish the account, it will result in liquidation.

⚡ What is margin?

It is the amount of money a trader puts in to open a position.

🔥 During liquidation, will all coins in the account be destroyed?

If cross margin was used, the investor will lose all of their savings. If isolated, only the allocated assets will be liquidated.

🔔 Where will the margin call notification come?

The system will send an SMS and push to your phone, a letter to your email. Also the notification will be displayed on the website in the futures section.

Is there a mistake in the text? Highlight it with mouse and press Ctrl + Vstupte.

Autor: Mgr: Saifedean Ammous, odborník na ekonomiku kryptoměn.