Digital platforms like Currency.com allow customers to buy and sell virtual assets. At the same time, users can earn good money on trading. But it is important to know the rules of cryptocurrency trading on exchanges for beginners. Otherwise, there is a risk of making unfavorable transactions.

What is cryptocurrency trading

The term refers to exchange trading in digital assets. The main purpose of such activity is to profit from cryptocurrency transactions. Usually users apply the resale scheme – buy cheaper and sell more expensive.

Participants of exchange trading are called traders. They use analysis to determine the current state of the digital economy and open positions (buy assets) for up to 1 month.

How the cryptocurrency market works

April 2022, some users consider digital coins and tokens to be part of the global economy. But due to their specifics, cryptocurrencies belong to a separate financial market. It is worthwhile to understand how it works.

Differences from traditional currency and stock markets

Cryptocurrencies are not like other financial assets. The main differences of the digital market:

- High volatility. Market quotes of many cryptocurrencies are very volatile. Coins of some blockchain projects periodically demonstrate growth of 1000% and higher.

- Low entry threshold. You can buy cryptocurrency on exchanges for as little as $10. But brokers, for example, on the stock market often require large investments of $10 thousand and more.

- Round-the-clock access. Cryptocurrency exchanges work in 24/7 mode. Traditional brokers provide clients with access to different markets at certain times.

And this is only part of the differences. For example, blockchain projects with digital coins solve real problems like lack of anonymity.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

Types of cryptocurrency exchanges

All digital trading platforms work with blockchain, a distributed ledger technology. But they are still divided into 2 types:

- Centralized exchanges (CEX). They are controlled by development companies and regulators (private and public). The workability of centralized platforms is ensured by trading kernels. CEXs charge a service fee for transactions.

- Decentralized exchanges (DEX). Their activity is not regulated by anyone. The workability of decentralized platforms is ensured by smart contracts. DEX also has a commission – it is charged for providing liquidity.

Terms of trading on the exchange

The conditions depend on the types of trading platforms. The main trading conditions on CEX and DEX are presented in the table below.

| Requirements | CEX | DEX |

|---|---|---|

| Create a trading account | ||

| Create a wallet | ||

| Identity verification | ||

| Deposit to account/wallet | ||

| Pay commissions | ||

What influences the cryptocurrency market

Quotes of all tokens and coins depend on 4 main factors:

- Bitcoin price fluctuations. This factor only affects altcoins. Analysts have long noticed that the price charts of minor cryptocurrencies often repeat the pattern of fluctuations in BTC quotes. As a result, when the price of Bitcoin rises, the value of almost all altcoins increases.

- News background. Positive and negative headlines about cryptocurrencies in the media affect the entire digital market.

- Supply mechanism. For example, native cryptocurrencies of networks with a Proof-of-Work (PoW) type consensus algorithm are issued by mining. In this case, the maximum number of such coins is often limited at the program level. And due to the periodic decrease in the emission rate, the demand for coins begins to catch up with their supply rates.

- Improvements in crypto networks. After a successful hardfork of a particular blockchain, the price of its native coin may increase. A failed upgrade, on the other hand, has the opposite effect.

Market trends and cycles

In the world of digital assets, there is a concept of market trends. Market trends are part of natural cryptocurrency cycles. They have four phases. Knowing them makes cryptocurrency trading easier:

- Accumulation. This period is considered the first by default. It comes after the cryptocurrency market has reached its bottom. At the beginning of the accumulation phase, investors make failure purchases – they buy assets at the lowest quotes.

- Growth. This phase is called a bullish trend. During the growth phase, the cryptocurrency market begins to peak exponentially (at an increasing rate). During this phase, the general mood of traders and investors becomes more optimistic.

- Plateau. This period means that quotes reach their peaks. During the plateau phase traders and investors have mixed moods. Sellers start to dominate over buyers. Assets are traded in narrow corridors (quote ranges).

- Fall. This period is called a bearish trend. It is considered the most difficult from a psychological point of view. The drawing of the bearish trend on the charts also has an exponential character.

How to start trading cryptocurrency on the exchange

Before that, you need to learn the basics of cryptocurrency trading for beginners. Without basic knowledge, you can not trade. Otherwise, there are great risks of getting losses.

