Cryptocurrency exchanges are at the forefront of digital market development. Trading platforms are the first to test and introduce new technologies, such as risk-free investments. In the material – about what is bicurrency investments in Bybit. In classic trading, users make predictions and receive a profit or loss. Structured product on Bybit allows you to earn at any outcome. If the bet is correct – in USDT, in case of error – in the selected cryptocurrency. Crypto exchange customers can invest in BTC, ETH, DOGE, DOT, LTC and other coins.

An explanation of what Dual Investments is

Dual Investments is a product for making money in a low-volatility market. The investor makes a prediction on the movement of the cryptocurrency within a time frame. At the end of the subscription period, the exchange accrues a reward at a rate. If the prediction is correct – in USDT, erroneous – in cryptocurrency.

The long presence of the coin in the sideways allows you to earn an additional 100-500% per annum. When leaving the channel, you can buy or sell the asset at a good value.

Principles of work

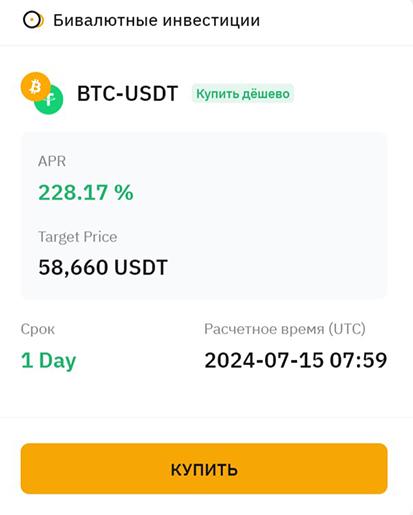

The investor’s task is to determine the price range in which the cryptocurrency will be in a specified period of time. Usually, bets are taken for a week, but other terms are also available – from a day to a quarter. The shorter the time period and the closer the target price is to the market rate at the time of the transaction, the higher the reward. There are such types of bicurrency transactions:

- “Buy cheap”. The user has USDT on his account and makes a forecast for market growth. In case of success, he is credited with stablecoins at a high rate. If the forecast is wrong, the amount invested, along with interest, will be recalculated in cryptocurrency at the target price. This is the expected rate below which the market should not have gone.

- “Sell high”. The investor has a cryptocurrency in the account and makes a prediction for a continued fall or a flat to no higher than the target rate. If the bet works, the client will receive income in the original coins. In case of error, the investment amount and interest will be recalculated at the strike (target rate) and credited to the spot account.

Related Risks

Bi-currency investment is a product with guaranteed returns. But users may face these risks:

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

- The cryptocurrency market is highly volatile, so by the expiration date, the exchange rate may go much higher/lower than the target value. In this case, the investor will receive a paper loss in USDT. To get to the plus side, one will have to wait for a few weeks or months.

- Once the coins are placed, it is not possible to cancel the subscription. This can lead to losses in a highly volatile market.

- You need to understand when it is worth subscribing to a product and when it is less risky and more profitable to buy futures. Without a good knowledge of the market, trades will result in losing money.

When to use bicurrency products

This tool is equally useful for experienced traders and beginners. Bi-currency transactions bring additional income that exceeds the deposit rates.

The product can also be used instead of a conditional buy or sell order. It is worth noting that it works only on low-volatility markets. During a strong up or down trend, it is more profitable to buy coins or futures.

In a rising market

The strategy is profitable to use during upward sideways or channel movement with a forecast for an upward opening. On the crypto exchange Bybit, the transaction can be made as follows:

- Go to the “Banking” section and select the “Structured Products” category. Next, you need to click on the “Buy Cheap” button.

- Assign an investment term – a period of 3-5 days is recommended.

- Specify the strike. It is safer to choose a price within 3-6% of the market. It is good if it will be behind a strong support or a figure of thechanalysis (triangle, channel).

- Enter the transaction amount and confirm the operation.

The user’s task is to choose such strikes so that the cryptocurrency rate by the time of expiration is above the market. In this case, it is possible to receive high interest income for a long time.

If the target value is reached, the user will be credited with the cryptocurrency and profit calculated at the strike price.

