Verification of an individual’s personal data to gain access to functionality and increase limits is a mandatory step on many trading platforms. Verification on a cryptocurrency exchange is a necessity to follow the rules of regulators for working with fiat currencies. The user fills out an application form on the website, attaching copies of passport, ID number, etc.

General Data Protection Regulations (GDPR)

Verification on the cryptocurrency exchange helps to establish the identity of each account holder, reducing risks, increasing trust in the platform. It enables compliance with regulatory requirements.

Information is collected and stored according to the norms of the laws adopted in the states. For example, in the European Union, these are the provisions of the General Data Protection Regulation (GDPR).

The regulation defines requirements for the protection of personal data of EU citizens to make it easier for businesses and regulators to build international relations.

Personal information includes everything that can be used to identify a person. This includes state or international documents, logins, IP addresses, phone numbers, e-mail addresses, bank cards and accounts, which, if stolen, allow fraudsters to pose as other people.

To improve security, all companies are required to act with GDPR principles in mind:

5020 $

бонус за нови потребители!

ByBit осигурява удобни и безопасни условия за търговия с криптовалути, предлага ниски комисиони, високо ниво на ликвидност и модерни инструменти за анализ на пазара. Поддържа спот и ливъридж търговия и помага на начинаещи и професионални трейдъри с интуитивен интерфейс и уроци.

Спечелете бонус 100 $

за нови потребители!

Най-голямата криптоборса, където можете бързо и безопасно да започнете пътуването си в света на криптовалутите. Платформата предлага стотици популярни активи, ниски комисиони и усъвършенствани инструменти за търговия и инвестиране. Лесната регистрация, високата скорост на транзакциите и надеждната защита на средствата правят Binance чудесен избор за трейдъри от всяко ниво!

- Use the minimum amount of data.

- Transmit and keep information up to date.

- Ensure the security of the information.

- Keep for the legally prescribed time.

GDPR requirements have been mandatory for all EU countries since May 25, 2018. They have proven to be effective and are used by many countries around the world, including the US and the UK, for identity verification.

Differences between KYC and AML

Special checks have been developed for exchange platforms, venture capital funds and other companies. They are needed to track the movement of funds within a single system.

KYC

The Know Your Customer procedure involves identifying customers of companies before they access transactions and other operations. This allows to get rid of fraudsters, terrorists and create a unified counterparty base.

The main actions of exchanges:

- Evaluation of large transactions.

- Collection of data on identity, citizenship.

- Checking for illegal activities.

- Tracking of asset deposit/withdrawal addresses.

- Search for suspicious money and cryptocurrency transfers.

At the registration stage, all those who do not have the right to conduct legal activities (for example, minors or users with criminal records) are rejected. Data from the collected database is also used to investigate crimes.

AML

The rules were developed in 1989 by the intergovernmental organization Financial Action Task Force (FATF). They focus on anti-money laundering and imply that trading venues:

- Analyze transactions for amounts of $10,000 or more.

- Some types of transactions are reported to regulators.

- Monitor users of financial organizations.

- Recognize and then seize illegally obtained funds.

KYC/AML vary in scope. One checks are conducted at the individual level to assess risks. The second is at the global level, providing close monitoring of transactions to combat financial crime.

KYC is the first stage of due diligence in anti-money laundering (AML).

The need for verification in exchanges

Identity verification helps avoid the major risks of dealing with anonymous accounts, including hiding crimes and frauds using blockchain technology. Verification on a cryptocurrency exchange creates a safe transaction space for the users themselves as well, not just the platform.

According to a December 2021 blog post from analytics company Chainalysis, fraudsters generated $7.7 billion in revenue in one year of operation. These funds were not withdrawn from the system. They passed through dozens of accounts and cryptomixers so that the source of their origin cannot be traced. Therefore, any wallet can hold compromised assets.

To prevent crypto platforms from turning into money laundering sites, verification with a cryptocurrency exchange is done. In the early days of the cryptosphere, it was passed if there was a corresponding clause in the company’s rulebook. But five years ago, the fraud situation worsened. Verification has become a common legal practice.

Both the top exchanges with EU registration and other organizations in jurisdictions with less strict rules require personalization of accounts in order to work in a unified legal field.