Basic skills of a trader

For more successful trading on the exchange, you need to have 3 basic qualities:

- Analytical. For successful trading, you need to study the news background of the cryptocurrency market, quote charts and other things on a daily basis.

- Cool-headedness. During trading, you need to remain calm in any situation. High emotionality harms sober thinking and does not allow you to make the right trading decisions.

- Patience. In case of unprofitable investments sometimes you just need to wait a little longer. Also you should not forget about the cyclical nature of the market.

People with the described qualities find it easier to earn on cryptocurrencies. They are able to make the right inferences and do not become so-called hamsters.

Basic principles of cryptocurrency trading

Trading should not be treated negligently. Crypto trading requires responsibility and discipline. For this reason, trading has the following basic principles:

- Always have a reserve of savings for additional purchase of assets. After investing, the price of the purchased cryptocurrency may decrease. Then it is recommended to buy up the asset in order to level out the losses and increase the overall profit.

- Write out transactions or use exchange reports. You should do this at least once a month. Records and reports allow you to evaluate trading results and adjust current strategies.

- Do not trade with the last or borrowed money. It is difficult to make money on the cryptocurrency market. For this reason, it is better not to take risks or dig a potential debt hole.

- Do not neglect education. Trading cryptoassets is nervous and hard work. It requires diligence and constant learning.

- Recognize losses. Unwillingness to lose savings and excessively long waiting for growth leads to missing new opportunities. If investments are not successful, it is better to close current positions and choose other projects for investment.

Trading should be based on these principles. Deviations from them increase the risks of capital loss when trading cryptocurrencies on the exchange.

Technical and fundamental analysis

There are 2 main methods of studying the cryptocurrency market:

- Technical. Using this method, a trader mainly studies cryptocurrency charts. Different technical analytical tools and comparison of current indicators allow to identify repeated patterns (patterns), make pictures about current trends, etc.

- Fundamental. This method of study allows you to get information about the real prices and growth prospects of cryptoassets. Fundamental analysis is based on the study and comparison of basic aspects: technical indicators of blockchains, the number of users, their interest in the projects, etc.

Individually, these methods do not give investors a full understanding of the current situation. Technical and fundamental analysis should be used together.

Potential risks

They accompany any cryptocurrency transaction. For this reason, it is important to have an analytical mindset and be cold-blooded. Otherwise, the risks of losing your savings increase and trading literally becomes dangerous.

Cold-bloodedness does not allow FoMO (Fear of Missing Out) – the syndrome of lost profits – to develop.

Starting capital

Its amount does not matter. You can start trading cryptocurrency from scratch or with an investment of $50 thousand. But 1 fact when choosing the amount of the initial investment should still be taken into account – the contribution should not be a pity to lose. The trader should accept defeat in advance – to come to terms with the potential failure.

Portfolio diversification

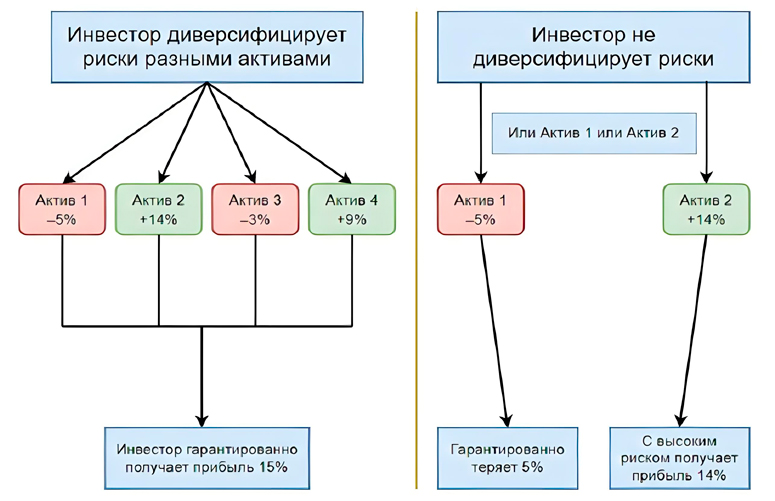

This term means smoothing out the overall risks of investments. Diversification implies the collection of an investment portfolio of cryptocurrencies of different blockchain projects. The range of the final purchase is recommended to make the widest possible (from 10 coins and tokens).

