In the USSR, the entire economic system was under the control of the state. Banks, pension fund and other companies were centralized. In modern Russia, commercial organizations have emerged that are classified as traditional decentralized finance. The creation of blockchains has given a new impetus to the development of DeFi. To understand the advantages of this method of money management, you need to know the differences between centralized finance and decentralized finance. They are characterized by different subjects and level of control.

The concept and structure of the financial system

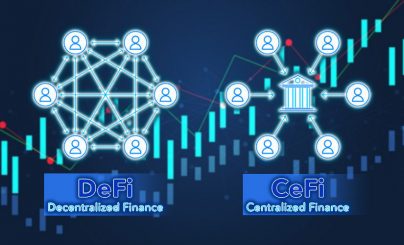

This is a set of mechanisms that allow market participants (creditors, investors, states) to exchange money. Financial services are provided both at the national and global levels. According to the sources of resource inflows and methods of their management, the system is divided into 2 spheres: DeFi and CeFi.

Centralized

Public finances are a key part of the economy. They are controlled by the state and, according to the Budget Code of the Russian Federation, are distributed by levels:

- Federal.

- Subject (region, republic, krai).

- Local (cities and rural settlements).

Budgets are the financial foundation of the management of state authorities. The levels exist autonomously. The local budget is not included in the federal budget, although money is actively moved between them. As part of the centralized system, trust funds are formed for the distribution of deductions from specific types of income, their effective use.

For competent planning of resources, the state makes a consolidated budget. It takes into account the available money at all levels of the economy.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

Thanks to the national budget system, the country ensures the development of the economy, science, pays the costs of the army and municipal organizations. The correct distribution of centralized finances is the foundation on which the conditions for the growth of the standard of living in the country are created.

Features and composition

The centralized financial system consists of 2 groups of elements. They differ in the spectrum of tasks for which funds can be allocated. The first includes the budgets of cities, regions and the country, and the second:

- Pension and Social Insurance Fund. In it, resources are formed by investing and with the help of federal grants. The funds of the organization are spent to pay pensions and various benefits (for example, maternity capital).

- MHI Fund. It receives deductions from citizens – 5.1% from each salary. Money is used to cover the cost of medical services.

The peculiarity of this category of finances lies in the principles of functioning. They provide an opportunity for the solution of large tasks of the state and municipal sector. The principles of a centralized system:

- Constant analysis of receipts and expenditures, tracking of untargeted spending.

- The use of money to solve state tasks and meet public needs.

The main functions of centralization should include planning and control. The state monitors the movement of money, and with the help of the power apparatus stops inappropriate spending.

Decentralized

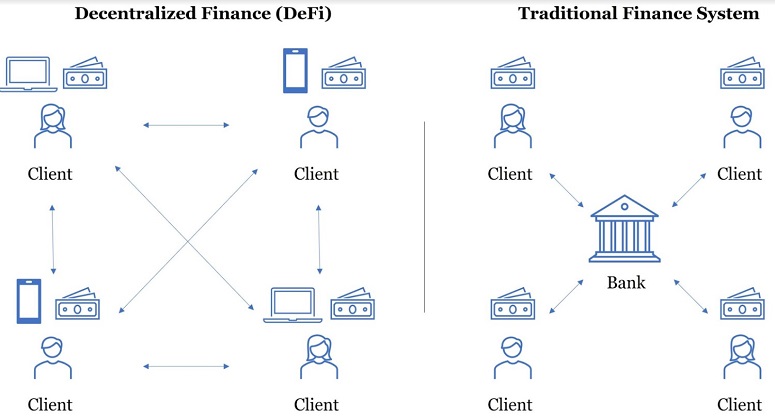

This group of assets forms the basis of the world financial system. Decentralized money differs from state money in that it can be freely used. Law enforcement agencies will not mind if a person spends his entire paycheck for the day on unnecessary things, or the director of a private company buys a car, taking money from the proceeds.

Although the state’s budget system does not manage decentralized assets, it is dependent on them. The country receives almost all financial resources from payments from companies and individuals.

Russia’s total tax revenues for 2022 amounted to 25.2 trillion rubles, while the oil and gas sector brought in only 9 trillion. This explains why the state actively supports business with subsidies and various discounts.

Structure

The system of decentralized finance consists of more entities. This group includes:

- Commercial and non-commercial enterprises.

- Financial intermediaries.

- Population (also called households).

- Subjects operating without registering a legal entity (e.g., sole proprietorships).

Movement of money and international markets

At the global level, finance moves according to the same principles as at the national level. The key international markets are focused on securities and loans. The latter come in 2 types:

- Primary. On it the distribution of money between investors and recipients takes place.

- Secondary. Here debt obligations are sold.