Many business representatives were forced to switch to verification in order not to lose the solvent audience from countries with strict regulation – the USA and the European Union. With the introduction of identification, new opportunities for scaling their activities opened up for these companies.

Risks of trading without account verification

Many people are afraid to undergo verification, believing that their income will attract the attention of tax authorities or personal information will be stolen by attackers. These fears are supported by several scandals, and not only in the cryptosphere.

For example, in 2021, the Facebook team* sued a Ukrainian citizen over the theft of data of 178 million users of the social network in 2018. During the same period, information about 429.6 thousand customers and employees of British Airways was stolen. The investigation of the incidents was conducted for 2 years.

Phishing is common in the digital asset industry. Scammers make a fake website, inattentive users enter personal details or connect a wallet and attackers gain access to their account. Among those affected:

- Customers of dozens of crypto exchanges.

- Users who participated in contests.

- NFT buyers in GameFi and other projects.

Verification also has many advantages. For example, it is difficult for fraudsters to withdraw cryptocurrency to their account from a hacked personalized account. They simply leave the platform. This effect, according to the COO of the EXMO platform, was observed on their trading platform in 2020.

Law-abiding traders filled out applications, sent scans and continued their work. They are not frightened by the below mentioned risks of working without KYC verification.

Compensation of funds

In case of bankruptcy, unverified users will not be able to file a refund claim to get compensated legally. Given the frequent hacks of even major exchange, payment platforms and startups (Poloniex – 2014, Bithumb – 2017/2018/2019, HitBTC – 2019, Binance – 2019), this is a tangible disadvantage.

Compensation to customers of bankrupt MtGox (2014) and Cryptopia (2019) has not yet been issued in full due to lack of account verification. When exchanges verify users, it is much easier to achieve refunds.

Blocking of funds

No one is immune from buying illegal digital assets. Exchanges thoroughly examine transactions using services and their own programs. If there are suspicions, the platform can automatically block the account. Verified users will find it easier to remove the blocking by proving the origin of the cryptocurrency.

Difficulties of conversion to fiat

To safely and without intermediaries exchange cryptocurrency for fiat funds, exchanges cooperate with banking systems. Working with them is possible only for regulated platforms. Therefore, companies introduce user verification.

Unregulated platforms work through intermediaries. When transferring cryptocurrency from accounts, they remove any responsibility. If the crediting of funds is delayed, it will be difficult to fix the problem. Intermediaries often have an unqualified support team and do not work 24/7.

Verification process on a cryptocurrency exchange

Differentlevel verification of identity allows you to set different limits for working on the platform. For the initial level of verification on the cryptocurrency exchange, you need to provide a minimum of information, but the higher the daily trading volume and activity of the client, the more detailed you need to fill out the form on the site.

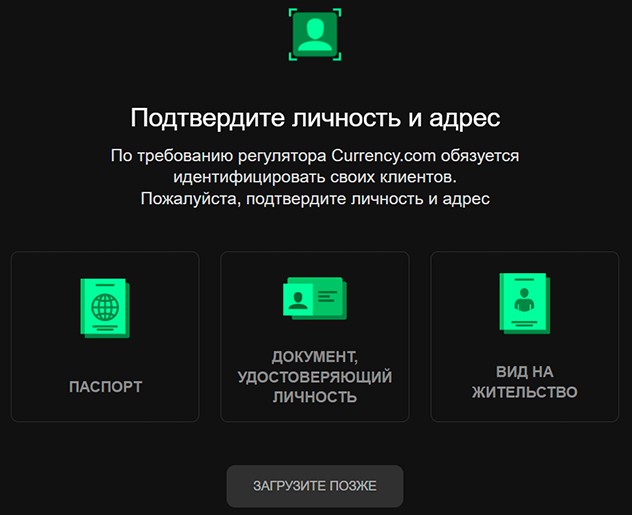

The main direction of verification is to check the identity and confirm the place of residence. It is necessary to provide correct information and scans of documents. If the fact of fraud is found out, false information or poorly readable scans are provided, the verification will not be passed.

In some cases, the platform conducts verification in manual mode. Then the provided documents will be reviewed by the exchange operators. They may also require additional information from the client.

The main KYC-document for individuals is a state ID (passport, driver’s license, etc.). For large investors, information about the origin of assets may be required.