With diversification, the fall in quotes of one cryptocurrency is leveled by the growth of the price of another. However, risk smoothing does not make much sense when buying random altcoins (without studying their prospects). To maximize income, you should analyze projects and purchase only potentially profitable cryptocurrencies.

Cryptocurrency selection

Depending on the trader’s goals, the asset should have certain perspectives. For example, for short-term trading, one can choose cryptocurrencies with upcoming upgrades that the community has a positive opinion about. Such improvements often provoke a rapid growth of quotes.

If you want to make long-term investments, you should study the white paper of crypto projects with a focus on roadmaps. One should not forget about the competence of the development team.

Project ideas should be unique and interesting to members of the digital community. Then their coins can grow in the future.

Choosing a cryptocurrency exchange

Traders have different preferences about trading platforms. But there are general selection criteria. The main parameters of crypto exchanges:

- Reliability. A cryptocurrency exchange must ensure the safety of user’s savings. For example, CEX clients should be able to connect two-factor authentication (2FA) to trading accounts.

- Convenience and intuitiveness. A cryptocurrency exchange should be easy to learn. A busy and poorly understood interface will complicate the trading process.

- Benefits. Crypto platform should not charge unreasonably high commissions. The optimal value of the fee is 0.1% of the transaction amount.

- Asset diversity. A cryptocurrency exchange should offer a wide range of investment instruments. This will allow trading hundreds of digital assets within one platform.

Choice of strategy

There are different ways to trade virtual assets. As of April 12, 2022, there are about 20 cryptocurrency trading strategies.

| Name | Brief description |

|---|---|

| Margin trading | This strategy is considered a high-risk strategy. It involves borrowing from a digital exchange to make cryptocurrency trades. The amount of leverage in Xs reflects the trader’s additional profits and increased trading risks. |

| Scalping | It is considered a very profitable strategy. Some traders earn up to 500% per month on scalping. The point of the strategy is to make short trades with a small profit – up to 2-3%. The time of holding positions is often less than 10 minutes. |

| Long-term investments | Investments of this nature also bring a large income. Long-term investments are market positions opened for a period of 12 months or more. In the long term, the profitability of such investments reaches 1000% and higher. |

| Trend trading | The meaning of the strategy is to buy assets during a prolonged bullish trend. At the same time, trend trading does not provide deals against the direction of movement of market quotes. |

| Breakout of resistance level | This strategy involves buying cryptocurrency assets in an uptrend when the price overcomes an important mark on the chart. After breaking through the resistance level, the growth of quotes often continues. |

The process of trading cryptocurrencies on the exchange

It is associated with the operation of the trading terminal and its functions. Thanks to them and the core of the platform, cryptocurrency trading on the exchange is possible. Through the terminal, traders open orders and make transactions.

Stages

Before trading cryptoassets, you need to undergo training. It consists of 3 stages:

- Registration of a trading account on the exchange or wallet.

- Identity verification (on CEX).

- Deposit funds into the trading account or wallet.

After passing all the stages, all the functions of the selected cryptocurrency exchange become available to users. Otherwise, it will not be possible to fully trade virtual assets.

To register, you need to proceed in this way (using the example of Currency.com exchange):

- Go to the website of the crypto platform.

- Click “Registration” in the header of the service.

- Enter a valid e-mail address.

- Specify a password (1 time) and click on “Next”.

- Click on “Fill out profile” in the opened window.

- Specify the country of residence and citizenship.

- Check the box “I am not a US resident” and click on “Continue”.

- Enter your full name.

- Enter the date of birth.

- Check the box labeled “I certify that I am acting on my own behalf and in my own interest” and click “Continue”.

- Enter your address (according to your residence address) to confirm your identity and click “Continue”.

- Enter a phone number and confirm it.

After the twelfth step, the preliminary registration will be completed and the page of the personal cabinet will be loaded.

Without verification, the user will be able to deposit $1 thousand and make transactions for 15 days.

After the test period, the platform will automatically freeze the client’s cryptocurrency trades on the exchange and require KYC verification.

Verification of identity is done according to the following algorithm:

- Go to the Currency.com website.

- Authorize the account.

- Go to the account settings section.

- Click on “Finalize registration”.

- Upload a photo of the main spread of your passport or other ID.

- Send a scan of your utility receipt (bank statement or rental agreement) to confirm your place of residence.

