Trading digital assets can bring an experienced trader a lot of profit. This is due to the sharp price changes that occur in a still rather low-liquid market. To find a profitable entry point and earn on the difference of cryptocurrency rates help special trading strategies. There are different tools to benefit from the movement of quotes. The trader needs to create an account on the exchange to open positions through the terminal. It is necessary to learn how to use technical analysis tools and understand the data. Although cryptocurrency is a new and exciting industry, it carries high risks.

How the exchange rate is formed

The principle that determines the current value of digital money is supply and demand in the market. If there are many sellers of coins, and there is no shortage to buy, quotes will fall. And vice versa, with limited supply, currency holders try to get the highest possible price. The issuance of digital assets is embedded in the blockchain algorithm. Some, such as Bitcoin, have a fixed maximum issue (21 million coins). Ethereum, for example, doesn’t have a limit, but the network uses a coin-burning mechanism to prevent the volume from growing too large and to slow inflation. There are other factors affecting the market:

- News. If a cryptocurrency receives support in publications, the number of people willing to buy it increases. Negative information sows panic among investors and stimulates sales, lowering the rate.

- Actions of large players. In low-liquid markets, a group of traders with large capital can artificially create supply and demand by managing the value of an asset. On the stock exchange, this is monitored by securities commissions, which do not allow manipulation. The crypto market is not regulated, so such actions are likely.

- Legal status. Countries periodically introduce different rules for the circulation of digital coins. Norms aimed at legalizing investment in cryptocurrencies lead to market growth.

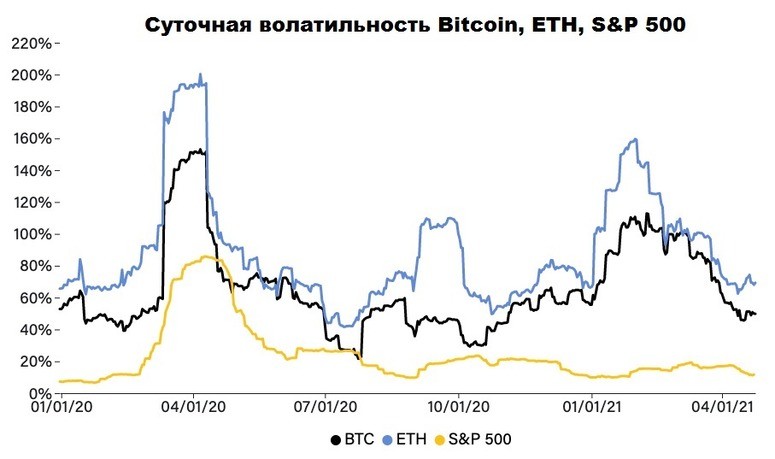

Volatility of cryptocurrency rates

The rapid change in the value of an asset in a short time is a problem faced by investors and traders, as it is difficult to predict in advance. There are several factors that explain why this happens.

| Reason | Description |

|---|---|

| Liquidity | The ability of the market to meet supply and demand at the fairest possible price. A shortage of sellers or buyers causes severe volatility. |

| Capitalization | The higher the market value of an asset, the more difficult it is for a small group of investors to put pressure on it. This requires a large amount of capital. |

| Collateralization | Because cryptocurrency is not tied to real physical assets, it is difficult to estimate their objective value. |

Increased volatility and lack of liquidity can create a dangerous combination because both factors feed each other.

The volatility of cryptocurrency exchange rates comes from different perceptions of intrinsic value as a means of saving and a method of transferring value.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

Storage is the function by which an asset becomes useful in the future.

It can be held on to and later exchanged for some good or service.

Transfer of value is any object used to transfer ownership in the form of assets from one party to another.

Experts agree that the volatility of the digital money market falls with the growth of capitalization and the influx of new participants. Having passed the stage of formation, price fluctuations will probably come to the average values of the stock market, and it will become more difficult to make money on the difference in cryptocurrency rates.

How to capitalize on cryptocurrency rate differences

Market participants capitalize on diverging prices of digital assets. Traders use spreads to buy coins at a low rate and then sell them at a higher rate. This is called arbitrage. There are 2 main types:

- Inter-exchange. This method involves buying a token on one platform and transferring it to another where it trades at a higher price. For example, if the value of BTC on Binance is higher than on Kraken, you can buy it on the second platform and sell it on the first.

- Intra-exchange. The approach is realized within a single platform. Triangular arbitrage uses the price difference between trading pairs. For example, a trader can exchange ETH for BTC, BTC for XRP and XRP back to ETH.

Usually, arbitrage opportunities are provided by less popular coins. Such assets are very volatile. However, this adds risk. The user will lose money if the price goes the other way. When searching for spreads, the following factors are taken into account:

- Fees. Exchanges charge fees for depositing and withdrawing cryptocurrencies, as well as for placing orders. Sometimes fees make arbitrage exchanges unprofitable.

- Verification. Some crypto exchanges have strict identity verification procedures. The process can take up to several days.

Potential profit. The amount a trader will receive as a result of the exchange may be insignificant. In order to arbitrage with greater profits, it is necessary to increase the volume of trading.

