Cryptocurrency trading can bring hundreds of percent to your deposit per year. To get such results, you need to spend a lot of time analyzing the market. Therefore, new users often buy the signals of experienced clients. Copytrading on Binance allows you to repeat the operations of top futures traders. Access to the option is provided through the TraderWagon affiliate site. Users select strategies and manage subscriptions. The exchange balance is used for transactions.

Description of what copytrading is

A buy-and-hold strategy doesn’t require much effort and can yield good returns during the bullrun. However, most of the time asset prices spend in a sideways pattern. During this time, investors suffer losses and traders make money.

For successful trading, you need to have a good knowledge of fundamental and technical analysis and follow the news. This is incompatible with other activities. But with the help of copytrading, inexperienced users can repeat the transactions of successful traders on their accounts.

The process is automated, so it takes minimum time. You only need to set the parameter once and run the algorithm.

Why it is needed

The amount of a trader’s earnings depends on the initial capital. You can increase profitability by providing access to your trades to other users for a commission. Copying trades on Binance and other exchanges is beneficial to both parties. The trader receives profit without additional risk, and new clients earn without experience and knowledge of the crypto market.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

Differences from social trading

With this approach, traders share strategies and publish cryptocurrency signals in the public domain. Popular platforms include TradingView, Telegram channels, chat rooms, blogs and forums. Beginners can study the directions of trades and enter them based on the signals.

The results of such trading are often zero or negative, as users combine approaches rather than sticking to one strategy. Every trading system has drawdowns; losses are offset on the profitable side. But new clients drop the approach on a minus series. In addition, the trader may signal late and the subscriber will enter the trade at a worse price.

Unlike social trading, copy-trading is an automated solution. The algorithm opens orders without delay. At the same time, the user is in full control of their account. This distinguishes copy trading from trust management.

Schemes of copying trades

There are no strategies on the market that bring profit in all conditions. From time to time all traders suffer losses. Therefore, it is important to create a source of passive income, and connecting copytrading is one of the easy ways. Available schemes:

- Classic. The user selectively repeats the parameter of the main account. Communication is carried out with the help of social networks. The subscriber independently chooses the level of risk, some transactions can be skipped.

- Mirror. With the help of a special program, all transactions on the strategy are copied. You can work with any deposit and choose the percentage of risk per transaction.

The second scheme is more popular due to its simplicity and safety. Users can analyze the strategy and set the optimal settings. There are several types of mirror copytrading:

- Repetition of the leader’s trades. Users analyze the trading of traders from the top 20 and connect to the best. In this case, the entire deposit is involved.

- Portfolio. Clients choose different strategies. Some of them earn on trends, and others – in the sideways. This allows diversifying risks.

- Copying operations of the top 10 clients. Users divide the capital into equal parts and connect to all popular strategies at the same time. If a trader falls out of the top, he is replaced by a more successful one. Due to the high profitability of most trades, losses can be compensated.

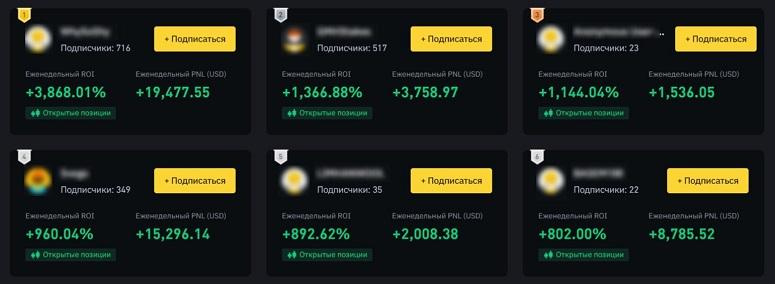

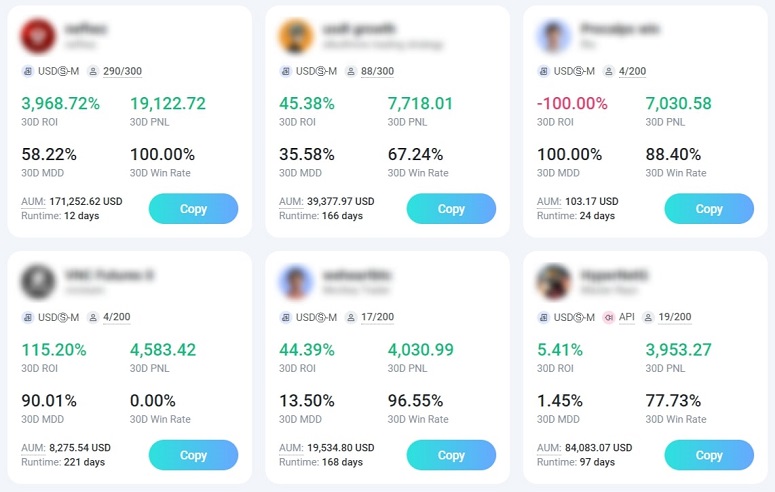

Potential earnings

Traders from the top 10 show profits of thousands of percent per annum. But to demonstrate such results, you need to take high risks. It is possible to work well with a lucky coincidence of circumstances. If the market changes, the trader will lose his deposit. Therefore, it is safer to choose conservative strategies. Profit of 10-15% per month is considered a good result.