After that, the uploaded documents will be processed. The verification process on Currency.com takes 24 hours on average.

The client will receive an e-mail to the linked e-mail about successful verification of identity.

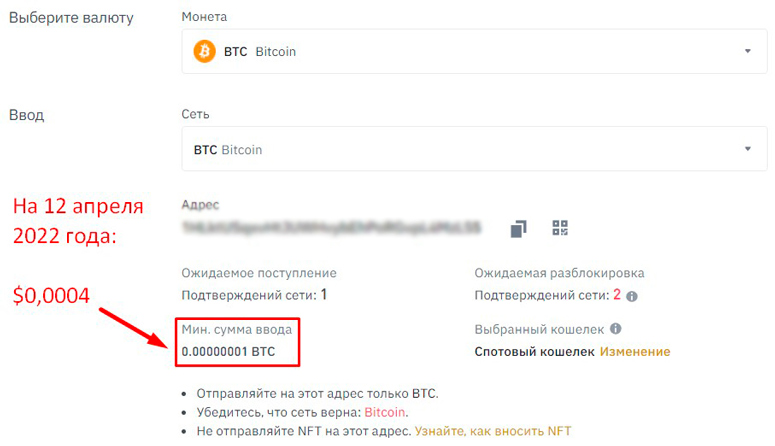

Deposit to the trading account on Currency.com is possible with cryptocurrency and fiat. To make a deposit with digital assets, you need to act according to the following algorithm:

- Open the exchange’s website.

- Log in to your personal cabinet.

- Go to the interface of the trading terminal.

- Press the “Deposit funds” button.

- Select the coin or token of interest.

- Transfer the cryptocurrency from the digital wallet to the received address.

The transaction will then go to the blockchain for processing. The waiting time depends on the speed of fuknzionirovaniya of a particular network.

To fund your account with fiat money you need to:

- Log in to your account on the platform’s website.

- Go to the “Deposit funds” section.

- Choose the method of deposit (bank transfer or via card).

- Follow the further instructions of the cryptocurrency exchange.

- Confirm the deposit.

After performing these actions, the sent transfer will be processed by the processing service (payment system) of the bank. The terms of crediting depend on the card issuer.

Price chart

When trading cryptocurrency on the exchange, you need to monitor the quotes of the assets of interest and purchased. To display the dynamics of prices, the terminals of platforms use charts. Traders can customize them and apply to them technical tools for analysis.

Main types of orders

Different types of orders are distinguished by the method of execution. The following order types are often available on crypto exchanges:

- Market. Orders of this type are executed instantly at the current quotes of the assets being bought/sold. Traders cannot set price levels for transactions on market orders.

- Limit. Such orders are executed when price levels set by users are reached. Limit orders allow for more profitable cryptocurrency transactions.

- Stop-limit. Orders of this type involve users setting 2 price levels. The first one is needed to trigger the trigger that creates the order. The second level is the buy/sell price of cryptoassets. But until the trigger is triggered, users are free to operate with their existing savings.

Also, traders of digital currencies often use orders of Take Profit and Stop Loss types. But such orders are supported by a small number of platforms, and they are not the basics of crypto trading for beginners.

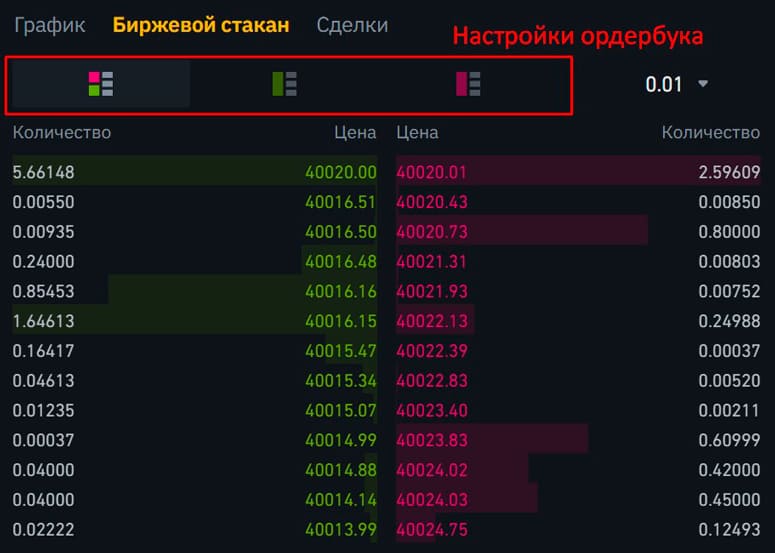

Exchange stack

Orderbook is a table with limit orders of traders active on the platform. Usually, the exchange stack is divided into green and red parts. The colors mean the lists of buy and sell orders.