In addition, there is a money market at the global level. It is divided into:

- Interbank. This is a deposit market of financial institutions for short-term unsecured loans up to $1 million.

- Accounting. Here the circulation of bills of exchange of organizations and states, as well as short-term commercial papers is conducted.

Decentralized finance based on blockchain

DeFi are projects created with the help of distributed networks. They perform the same functions as traditional institutions (banks, exchangers, funds), but each member of the community acts as a subject.

The peculiarity of DeFi is the opportunity to participate in the development of the project. In this case, a person does not take a dependent position (unlike employment in a bank), but receives the right to vote.

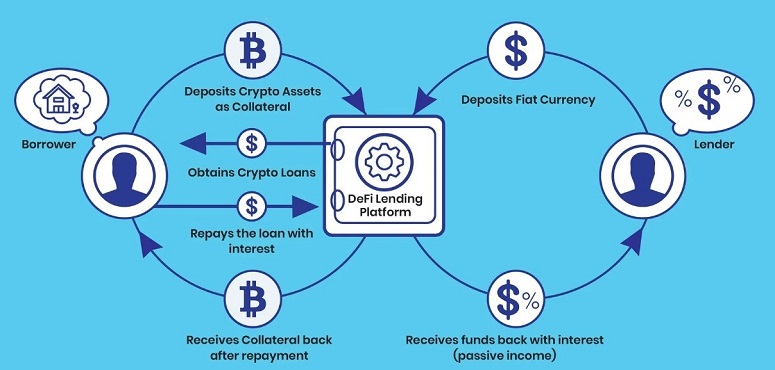

It is worth considering the principle of operation of such platforms on the example of MakerDAO:

- Investors put money into the project and receive management tokens. From their number depends on the weight of the vote and income.

- Borrowers who want to take a loan freeze ETH on a special wallet as collateral. In return, the platform issues DAI stablecoins. Their value is pegged to the dollar.

- DeFi-bank clients repay the amount with interest and get ETH back, and the steiblcoins are destroyed.

- The commission paid by the borrower is distributed to investors.

So far, such platforms are still inferior to traditional ones, but DeFi is actively penetrating new areas. Now it is already being used in the following areas:

- Banking. Customers take loans and make deposits in cryptocurrency.

- Trading on exchanges. On the platforms (Uniswap, PancakeSwap), based on the principles of decentralized exchange (decentralized exchange), there is no single supervisory body. They are considered less safe, unlike Binance, Bybit.

- Tokenization of shares. Owners of securities of a number of companies are able to create a derivative instrument. A share is tied to a digital coin, which is held by a broker. Tokens can be exchanged using smart contracts and stored on wallets. Injective Protocol has such technology.

Differences between centralized finance and decentralized finance

DeFi is actively developing, but it is still very much inferior to CeFi due to less security, limited resources. So far, people have little trust in them, even in the field of cryptocurrencies, choosing platforms by the type of organization, resembling traditional banks: Binance, OKX, Huobi. It is worth examining in detail how centralized and decentralized finance differ in the field of blockchain and digital assets.

| Criterion | CeFi | DeFi |

|---|---|---|

| The money is held on deposit. A third party company is responsible for their safety. | The user has full control over the assets, but if access to the wallet is lost, the money will be lost | |

| The user works with a familiar interface (banking application, exchange website) where he/she performs all transactions with money | Customers of DeFi platforms transfer money using smart contracts, blockchain | |

| Companies can work with both rubles, dollars and cryptocurrency | Services are cut off from the traditional system, so it is impossible to pay with a bank card | |

| Centralized platforms monitor client activity and block suspicious transactions | Market participants must independently verify counterparties and protect finances | |

| Customers cannot verify transactions unless the regulator discloses them | Work is conducted on a transparent and publicly accessible platform |

Frequent questions

⚡ What are the disadvantages of DeFi projects?

Their main problems are low liquidity and slow transaction processing. In addition, there is no support service, because of which DEX exchanges should not be used by beginners.

📌 Is DeFi legal in Russia?

The legal status of decentralized finance on blockchain has not been established in Russia. The Central Bank has analyzed DeFi, but laws related to them have not yet been developed.

✨ How to use Bitcoin in DeFi?

Because of its specificity, the token is incompatible with decentralized platforms. To use the coin, you can buy the stablecoins linked to it (e.g. WBTC).

🔔 Do I need to go through KYC on DEX exchanges?

No. This procedure is only available on CEX platforms.

📢 What is a smart contract?

It is a contract written in the form of a program. It is cryptographically signed by both parties and is executed when certain conditions are reached.

Is there a mistake in the text? Highlight it with your mouse and press Ctrl + Enter.

Author: Saifedean Ammous, an expert in cryptocurrency economics.