Risks

Despite the apparent simplicity of the strategy, not all traders are able to earn on it. When copying orders, you need to take into account such risks:

- Past results do not guarantee good earnings in the future. The market may change and the trader will not have time to readjust.

- Unconscious copying. It is necessary to understand at least in general terms the essence of the strategy and what risk a trader takes on a deal. This will allow making well-considered decisions and disconnecting from aggressive strategies.

- Illiterate portfolio investing. When copying different traders, trades may conflict. If there are a lot of them, the user risks losing control. Therefore, it is better to open a different account for each strategy, and use the isolated margin mode on futures.

- High slippage. It is not worth repeating transactions on illiquid assets. A trader can open an order at a good price and close it in a profit, while his followers will get a loss due to high slippage.

Pros and cons of copytrading

Any user can repeat trades, it is not necessary to understand the market. It is enough to find a successful trader. However, not everyone works honestly.

Some traders run many strategies simultaneously in different directions and show only successful accounts. Due to the lack of real skills, the strategy brings losses after a short time.

Therefore, you need to look not only at the equity (profitability graph) and portfolio trades, but also the history of the user’s strategy. Other pros and cons of copytrading are collected in the table.

| Advantages | Disadvantages |

|---|---|

Features of copytrading on Binance

The service is available on the platform of the official broker Binance – TraderWagon. To activate copytrading on Binance Futures you need to:

- Go to the Binance Futures platform. Select the item “Copytrading”.

- The partner’s website will open in a new tab. Log in to the program under the Binance login.

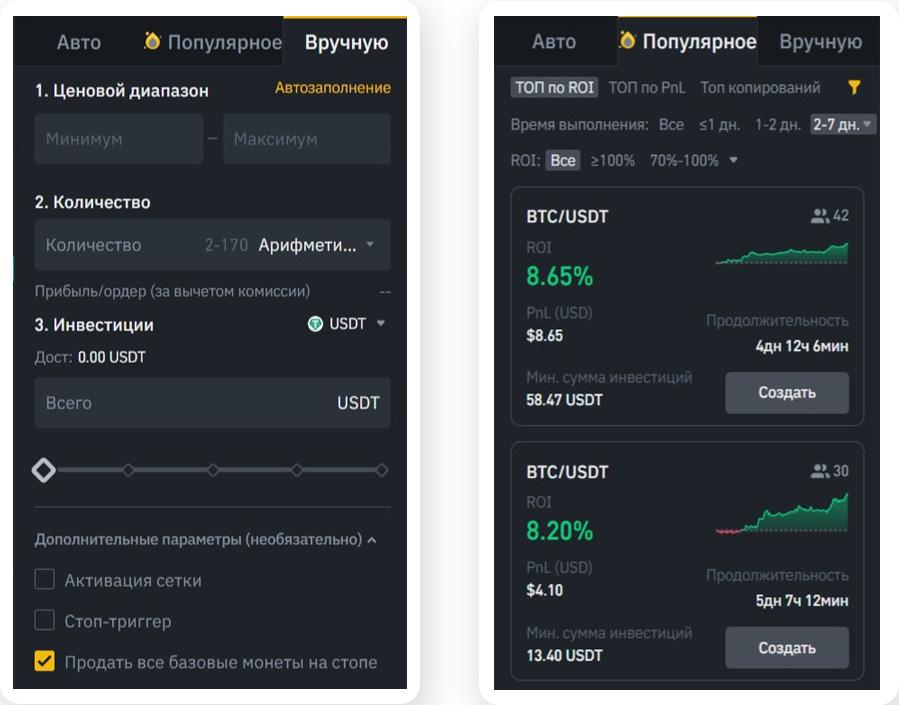

You do not need to replenish your balance to trade. The money remains on Binance. You can also use the native tools of the exchange. In the “Trading Bots” section, the results of the most profitable traders are published. You can copy settings from them.

Binance clients work on several strategies. The main ones are:

- Grid (spot or futures). This strategy works well in flat markets. A long is opened on falling prices and a short is opened on rising prices. After receiving the specified profit the order is closed. The bot trades only in the specified range. When leaving the channel, the work is suspended.

- Rebalancing. When creating a portfolio, users buy coins for the same amount. Some assets grow, others fall, so the position sizes change. The robot performs rebalancing – it buys the lagging ones and sells the growing ones.

- DCA. The bot buys coins according to a set plan – by time or by levels. This allows investors to get the best average price.

How to customize the API

The option allows you to connect to Binance servers and use exchange data in other applications. Using the API, you can open and close trades and view the wallet history from another program.

Only account holders with non-zero balances can activate the option.

Therefore, you need to make a deposit of any amount and enable two-factor authentication. Instructions for creating API keys:

- Log in to your Binance account on the website or through the mobile app.