The trader will have to wait for the market direction to change. Then it is possible to sell the coins to breakeven and receive income.

In a falling market

The strategy is recommended to be used only during descending sideways with a forecast for a trend change. With a collapsing market movement, volatility is too high, so you will not be able to earn. Instructions for a transaction on the Bybit trading platform:

- In the “Banking” section, click on “Bybit Structured Products” and select “Sell High”.

- Assign an investment term. The exchange offers the best rates when investing for 5 days.

- Specify the strike. The closer the price is to the market, the higher the interest rate. It is necessary to choose the golden mean – with a good interest income and a small probability of achievement in the specified period of time.

- Enter the order amount and confirm the operation.

If the target price is not reached, the user will receive profit in coins. If the rate grows above the strike by the time of expiration, the client will be transferred the income and the invested amount in USDT. The cryptocurrency will be sold at the target price. During a prolonged flat period, it is possible to receive additional income for a long time before the transaction at an attractive rate.

Instead of a conditional order.

Buying on a correction is one of the most profitable investment strategies. With the Dual Investments tool, you can buy coins at a good price and earn extra income. The instructions are as follows:

- Select a coin in the Dual Investments section of Bybit.

- Perform technical analysis and mark attractive levels for purchase.

- Go to the Bybit Earn page and select “Buy Cheap”.

- Set the investment term, strike and transaction amount.

- If the rate will be lower than the estimated price, the trader will receive coins at a good value and interest income. Otherwise – only a small profit and the opportunity to repeat the operation.

Section of bi-currency investments on the Bybit exchange

In 2024, users can open orders for 40 popular coins, including BTC, ETH, DOGE, ADA, LTC, MATIC. The paired asset is USDT only.

The section is available to all verified clients. There are no subscription fees. To start investing you need to:

- Log in to your account.

- Go to the “Banking” page, then “Bybit Structured Products”.

- Open “Bicurrency Investments”.

- Select the offer, coin, expiry date and specify the investment amount.

- Confirm the operation.

Buy direction

The direction is used if the client has USDT on his balance and is ready to buy coins at the target price. If the rate falls below the strike by the expiration date, the system will buy cryptocurrency for the amount invested. Interest on the target price will be added to the balance. If the strike is not reached, the investment amount and interest in stable coins will be transferred to the account.

For example, a trader signs up for a “Buy Cheap” subscription on the BTC/USDT pair for $200. The strike is set at $57k, the maturity is in 3 days, and the rate is 130% per annum. The following options are possible:

- The exchange rate rises above $57 thousand by the expiration date. The user will receive the initial investment ($200) and interest ($200 x 1.3 x 3/365).

- The settlement price fell below $57 thousand. The client will receive the same amount as in the first case, but it will be recalculated in BTC at the target strike: ($200 + $200 x 1.3 x 3/365) / 57000 = 0.003546 coins.

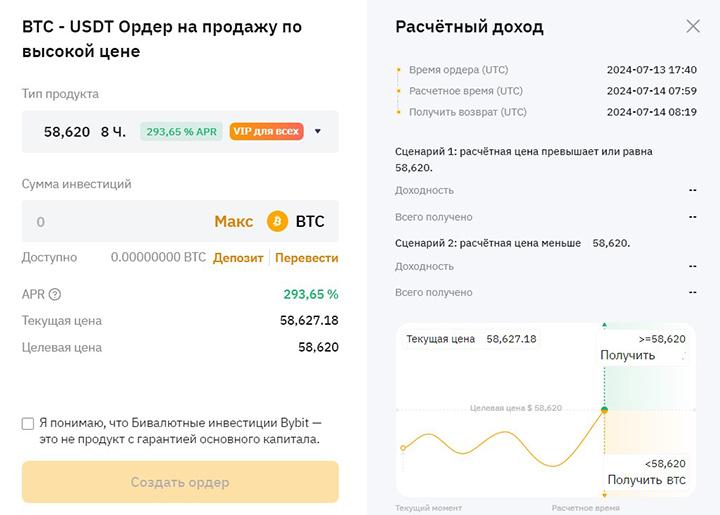

Sell direction

The trader has cryptocurrency on his balance. You can simply place a conditional order and wait for the movement or apply the Dual Investments tool.