Effective modern tools for trading

In trading, it is necessary to use various resources to evaluate and predict the movement of the cryptocurrency exchange rate. Exchanges have terminals for transactions, the functionality of which includes indicators for technical analysis:

- OBV – connects trading volumes and price changes. The beginning of a trend is indicated by a sequence of peaks. An uptrend is expected if each peak and trough is higher than the previous ones, with a falling trend – vice versa.

- MA (Moving Average) – calculates the average price for a certain period of time. Trend indicator in accordance with the laid parameters gives a signal to sell when quotes cross it from top to bottom and vice versa.

- Bollinger Lines – based on 2 moving averages (Moving Average), forms a corridor of price movement. Trading is conducted on the breakdown of one of the boundaries. Crossing from bottom to top is a signal to buy and vice versa.

You can rely only on technical analysis in case of short-term trading on minute charts. In addition to built-in indicators, experienced traders use third-party services to analyze the market and find entry points.

| Name | Description |

|---|---|

| CryptoProGuide.com | Popular site for tracking cryptocurrency rates and their capitalization. Easily search and sort exchanges with analysis and customer reviews. |

| TradingView | A large set of indicators, an idea feed that displays new forecasts of only those authors to whom the user has subscribed himself. Market monitoring with the ability to select by parameters (growth, oversold, capitalization), convenient mobile application. |

| Bitcointalk | The first major cryptocurrency English-language forum. Here you can learn any information about the principles of blockchain, coins, ICOs, discuss forks and future listing of new tokens. |

A working trading strategy for beginners

The plan is necessary for a trader not to waste resources on random haphazard transactions, which are accompanied by losses. Constituent elements:

- A list of currency pairs involved in trading. You should not focus on one asset. It is better to choose cryptocurrencies with low correlation (when the change in one value interacts with another).

- Technical analysis. It is necessary to determine a working system of several indicators to confirm market entry points.

- Stop Losses. The level of loss limitation reduces the mental pressure on the trader and allows not to lose all the capital for 1 unsuccessful transaction.

Earning on the difference of cryptocurrency rates is possible:

- In short-term trading (scalping). This is high-frequency high-speed trading on minute charts with the duration of holding orders from a few seconds. The scheme is profitable at a certain cyclicality of price movement or on the spread between supply and demand. This approach requires a deep understanding of the market mechanics, which is often not typical for novice traders.

- Medium-term trading. Assumes holding a position for a long period of time. The strategy is based on technical indicators (moving average, Bollinger lines) and analysis of resistance, support, trading volume. Trading is carried out not less than 15-minute chart, and the entry signal is considered valid until the opposite one is received. This type of trading is preferable for those who begin to comprehend the basics. An important part of the strategy that allows you to earn on the difference in cryptocurrency rates, can be the method of averaging the position. The amount of investment is divided into several parts and invested gradually. It is allowed to distribute the capital and buy up the asset when it breaks through important support or resistance levels. The profit from the first purchases will cover the probable losses of subsequent orders.

This example shows the general principles of building a trading strategy and is not a recommendation for action.

Pitfalls

Even with a profitable plan, a trader can lose capital. Technical and fundamental analysis were developed for the stock market, where sharp price fluctuations are considered to be very rare. Therein lies the first problem of trading.

Due to high volatility, indicators can give false entry signals, misleading the user. Fundamental analysis of altcoins can be ineffective due to the strong influence of bitcoin and ethereum movements on the whole market.

A big problem is the security of exchanges from hackers’ attacks. All user data is stored on the company’s servers, and having gained access to them, attackers withdraw money to their wallets.

Margin trading to make money on the bitcoin difference is not a problem in itself, but in inexperienced hands leads to a rapid loss of all funds. Using borrowed money, a trader can open large order sizes, many times exceeding his own capital. In case of a positive outcome, the trader will get a quick profit, but in case of a negative development of events, the market movement in 10% of cases will lead to the loss of all funds.

Psychology is inseparable from trading. Losses arising in trading make even the most experienced market participants nervous and doubt their decisions. Exiting a profitable position early and unwillingness to close a losing strategy is a manifestation of low psychological stability.

The best exchanges for beginners

When choosing a trading platform, you should pay attention to such criteria as:

- User reviews.

- The number of currency pairs.

- The volume of trading.

- The size of commissions.

Frequently asked questions

🤖 Can I use trading bots?

Yes, but not all of them. If they do not give an advantage (for example, in the speed of opening trades), it is not prohibited by the rules of exchanges.

❓ Can trading commissions be reduced?

Yes. The exchanges have loyalty programs for holders of native exchange tokens. The more such assets a client has, the lower the fee for making transactions through the platform.

💰 How many times will profit increase with margin trading?

It depends on the leverage. For example, at x10, the income will be 10 times higher than opening without leverage.

📱 Is it possible to trade cryptocurrency via smartphone?

Yes. Almost all major exchanges have mobile apps with a terminal for making trades.

📝 What is arbitrage?

A method of making profit due to the difference in rates of one cryptocurrency on different exchanges.

📚 What is spread?

The difference between the buy and sell prices. When opening a position there are 2 values: for a long position it will be slightly higher than the market price, for a short position it will be lower.

Is there a mistake in the text? Highlight it with your mouse and press Ctrl + Enter.

Author: Saifedean Ammous, an expert in cryptocurrency economics.