One of the problems faced by traders is the inability to determine the entry point to the market and the optimal moment to complete a transaction. Often users are sure that the price of bitcoin and other assets will rise. But at the same time, the trader does not know what level the chart will reach. The holder of tokens or coins runs the risk of being late in opening or finalizing the transaction and losing money. Binary options on cryptocurrency is one of the ways to earn money, in which it is not necessary to determine the points (zones) of trend reversal. It is enough to correctly predict whether the rate of BTC and altcoins will rise or fall. This makes the service popular among novice crypto traders.

What are binary options

Many terms in cryptotrading originally appeared in other markets (stock, currency, commodities). In particular, binary options (abbreviated as BO) have been used by forex brokers for a long time. This is due to the fact that crypto trading is in many ways similar to conventional trading in fiat currencies.

A binary option is a contract (agreement) between a platform (broker) and a client. The user tries to predict in which direction the quotes of the selected asset will change. If his assumption is correct, the broker pays the client a reward. But in case of an unsuccessful prediction, the trader loses the money deposited as a deposit for the BO.

Essentially, binary options on cryptocurrency is a bet between the user and the trading platform. More often, the bet is made on the direction in which the quotes of the token or coin will change. If the trader is confident in the price growth, he buys a put option. The reward is paid on the condition that in the future the rate of the crypto-asset will increase. Call options are used if the trader predicts a decrease in quotes.

In addition to the classic (up-down type), there are other types of BOs:

- “One Touch”. The user receives an award if the chart of the trading pair reaches the specified mark at least once during the contract period.

- “No Touch”. The client makes a prediction that the price of the cryptoasset will remain below or above a certain level.

- “Range.” This type of options is used if the exchange rate of the currency remains at approximately the same level for a long time. The client loses the deposit amount when the chart goes out of range during the contract period.

Advantages of binary options in cryptocurrency trading

The main plus of BO compared to other types of trading is the simplicity of making predictions. It can be difficult for beginners to determine at what moment to buy or sell an asset. Experienced crypto traders use different methods of analysis to find pivot points (levels). It is easier for beginners to determine whether the price of a token or coin will rise. But transactions with BO can also lead to losses. This way of earning money also has disadvantages.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

| Advantages | Disadvantages |

|---|---|

| Fixed amount of profit. Concluding a contract, the user knows in advance what reward he will receive in case of a successful forecast. | In case of an unsuccessful transaction, the trader loses the deposit amount. Binary options on bitcoin are called “all-or-nothing” type contracts. |

| The possibility of quickly doubling the starting capital. The premium for an accurate prediction on the growth/decline of the crypto asset price can reach 99%. This means that after a series of 5 successful transactions (subject to reinvestment), the client will increase the initial investment almost 32 times. | The risk of losing the deposit due to a sense of excitement. As soon as a beginner fails, there is a desire to double the amount of the contract. This can lead to a rapid loss of capital. |

| The possibility of earning both on the growth and fall of quotes. Cryptocurrencies do not always rise in price. Investors lose money when the price of BTC and altcoins falls. Clients of brokers with BO can multiply capital even if there is a downtrend in the market. | High level of fraud. Unlike large crypto exchanges, there are many dubious companies working in the field of options. |

Where is the best place to trade

Usually, cryptocurrency BOs are available on platforms that simultaneously work on forex. On exchanges of digital assets, binary options are less common. In any case, novice traders should look for websites of large and reliable companies.

Alpari

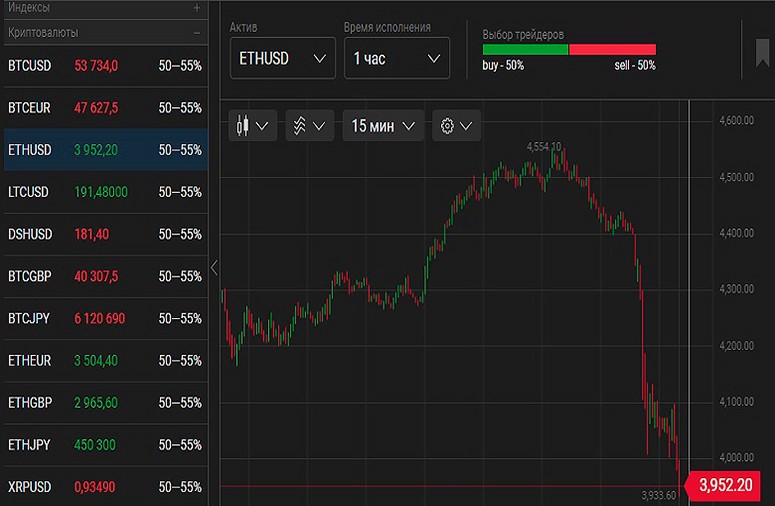

One of the largest forex brokers in the CIS. The options on this platform are called Fix-Contracts. In November 2021, BOs on 11 cryptocurrency trading pairs were available. The only contract type when predicting token and coin rates is up and down.

