Distributed registries are used not only in the cryptocurrency sphere. Developers create a variety of projects using blockchain. Decentralized technology allows them to improve their products. For example, thanks to the use of blockchain in insurance, entrepreneurs can freely refuse intermediaries and provide transparent services. Traditional databases do not provide businesses with such resources.

Opportunities for blockchain technology in the insurance industry

Distributed registries can simplify many tasks. For example, the application of blockchains in the insurance niche makes the industry more transparent and reliable. The technology also opens up new opportunities for entrepreneurs and users.

| Advantage | Brief description |

|---|---|

| Reduced commissions and fees | Transactions in a decentralized network are cheaper |

| Increased speed of insurance agencies | Blockchain simplifies transactions, reduces the impact of the human factor (slow preparation of contracts, errors in documents) |

| Reducing risks and improving user experience | Smart contracts, in which the terms of the agreement are spelled out, are automatically executed when an insured event occurs |

| Reducing the insurance market’s dependence on intermediaries | Each participant has access to transactions through a decentralized offering interface. Intermediaries can work exclusively within the framework of the project’s partnership program. |

Also, blockchain in insurance helps the industry save up to $200 billion a year in costs. This opportunity is opened up by digital smart contracts. They automate processes and protect data.

Insurance policies

Blockchain simplifies the interaction between parties to a transaction in an online marketplace. Within such a blockchain, insurance premiums and claims fees are faster and cheaper. It is also becoming easier to provide customers with direct access to multiple carriers through a single platform.

Index Insurance

Blockchain networks automate all processes. This is facilitated by the use of smart contracts. In digital networks, transactions are calculated by a program rather than manually by company employees. Also, the application of blockchain technology optimizes the insurance of non-standard cases, for example:

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

- A fall in the market for cryptocurrencies and other trading instruments (investments).

- Delayed or canceled flights (cargo transportation).

- Crop failure (agriculture).

Robust fraud protection

Blockchain networks optimize claims processing for insurance companies. Decentralized systems are well protected – they cannot be hacked or accessed by unauthorized parties. Fraud is reduced because blockchains store only accurate information.

Additionally, users of insurance services receive extended access rights to personal information. At the same time, the security of the network is preserved.

Reinsurance

Through blockchain networks, companies in this field and regulators controlling their work freely exchange information in real time. Digital technology also automates risk modeling and audit processes.

Microinsurance

Decentralized platforms help bring service providers and their users together in a single service. Blockchain in insurance gives customers the ability to enter into peer-to-peer transactions – contracts without intermediaries. Decentralized platforms help bypass corrupt bureaucracy.

Customer identification

Thanks to blockchain technology, insurers are able to create and use off-the-shelf solutions for consumer verification. Each document is recorded in a decentralized registry and encrypted using cryptographic methods.

The stored information can be accessed only with public and one-time secret keys. Using them, participants give insurers a limited time to verify documents.

In blockchain networks, only the purchasers of services control personal information. This solution complies with GDPR (General Data Protection Regulation) standards. It also reduces the time and price of customer verification.

Top 5 real-world projects using blockchain

At the beginning of 2023, distributed registries are already being applied in the insurance sector. The most popular projects are:

- Etherisc.

- VouchForMe.

- KB Insurance.

- Preservation / Claims Alliance Chain.

- Blockchain Insurance Industry Initiative (B3i).

Etherisc was founded in July 2016 by Christoph Massenbrock, Stefan Karpischek and Renat Hasanshin. This project is based in the Ethereum cryptocurrency network. After 5 months, Etherisc organization presented a White Paper (technical development plan) to the public.

In February 2022, Etherisc is independently developing decentralized products inside the Ethereum cryptocurrency platform. At the same time, the company gives other projects the opportunity to create a common infrastructure.

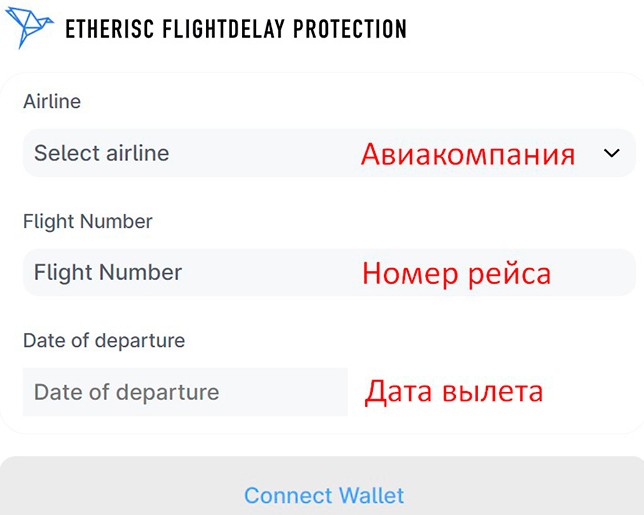

The first blockchain-enabled product in insurance from Etherisc is a decentralized application (dApp) that allows you to receive payments in case of flight delays. Etherisc users buy policies for cryptocurrency and fiat through the application. When an insured event occurs (flight delay), the payout is automatically sent to the client’s account.

Etherisc creators develop their dApps on smart contracts inside the Ethereum network. They are always open source. This solution increases app transparency and user trust. Due to decentralization, there are no conflicts of interest in Etherisc products.