If by expiration the rate will be lower than the estimated price, the trader will receive the initial investment and profit in cryptocurrency.

If the value rises above the strike, the coins will be converted at the specified price. USDT will be credited to the balance.

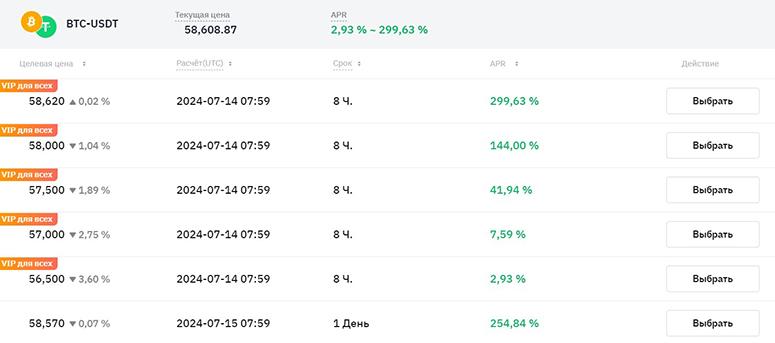

The tool is used in flat markets. In this case, the income will be higher than simply holding a position or depositing coins. Profit depends on the expiry date and the target price. To select an offer you need to:

- Open the section “Bicurrency Investments”, then – “Sell Expensive”.

- Select a coin in the list or search for it in the “All tokens” window.

- Click on the “More” button.

- The options can be filtered by APY.

For the best yield, you should choose an offer with a good rate and a strike 2% or more above the market. You can calculate the potential profit in advance.

It is not recommended to open a deal if important news is expected soon (Fed meetings, labor market reports, corporate events). The outcome may be unexpected.

In a positive market, the rate of the digital asset is able to overcome resistance and grow significantly. The investor’s coins will be sold cheaper than they could with a simple hold.

Advantages and disadvantages of the investment instrument

Bicurrency investments in Bybit can bring income above the deposit in conditions of low volatility. Clients choose the investment timeframe – from a few hours to 7 days. But like any financial instrument, Dual Investments is associated with risks. Pros and cons can be compared in the table.

| Advantages | Disadvantages |

|---|---|

| It is possible to earn high interest on flat markets. | Profit in USDT or fiat may be less than the estimated one due to price fluctuations. |

| The tool is used in hedging strategies or instead of a conditional order. | Funds are blocked for the subscription period. It is impossible to return the deposit early. |

| The trader will be rewarded regardless of the correctness of the forecast. | The order will be executed only if the price is above/below the target price at the time of expiry. If the rate rises and then falls, the order will not close. The investor may lose profit or incur losses. |

| Can be used for most liquid assets. | Orders with maximum yield on BTC/USDT, ETH/USDT, MNT/USDT are available only for VIP clients. |

Frequently Asked Questions

💰 How do I calculate the potential return before locking in assets?

You need to select an offer and enter the order amount. A calculation will appear at the bottom of the page with the exact amount of digital assets for each scenario.

❓ Is Dual Investments’ return fixed?

The interest rate is only frozen once assets are locked in. APY of available products changes every 5 minutes.

🤔 What does the yield of bicurrency trades depend on?

The lower the probability of order execution, the lower the profit. Maximum bets are offered in products with an expiry time of 8 hours and a target price of 0.5-1% of the market.

🕖 What is the settlement time?

The target price is reached if the average value on the day of expiry is above/below the strike before 5:00 Moscow time.

💡 Which is more profitable – holding or bicurrency investments?

It depends on the plan. If the user wants to close the position after a multiple of price growth, it is better to hold coins on deposit. The profit in Dual Investments will be less. If the plan is to earn on the growth of 10-20%, the profitability in Dual Investments will exceed the result of simple holding.

Is there a mistake in the text? Highlight it with your mouse and press Ctrl + Enter

Author: Saifedean Ammous, an expert in cryptocurrency economics.