Information on trading volumes

Trading terminals have built-in algorithms to calculate the amounts of all transactions on cryptocurrency pairs over the last 24 hours. Often this information is displayed in the equivalent of 2 assets. For example, for the ADA/USDT trading pair, the information will be presented in Cardano and Tether.

Transaction History

Users of crypto platforms can track the chronology of the orders made. Often, the corresponding section of the trading terminal is called “Transaction History”. It contains general information about executed orders in chronological order, for example:

- Cryptocurrency pair.

- Transaction type.

- Date of order execution.

- The price of the asset.

- Number of coins or tokens bought/sold.

- Commission amount.

- Transaction amount.

Also in terminals you can set the history period of orders to view. This helps to find deals easier and make profit reports faster.

Trading terminal

This term means an interface for trading. It consists of the following main elements and sections:

- Price chart.

- Exchange stack.

- Information about the trading volume of the pair of interest.

- Transaction history.

- Open orders.

- Window for creating orders.

Trading terminals allow you to buy and sell cryptocurrencies on exchanges. They simplify the interaction of users with the market of virtual assets.

Commissions

Crypto exchanges charge fees from customers for transactions. The amount of the commission depends on the trading conditions of a particular platform. At the same time, popular cryptocurrency exchanges often charge less than non-popular exchanges.

Some platforms provide clients with the opportunity to reduce trading fees for the exploitation of service tokens.

The main types of trading

As of April 12, 2022, there are different cryptocurrency trading. Its main types are presented in the table below.

| Types of trading | Brief description |

|---|---|

| Spot trading | This type of trading involves the purchase of underlying cryptocurrencies with immediate payment of executed orders. After spot trades, buyers receive coins/tokens into their accounts instantly. This kind of trading is a classic. But leverage cannot be exploited in the spot markets. |

| Margin trading | This type of trading involves the use of leverage. It allows you to increase profits from crypto trades. But margin trading is dangerous. Because of wrong decisions, you can completely lose your invested savings. |

| Trading derivatives (instruments derived from the underlying assets) | By April 2022, this type of cryptocurrency trading has become popular. It involves trading in futures, options and other derivative contracts. In this case, the price of derivatives is almost always equal to the spot quotes of the underlying assets. |

Example of cryptocurrency trading on the exchange

Trading digital assets comes down to analyzing and operating orders on the platform. To understand how to play on the cryptocurrency exchange for beginners, you need to understand the example of trading on CEX.

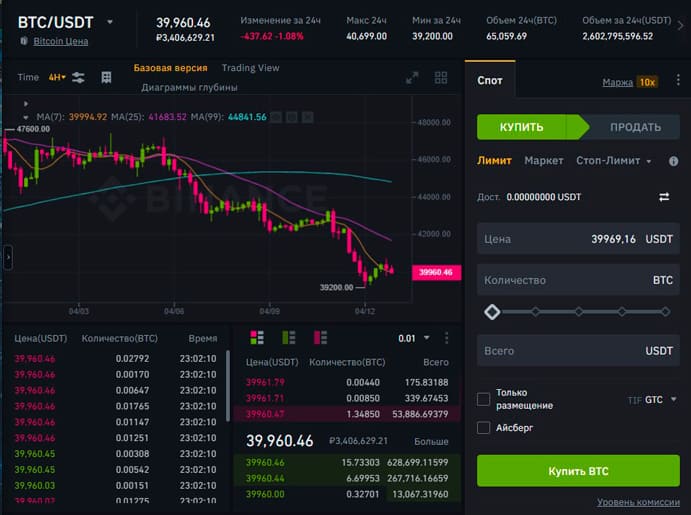

After verifying the identity and funding the account, the user becomes available to trade through the platform terminal. Buying cryptoassets on the market is carried out according to the following algorithm (by the example of the Binance exchange using the ruble – RUB):

- Put the cursor on the inscription “Trading” in the header of the service.

