In the summer of 2023, Russia launched a third form of state currency. The digital ruble is still being tested by Russian banks and companies. More than 30 legal entities in 11 cities took part in the program. For example, in October 2023, the Moscow Metro was connected to the project – you can buy a “Troika” travel card for virtual money. The government also plans to issue pensions in digital rubles. The Central Bank realizes that the elderly will need time to get used to the innovation. In the article – what is the digital ruble for pensioners in Russia, how the new money works and how it is better than cash.

What is a digital ruble for pensioners in Russia?

In August 2023, in the Russian Federation, the basic law came into force, fixing the legal norms for the introduction of a third form of national currency. The digital ruble (CBDC) will be issued in addition to the existing money (cash, non-cash). But first the new currency will be tested in real conditions.

It will take time to test the functions. The Central Bank plans to put the monetary unit into circulation by 2025. Digital RUB will start to be used to pay for purchases, transfers (including international), transfer by will. In the future, salaries, pensions and allowances will be paid in them. The recipients will open special accounts to which the funds will be transferred.

When it will appear

Many are interested in whether pensioners will be transferred to the digital ruble after the adoption of the law on the third form of national currency. Introduce the virtual RUB money will be gradually. According to the Central Bank estimates, it will take several years for full integration. The official launch is planned for 2025. First, the possibility of settlements between individuals and companies will be opened. After that, pensions and salaries will be digitized.

The Central Bank is considering the possibility of introducing virtual settlements for all types of social payments. Specific terms have not been specified yet. The state needs to prepare the relevant regulatory and legislative framework.

Whether all pensions will be paid in digital money

Virtual money will become an alternative form of payments. The Central Bank assures: there will be no total transfer of all pensioners to digital RUB. Citizens will be able to choose in what format to receive money. Cash payments via the Russian Post and non-cash payments using Mir cards will remain.

5020 $

bonus pro nové uživatele!

ByBit poskytuje pohodlné a bezpečné podmínky pro obchodování s kryptoměnami, nabízí nízké poplatky, vysokou úroveň likvidity a moderní nástroje pro analýzu trhu. Podporuje spotové i pákové obchodování a pomáhá začátečníkům i profesionálním obchodníkům díky intuitivnímu rozhraní a výukovým lekcím.

Získejte bonus 100 $

pro nové uživatele!

Největší kryptoměnová burza, kde můžete rychle a bezpečně začít svou cestu světem kryptoměn. Platforma nabízí stovky oblíbených aktiv, nízké poplatky a pokročilé nástroje pro obchodování a investování. Díky snadné registraci, vysoké rychlosti transakcí a spolehlivé ochraně finančních prostředků je Binance skvělou volbou pro obchodníky na jakékoli úrovni!

Transition to digital roubles

The procedure for transferring pensions to a virtual format was explained by the head of the Central Bank Elvira Nabiullina during the forum “Russia” in November 2023. The regulator intends to use the methodology tested during the implementation of the Mir national payment system. Citizens were not forced to use Russian cards. Pensioners had an alternative – to receive money through the Russian Post or in a bank. However, the authorities introduced a condition. Those wishing to receive their pensions on a card could open only Mir.

According to Elvira Nabiullina, the government plans to go the same way with CBDC. Pension will start to be transferred to the virtual account only upon the recipient’s application. If a citizen does not have an understanding of how to use the new money, they will not be forced to do so.

The Central Bank realizes that elderly people will need time to understand the tool. If a pensioner who does not know the technology receives a payment in CBDC, he or she will be able to cash it in any partner bank.

Right now, 15 financial institutions are connected to the program. This list will be growing.