When filling out the application form on the website, you need to:

- Enter full name, date of birth, contact e-mail, phone number, full residential address.

- Take selfies with documents, send a photo of a utility bill with the place of residence.

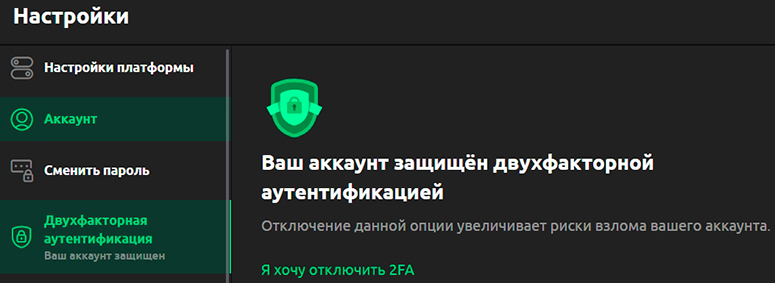

- Confirm the application by means of two-factor authentication (codes from SMS and e-mail).

Protecting the confidentiality of the provided personal information helps:

- Storing data in encrypted form on separate servers with fixing information about all specialists requesting authorization in the system.

- Limited access. Only the AML specialist and KYC staff get it.

Advantages and disadvantages of KYC and AML

Adhering to AML/KYC policies provides security of operation and opens more opportunities for both exchanges and clients. The pros and cons of checks are summarized in the table below.

| Side | Предимства | Недостатъци |

|---|---|---|

| Обмен | The identity of users is verified | Expenses for additional servers and software |

| Working directly with Visa and Mastercard | Hiring and training of employees | |

| Compliance with international requirements | Regular security updates and audits | |

| Account opening for citizens of any jurisdiction | ||

| All funds come from reliable sources | ||

| Direct withdrawal into fiat currencies through the official banking system | ||

| Client | Low commissions | Additional hurdle to conclude a transaction |

| Safe trading and legal income | Tax authorities will be aware of the income of exchange customers | |

| Blocking transactions from stolen cards | ||

| Quick exchange of cryptocurrency to fiat currencies |

Verification makes it safer to work on a cryptocurrency exchange platform. It also gives additional opportunities for trading: limits, methods of conversion to fiat, withdrawal through different payment channels.

Copies of documents are watermarked to exclude their use on third-party platforms.

AML verification of cryptocurrency

Cryptocurrency exchanges use a set of measures:

- Analyze transactions with large amounts.

- Develop AML monitoring systems.

- Assess risks and verify users’ bank cards.

- Monitor account activity (hacking, phishing).

- Consider requests from law enforcement agencies.

All data in the cryptocurrency exchange system is verified. Accounts with funds from suspicious sources are blocked.

Резюме

Verification has pluses for both users and digital asset exchange platforms. It provides a high level of financial security, helps in detecting fraud and illegal activity.

AML-compliance (cryptocurrency verification) establishes the connection of wallets with illegal transactions. The analysis helps to return stolen funds to the owners. This increases trust in the digital asset sphere and mitigates the actions of regulators.

* The activities of Meta Platforms Inc. and its social networks Facebook and Instagram are prohibited in the Russian Federation.

Често задавани въпроси

❓ What is KYC?

It is a verification of personal information of individuals who are users of cryptocurrency exchanges. The client fills out an application form, provides scans and photos of documents.

🏢 Is it always necessary to verify the address?

For the initial level of verification, a passport scan and filling out the application is enough. If larger limits are needed, you’ll have to upload a utility receipt for the address provided.

💡 What residence verification documents do cryptocurrency platforms require?

Utility bills with address, copies from tax, insurance and other organizations are required for verification on the exchange. You can attach bank statements, documents from government agencies.

🧐 What are the possibilities for users of basic accounts?

Restrictions depend on the internal policy of the platform. Without identity confirmation, cryptocurrency deposits and withdrawals are available.

✅ How quickly are accounts verified?

The verification period depends on the company’s internal policy. If the information matches the information on the scans, you can get basic access in a couple of minutes.

Има ли грешка в текста? Маркирайте я с мишката и натиснете Ctrl + Въведете

Автор: Saifedean Ammous, експерт в областта на икономиката на криптовалутите.