- Click on the item “Spot”.

- Select a crypto pair with the ruble, for example MATIC/RUB.

- Specify the Buy transaction type and Market order type.

- Enter the order amount in rubles.

- Click Buy MATIC.

After the sixth step, the order will be placed in the orderbook and executed instantly. As a result, the user’s account will be credited with the amount of MATIC coins at the market rate.

Cryptocurrency brokers

Cryptocurrency brokers are centralized digital trading platforms like Binance. They allow customers to transact in the digital asset market. CEXs also provide statistical information and various technical tools for analysis.

Bots for trade automation

Trading bots (robots) are software (software) with built-in analytical algorithms. But during trading, they are usually guided only by technical indicators and metrics. It is difficult for programmers to teach bots fundamental analysis.

As of April 12, 2022, there are 2 groups of robots:

- Arbitrage bots. On exchanges, the price of the same assets often differs. Arbitrage, on the other hand, implies reselling such crypto on different platforms for profit. But such trading requires a high speed of action. The problem is solved by arbitrage robots.

- Trading bots. Such software automatically trades the underlying assets within one exchange. The task of trading robots is to buy coins and tokens cheaper and sell them more expensive.

The exploitation of bots cannot guarantee profit. The profitability of trading robots depends on the software settings and the strategy used by the user.

Before operating the software, you need to understand how the crypto market works. For this reason, you can only use bots after gaining extensive positive experience in independent trading.

The best exchanges for beginners

When choosing a crypto platform, a novice user needs to study the following parameters:

- Interface.

- The number of order types.

- Security.

- The width of the range of cryptoassets.

- The availability of additional investment tools and other parameters.

However, the choice of an exchange should be given time. For this reason, the editorial staff has collected the best platforms for beginner traders.

Advantages and disadvantages of cryptocurrency trading

The pros and cons of trading virtual assets are listed in the table below.

| Advantages | Disadvantages |

|---|---|

| Perspectivity. Some cryptoassets allow traders to earn thousands of percent of annual profits. | High volatility. The amplitude of price fluctuations of many cryptoassets is very high. |

| Diversity. As of April 12, 2022, there are more than 8.1 thousand cryptoassets and many derivative instruments. | Lack of established legislation. Every year the governments of dozens of countries adopt new or change old measures to regulate the crypto market. |

| High liquidity. Cryptocurrencies are easy to buy and easy to sell. | High risks. The crypto market is very volatile. Incorrect predictions often deprive rookie traders of almost all their money. |

| Anonymity. The crypto market has methods of keeping personal information and passport data confidential. | Regular training. Part of the time should be spent on mastering new tools and methods of playing on the market. |

| Low entry threshold. You can buy cryptoassets for $1. | |

| Access to trading 24/7. Crypto exchanges work around the clock. |

Tips for beginners

To properly start trading on the cryptocurrency exchange on your own in Russia, you need to follow these recommendations:

- Invest a small amount in the first attempt of trading. The value of the investment should be such that it was not afraid to lose it.

- Choose strategies. Trade plans should be determined taking into account time consumption and current financial goals.

- Create orders for 2-3% of the deposit. This will allow you to avoid major losses when making wrong trading decisions and learn to make profitable deals faster.

- Do not regret the lost profits. FOMO makes you make new rash decisions and worsens trading results.

- Do not be greedy. Profitable trades should be closed. Expecting more income often leads to losses. It is better to make many low-profit trades.

- Accumulate knowledge. Regular study of the market of virtual assets and different instruments improves the results of crypto trading.

Frequently Asked Questions

📜 Do I need to keep a trading journal?

It is a must for achieving positive results in cryptocurrency trading.

❕ What are the best assets to start trading?

For initial experience, you should choose popular coins and tokens like Ethereum and Binance Coin.

✅ Should I trade using trading signals?

You can try it for the sake of experience. However, it is better to analyze the market and make decisions yourself.

❓ How are patterns organized?

Repeated patterns are based on statistics and trading patterns.

💼 Why do I need diversification of my investment portfolio?

It mitigates risks and increases potential returns.

Is there a mistake in the text? Highlight it with your mouse and press Ctrl + Enter

Author: Saifedean Ammous, an expert in cryptocurrency economics.