Olymp Trade

Operations with crypto-assets on the platform are available in 2 modes:

- Forex. Trading is conducted in CFD format (contract for price difference). Reminiscent of regular crypto trading, but the user does not receive real digital currency.

- Fixed Time Trades. Binary options on Bitcoin and other coins. The list of available assets includes BTC, ETH, LTC and a composite altcoin index.

FTX

The crypto exchange launched a prediction market in July 2021. Visitors bet on the occurrence of a certain event. If the prediction comes true, the participant receives a fixed reward. The site trades contracts for volatility (assets, the expiration of which occurs depending on the dynamics of changes in quotes). As of November 2021, there were no predictions on the crypto platform for the growth or fall of the rate of digital currencies. But the contracts for volatility are identical to BOs of the “range” type.

Pancake Swap

A decentralized crypto exchange for direct exchange of tokens and coins. In addition to trading services, Pancake Swap has a prediction marketplace. Visitors make bets on which way the cryptocurrency exchange rate will change after a certain period. In fact, predictions on Pancake Swap are binary options of the up-and-down type, in which both sides of the contract are customers of the platform.

Binary Options Trading Basics

The main principle of earning money on BO is predicting the dynamics of the cryptocurrency exchange rate. The trader needs to perform such actions:

- Analyze the cryptocurrency market. Find the most predictable tokens and coins.

- Analyze the trading pair. Determine in which direction the quotes will change.

- Choose the type of BO and the terms of the contract (term, deposit amount).

If the prediction was correct, the platform will automatically credit the trader with profit after the expiration (expiration of the option).

Popular trading strategies

There is no single way to make money on BO. Traders and analysts have come up with various strategies. The purpose of all techniques is to determine how the price of cryptoassets will change in the near future.

A common mistake of beginners is trading without a clear strategy. Beginners try to guess the dynamics of quotes, listen to intuition or other people’s predictions. Such actions lead to deposit reduction. The reward for a correct prediction is usually lower than the deposit amount that can be lost as a result of a mistake. Therefore, there is no point in working with BO without a clear and proven strategy.

Trend trading

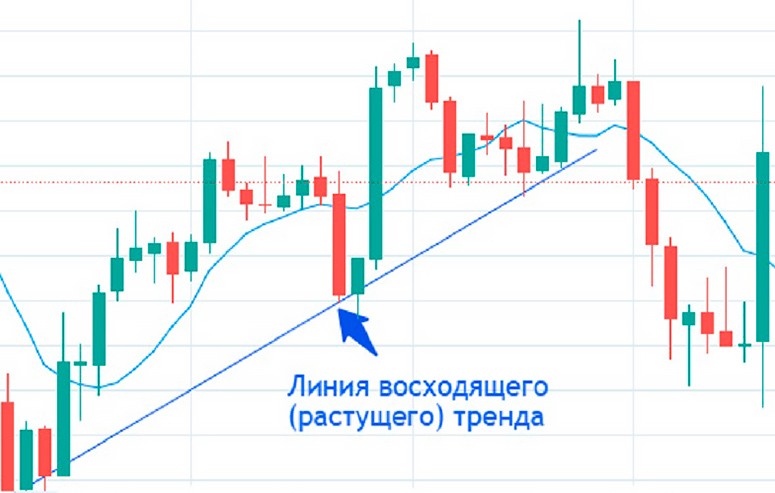

Experienced crypto traders often repeat the saying: Trend is your friend. In English it means “the trend is your friend”. The safest way to make money on speculative operations is to buy an asset at a time when it is steadily increasing in price. Such tools are used to determine the trend:

- Overlaying straight lines on the chart of a trading pair. It is necessary to connect the closing points of hourly or daily candles. You will get a line directed upward or downward. This way you can roughly estimate which trend is dominating the market.

- Moving averages (Moving average or MA). These are indicators that take into account the price change for the previous days. To determine the trend it is enough to add 2 MAs with different periods. If the moving average with a large range is below the “short” Moving average, the price of cryptocurrency will continue to grow.

Buy BO should be bought after the chart touched the line, but did not cross it. If the trend is determined by MA, the growth of quotes is expected when the “slow” Moving average crosses the “fast” one in the direction from bottom to top.

Application of indicators

Many strategies are based on mathematical formulas. Technical analysis indicators are tools in which the future rate is predicted by past quotes. By substituting the formula, you can predict the price dynamics of the crypto asset. In strategies for making money on BO use such indicators.

| Name | Method of application |

|---|---|

| Bollinger Bands (lines) | If the asset chart crossed the upper boundary of the indicator, a call option is purchased. In case of quotes decrease under the Bollinger Bands, a bet is made on the rate fall. |

| Stochastic oscillator (Stochastic oscillator) | If the main line of the indicator rose above the 80% mark and then returned to the center, the trader considers buying put options. It is believed that this position of the Stochastic oscillator indicates a change of trend to a downtrend. |

| MACD | The principles of trading are identical to the strategies with moving averages |

| Williams %R | Helps to determine the overbought state of the cryptoasset. If the indicator line is above the 80% mark, the currency rate can be considered overvalued. In this case, it is recommended to buy put options. |

MA+RSI

For accurate analysis, 2 or more indicators are usually combined. The simplest example of a strategy is the simultaneous use of moving averages and relative strength index (RSI). Usually the analysis is done in this sequence:

- The trader adds 2 or 3 moving averages with different periods and the RSI indicator.