Difference between conventional and digital payments

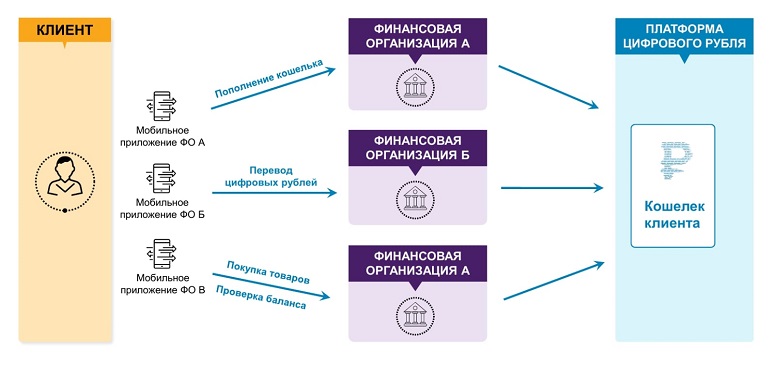

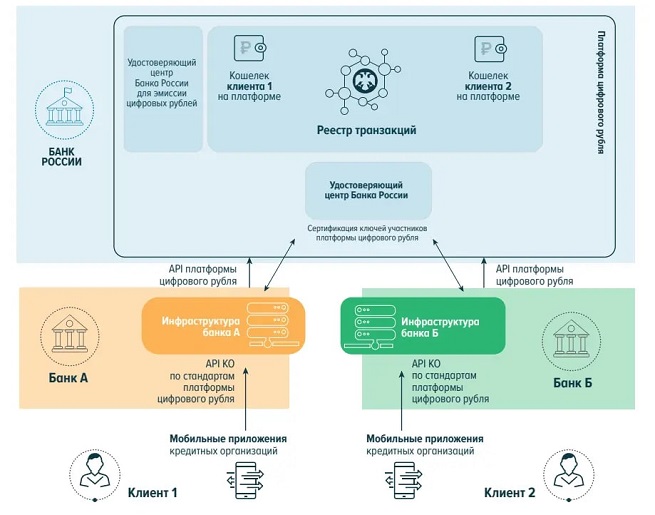

Pensions in virtual money will be credited to separate accounts. They will be opened by banks that have joined the program on the platform of the Central Bank. Virtual RUB can be used in the same way as non-cash money – to transfer money and pay for purchases.

The difference is in the more advanced protection of virtual money. Each RUB has a unique code that allows you to track the movement of funds. This makes fraudulent actions more difficult.

If attackers force a pensioner to transfer money to a fake account, law enforcers will be able to easily trace the transaction.

Another difference between virtual rubles and non-cash rubles is the technology of issuance. The former are issued by commercial banks, while the latter – only by the Central Bank. In fact, non-cash RUB are records on electronic accounts that customers own specific amounts. Banks can use them at their discretion. Virtual RUB are stored on the regulator’s servers. Commercial banks do not have access to them. Additional features of the new money and their differences from virtual money can be seen in the table.

| CBDC | Cashless money |

|---|---|

| Does not accrue interest on the account balance | It is possible to receive interest income on the deposit |

| To cash out, you will need to first transfer the money to a card or bank account | Pension payment is received on the card. Money can be withdrawn at any time. |

| Security is guaranteed by the Central Bank. Each monetary unit is embedded with a code that can be traced. | The funds in the accounts are protected. But fraudsters have many well-tried ways to steal. |

Who will receive a digital pension in Russia in the first place

There is no talk yet of a mass transition to virtual settlements. The first to receive digital pensions will be able to clients of financial institutions connected to the program. In 2023, these are Sberbank, VTB, Alfa-Bank, Tinkoff and 9 other institutions. The list will gradually expand.

Indexation of pensions

The Pension Fund performs regular recalculation of payments to citizens, taking into account inflation. After the introduction of the third form of RUB, the procedure will remain unchanged. Pensions will be indexed automatically, regardless of the method of receipt.

What problems there may be with payments

Many pensioners may have difficulties in mastering technology. Therefore, the government is developing support and training measures for the elderly. For example, a smartphone is needed to connect to the Central Bank’s platform and conduct transactions. However, many senior citizens use button phones. They can receive pensions from partner organizations or the usual way. Other potential problems:

- The regulator does not rule out security risks in online transactions. Pensioners should be informed about protection measures – responsible storage of access codes and personal data.

- Errors in data exchange may occur. Financial organizations will need to establish technical interaction.

Pros and cons of pensions in digital format

Cash payments in a new format can be useful for customers with computer literacy and access to the Internet. Difficulties will arise due to the lack of necessary skills and devices. The pros and cons of the digital ruble for pensioners can be compared in the table.

| Výhody | Nevýhody |

|---|---|

| There are no commissions for transfers | A wallet for the national currency can be installed only on a smartphone |

| You can make purchases without access to the Internet | Do not charge interest on the account balance |

| Money is reliably protected from fraud. Transfers can be traced. | Difficulties in withdrawing cash. First you have to transfer money to the card. |

| Money is stored on the Central Bank’s platform and is protected from bankruptcies of intermediary organizations | Requires knowledge of the work of online services |

| You can quickly transfer funds to any card |

Často kladené otázky

📢 How can I opt out of pension transfer to CBDC?

To receive payments in the new format, you need to write an application to the bank. Pension cannot be transferred to CBDC without the client’s consent. Therefore, no special waiver is required.

⚡ Is CBDC a cryptocurrency?

The third form of national monetary unit is created using blockchain technology. However, it is a fiat currency issued by the government and backed by its economy.

✨ Can I deposit money into the virtual wallet where pension payments are received?

Yes. The money can be deposited via a mobile application or at a bank.

📌 What should I do if I have lost my wallet password?

You need to contact the bank to restore access. You will need to confirm the right to own the account.

💳 How to transfer virtual pension to a savings account?

First, you need to send funds to a regular bank account. After that, you can open a deposit in non-cash RUB.

Chyba v textu? Označte ji myší a stiskněte Ctrl + Vstupte na

Autor: Mgr: Saifedean Ammous, odborník na ekonomiku kryptoměn.