- Open the “API Management” section.

- Click on the Create button.

- Select the type – System Generation.

- Think of a name for the key.

- Confirm the request with a one-time FA password.

The API key is created. To access it, go to the settings and check the Enable Reading checkbox.

Minimum amount and cryptocurrencies

Grid strategies can be used on different exchange instruments – on spot and futures. Orders can be opened for any amount from $1. To work on the averaging strategy, you need to be able to hold 10-20 positions at the same time and sit through drawdowns. Therefore, for comfortable trading you should replenish your account with $300-500.

Copytrading by author’s strategies works only on open-ended contracts. More than 200 coins are supported, including:

The minimum order size here is $10. But for effective copying of some strategies you will need an account for $300-500.

How to choose a trader

The financial result depends on the strategy of auto-sequencing. It is necessary to analyze the trader’s working principle. If he opens only long trades with high leverage and does not put stops, it is only a matter of time before the trader is drained. When choosing a trader, one should be guided by such criteria:

- Do not connect to accounts with a current profit of more than 1000%. It is impossible to demonstrate such results constantly. If the market changes, a losing streak will begin. It is possible to subscribe only after the drawdown of the account.

- Analyze the user’s trades. Sometimes it is possible to determine the trading style. It is not recommended to connect to strategies that do not provide for stops.

- Look for reviews about copytrading on Binance. This is how you can filter out scammers.

Copytrading on Binance Futures

On the main page of the Binance Futures section, there is a general table of leaders in terms of returns. You can filter the results by ROI or total profit, select traders with the maximum number of subscribers. The following tabs are also available:

- “Futures. You can select only master users or view all accounts.

- “Options”. It is not possible to subscribe to these trades. Only futures transactions can be copied on Binance.

- “Trading Bots.” The page allows you to connect an automatic strategy of Binance. The settings are copied from top traders.

- “Copytrading”. The user will be redirected to the TraderWagon page. There, it is possible to create an account and link the account to Binance.

To get started on the TraderWagon social trading platform, an account must be created. Customers of the exchange can select “Sign in via Binance”. The accounts will be linked automatically.

After that, you need to create an API key on Binance. It will be required to access the account. Entering the key on TraderWagon is not required – the program counts it automatically. Instructions on how to copytrade via Binance API:

- Go to the main page of TraderWagon.

- Select a strategy. Click on the “Copy” button.

- Select the mode – set order size or percentage.

- Customize stops and take-outs.

- Click on the “Send” button.

Connection fee for copy trading on Binance

Binance does not charge a fee for using the service. Clients pay a commission only for executed orders – 20%. The amount is divided equally between the master account and TraderWagon.

Alternative exchanges with a copytrading function

With the growing popularity of cryptocurrencies, there are many newcomers to the market. Therefore, social trading platforms are in demand. Here you can also meet scammers who sell unverified signals. Therefore, it is worth choosing a service with a good reputation and a large number of positive reviews. In 2023, the following platforms are popular:

- BingX. Social trading is among the main directions of the exchange. It is possible to work in auto-sequencing mode on the futures and spot markets, use stock indices, commodities and trade fiat currencies.

- Bybit. The service has been operating since 2022. Traders can use leverage up to 125x, while their subscribers can only use 5x. It is allowed to open orders for no more than 1 thousand USDT.

- OKX. Copying trades on the popular exchange is available from January 2023. Users can work with leverage up to 50 on futures contracts (up to 100 for a master account). Only the most liquid assets are available – BTC, ETH, DOT, ADA. Subscribers can open positions for a total amount not exceeding 1 thousand USDT.

FAQ

💳 What is the maximum number of strategies that can be connected to an account on Binance Futures?

The TraderWagon platform does not limit the number of subscriptions in a portfolio.

📌 What is fixed ratio mode?

An order in a connected user’s account is inserted proportionally. For example, if the lot size on the master account is $5 thousand (50%), the client’s position will be opened for half of the deposit. Small deviations may occur due to slippages or insufficient liquidity – the entry price will be worse or part of the order will not be executed.

✨ What happens if the master trader uses the isolated margin mode and the user has cross margin active?

A transaction in the auto-sequencing account will open of the same type. If a master trader works in isolated margin mode and adds money to a position from a futures account, the same action will be performed on his subscribers. A user can transfer money from a spot account, but such a transaction is not replicated. This increases the risks of the subscribers.

⚡ What is the maximum drawdown?

This is the level of the largest loss (in %) from the equity high. It is analyzed a section of the profitability chart for a certain period of time – a year or a month. In conservative traders, the drawdown does not exceed 20%.

📢 What are the requirements for a master trader on TraderWagon?

Any user can apply. You need to tell about your experience and provide a history of trades. You will need to fund your account with at least 500 USDT to create a strategy. You cannot add or withdraw money from your account after you start working.

Is there a mistake in the text? Highlight it with your mouse and press Ctrl + Enter.

Author: Saifedean Ammous, an expert in cryptocurrency economics.