- If the MA lines are below the candlesticks on the chart and the value of the Relative Strength Index does not exceed 50%, the quotes are expected to grow.

- In the opposite case (the moving average is higher), the trader buys put options.

Fibonacci Grid

Allows finding the expected trend reversal points by drawing several horizontal lines on the chart. Each of them corresponds to a certain Fibonacci number (a sequence in which the value of a level is equal to the sum of 2 previous ones). If the chart decreased to the next line of the grid and resumed growth, the trend has changed. If the Fibonacci level is broken, we can expect the rate to fall to the next numerical mark.

How to start trading

Earning on BO consists of such steps:

- Determining the asset to be used.

- Developing and testing a strategy.

- Choosing a broker or trading platform.

- Direct work with BO.

Selecting an asset

Binary options on cryptocurrency differ from similar instruments on the stock market and forex. Tokens and coins are characterized by high volatility. In addition, new crypto-assets appear regularly. Often novice traders have a desire to work with little-known tokens and coins, because their developers promise high returns. But if a beginner plans to use BO, then it is better to refuse to buy unfamiliar assets.

With each incorrect operation, the user loses the amount of the deposit for the purchased contract. A series of several unsuccessful forecasts can lead to the loss of the deposit. Therefore, it is better for beginners to choose the most common and predictable assets. In 2021, such trading pairs could include contracts on BTC/USD, ETH/USD, consolidated cryptocurrency indices.

Strategy selection

It is difficult to find effective techniques for analyzing the cryptocurrency market on the Internet. It makes no sense for successful traders to sell high-quality developments to all comers. Therefore, other people’s trading strategies turn out to be ineffective. To develop a quality methodology, you need to:

- Read informational materials, study the basics of economics and blockchain technologies.

- Register a free account (demo account) on one of the crypto exchanges.

- Try different indicators and ways of analysis, create an effective combination.

- Test the strategy (on demo accounts or trading with small amounts).

A common mistake of beginners is to move too quickly to large deals. After a few successful predictions, the user may think that he has understood all the nuances of crypto trading. Hasty transition to high-risk operations in this case often leads to loss of deposit. Any strategy requires thorough testing.

Choosing a platform

When evaluating a broker or crypto platform, such characteristics are important:

- Service reputation, customer reviews.

- The number of available assets.

- The average rate of remuneration (percentage of profit for a successful prediction).

- Terms of service (minimum deposit, withdrawal methods).

Realization of trading strategy

The situation on the financial markets is constantly changing. Even a successful strategy can lose its relevance. Crypto traders need to monitor the profitability, risks and stop trades if the trade began to bring losses.

A common mistake of beginners is deviating from the chosen methodology because of the desire to earn more. If the forecast turns out to be unsuccessful, the trader loses money. After that beginners may have a sense of excitement and think that the next deal will be lucky.

Such intuitive trading has nothing to do with real market analysis. Therefore, the strategy should be realized calmly and without emotions.

Conclusions

Binary options are a type of agreement between a broker (platform) and a client. Usually, the terms of the contract provide for the payment of remuneration if the user correctly predicts the dynamics of changes in cryptocurrency quotes.

BOs attract beginners with the illusion of easy earnings. It may seem to a beginner that option trading does not require careful analysis. Traders open trades at random, losing capital in the end. There is no single easy and safe method of making money from cryptocurrency transactions. Any transaction can be unsuccessful and lead to financial losses. Therefore, you should choose reliable platforms to earn money, and contracts should be concluded after a competent market analysis, not based on intuition and emotions of a crypto trader.

Frequently Asked Questions

❓ What is the minimum investment for option trading?

Some brokers allow you to deposit from $1. But in reality, it is impossible to make only successful trades. Therefore, you need a larger starting capital for stable earnings.

❗ Is it worth buying signals on BO?

There are services on the Internet where forecasts and ready-made strategies are sold. More often such offers are a scam. If an analyst is able to predict the dynamics of quotes with great accuracy, it makes no sense for him to sell his methodology cheaply.

💡 What is more profitable: regular trading or BO?

The advantage of classical trading is the unlimited amount of profit. If the rate of the asset grows dozens of times, the trader will quickly increase the deposit. But options trading also has an advantage – the size of the loss is limited by the starting price of the contract.

🔎 What is the best way to work: through Forex brokers or crypto exchanges?

The advantage of digital platforms is the availability of other instruments for profit (spot trading, futures, investment services).

🧾 Does the contract duration influence the choice of strategy?

Yes, the shorter time interval (timeframe) the client uses, the more difficult it is to predict the dynamics of quotes.

Is there a mistake in the text? Highlight it with your mouse and press Ctrl + Enter

Author: Saifedean Ammous, an expert in cryptocurrency economics.