In July 2018, the project launched its own tokenomics. A month later, the native cryptocurrency DIP Token was launched. In 28 days, the developers issued 45.5 million branded tokens.

At the beginning of 2022, the price of DIP is $0.08. The market capitalization of the asset is equal to $16 million. Etherisc cooperates with the Chainlink cryptocurrency project.

The insurance company uses the partner’s blockchain oracles for its decentralized Flight Delay application. Thanks to them, Etherisc verifies and validates the data entered.

The company is also working with ACRE Africa on microinsurance. The partners support more than 250,000 farmers in East Africa. Clients make small contributions of ¢50 each.

In February 2022, Etherisc is developing several programs at once:

- Hurricane Protection. The program will benefit low-income people and small business owners. Smart contracts will be triggered when strong wind gusts are registered within a 30-mile radius of the users’ permanent location, to which automatic payments will be transferred.

- Cryptocurrency wallet insurance. This program will protect customers who have up to $1 million in digital storage. The insured events are theft and hacker attacks.

- Collateral protection for cryptocurrency backed loans. The insurance policy will pay participants up to 100% of the amount of loans issued. Payments are due if the price of the loan recipients’ collateral decreases by 90% or more.

- Social Security. This program will provide low-cost protection against the risks of death or serious illness. Beneficiaries will be able to receive emergency payments.

Another popular company, VouchForMe, was formed by the rebranding of InsurePal. This blockchain-enabled project in insurance has been operating since 2015. VouchForMe is based on a unique concept of social proof. Its essence is to gain social approval. Using calibrated mathematical algorithms, the founders of the insurance company were able to confirm that social proof reduces breaches by 30-70%. As a result, the founders of VouchForMe received a patent for their technology.

The insurance company has one main principle – to give customers discounts on services if they have a financial guarantee from guarantors. As a result, VouchForMe users earn a kind of bonuses for inviting friends or acquaintances.

Guarantors receive platform tokens in return for the financial guarantee. Their contributions are withdrawn by the company if policyholders breach the contract.

VouchForMe is also based on the model of a classic combination of traditional insurance and peer-to-peer endorsement via blockchain. It is backed by a social proof algorithm. The creators of VouchForMe note that this approach incentivizes participants to be responsible.

The third popular organization is KB Insurance. In 2020, the insurance company from South Korea began to cooperate with the telecommunications corporation KT Corporation. Using blockchain technology, the service sends mobile notifications about upcoming payments and contract changes. The partnership with the corporation gives the insurance organization the ability to contact users even if they have changed phone numbers.

Information from the mobile notification service is logged by KISA, the Korea Internet Security Agency. This provides the insurer with proof of delivery of the messages sent. By officially registering with KISA, notifications are given legal status.

In 2020, another popular blockchain project in the insurance industry, the Preservation / Claims Alliance Chain, began operations. Eleven Taiwanese companies have joined the alliance. The idea was supported by the China Commercial Life Insurance Association. The alliance includes:

- Xinguang Life.

- Cathay Property Insurance.

- Yuanta Life.

- Global Life Insurance.

- Fubon Property Insurance and 6 other large niche organizations.

The work of the partners has been approved by the FSC, Taiwan’s Financial Supervisory Commission. The pilot project is aimed at identifying malicious insurers. Thanks to a single blockchain network, the companies in the alliance transmit information to each other. For example, if a conditional client purchases several policies shortly before his death, all insurance companies will know about the fraud attempt. Within the blockchain system, users can only update information once. The smart contract automatically transfers the data to the alliance members.

The fifth popular insurance project is the B3i blockchain consortium of 15 companies:

- Allianz.

- Swiss Re.

- Aegon.

- Zurich.

- Munich Re and 10 other companies.

The companies have created a distributed ledger (DLT). Thanks to blockchain technology, they have established a fast transfer of digital information. The time to send and receive data has been reduced from 2-3 weeks to a few seconds. This solution is developed on smart contracts and automatic validation.

After the launch of B3i, the simplified reinsurance product B3i Re was created. In 2021, the decentralized program received several improvements:

- Increased flexibility and contract lifecycle.

- Multicurrency has been added.

- Introduced graphical overviews of insurance contracts.

- Added endorsement transactions for intermediary businesses.

Frequently Asked Questions

❗ Why is it important to eradicate fraud with blockchain in insurance?

According to an analysis from Coalition Against Insurance Fraud, companies lose $80 billion every year due to the actions of malicious insurers. In order to cut losses, businesses are forced to raise the prices of their services.

🔎 What is P2P insurance?

This service is available on peer-to-peer platforms without intermediaries. The users of the platforms themselves form common mutual aid funds. After the occurrence of insured events, clients of the services receive payments from the reserves of the P2P-platform. The money is transferred to users’ digital wallets.

🧾 Why does blockchain insurance need smart contracts?

“Smart” digital contracts automate processes. Smart contracts make intermediaries unnecessary, which reduces the price of services.

💡 What does Etherisc do?

The project belongs to the niche of index insurance. Etherisc pays compensations (pre-determined amounts) after certain events.

🏦 Why do insurance companies often gather in blockchain alliances?

Businesses use decentralized networks to exchange data. This solution helps prevent fraudulent activities.

Is there an error in the text? Highlight it with your mouse and press Ctrl + Enter

Author: Saifedean Ammous, an expert in cryptocurrency economics.