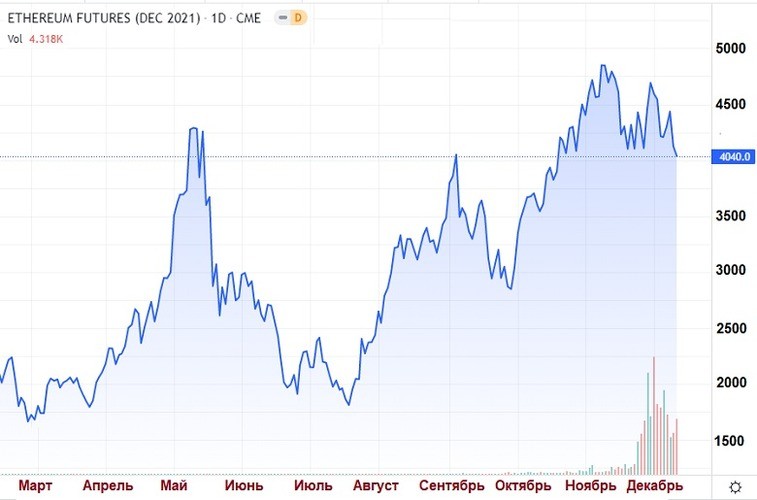

Етериум е популярен блокчейн проект, който се използва като платежна система и среда за децентрализирани приложения (dApps). Между януари и ноември 2021 г. курсът на монетата ETH се увеличи с около 561%, достигайки рекордната стойност от $4864. На този фон пускането на Етериум фючърси беше очаквано събитие, което позволи на големи търговци и инвестиционни фондове да инвестират в криптовалути. Нодеривати търговията може да бъде интересна и за начинаещите. Тя ви позволява да използвате ливъридж и да реализирате печалба по време на спад на котировките.

Какво представляват фючърсите

Дериватите са договори (споразумения), чиито условия предвиждат задължение на страните да извършат определени действия в бъдеще. Тази категория включва фючърси, опции, размяна наи форуърдни транзакции.

Фючърсът върху Етериум е договор, според чиито условия продавачът се задължава да достави на купувача определено количество монети ETH в посочения в договора момент на предварително определена цена. В някои случаи вместо действителното прехвърляне на криптовалута се допуска метод на сетълмент на изпълнението: борсата изплаща на търговеца разликата между първоначалната и крайната стойност на базовия актив.

Защо стартирането на фючърси върху Ethereum е важно събитие

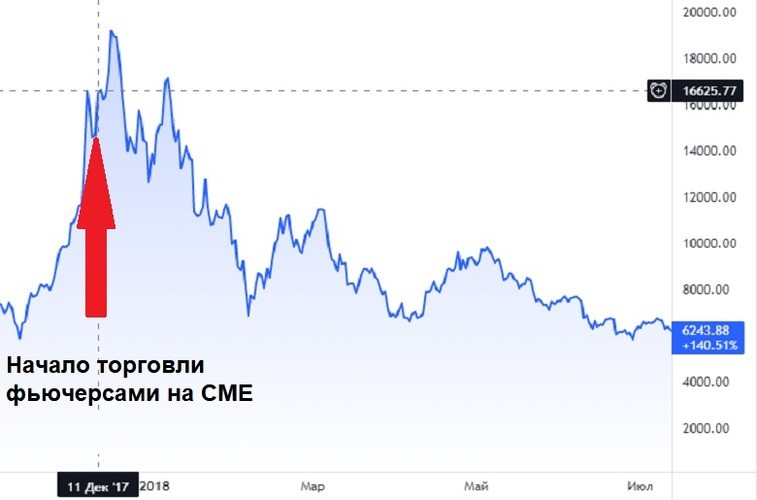

Първите деривати на криптовалута, търгувани на борсите, бяха обвързани с цената на биткойна. Фючърсите върху Етериум бяха пуснати по-късно:

- През юли 2016 г. започна да функционира криптообменът Deribit. През първите няколко месеца списъкът с инструменти включваше фючърси и опции върху биткойн. Стартирането на деривати върху Етериум се случи едва през март 2019 г.

- Най-голямата борса за криптовалути Binance първоначално работеше с договори за BTC. Инструментите за търговия с ETH се появиха през ноември 2019 г. Въпреки подобни действия на ръководителите на други криптоплатформи, обемът на сделките с договори за Етериум остана нисък, тъй като големите търговци и инвеститори предпочитат да работят на фондови и стокови борси.

- През февруари 2021 г. Чикагската стокова борса (CME) обяви договори за сетълмент, обвързани с обменния курс на монетата Etherium. Минималният обем на сделката беше 50 ETH.

- През декември 2021 г. започна търговията с микрофючърси на Ethereum на CME. Всеки договор се сключва за 0,1 ETH.

- Според експертите на информационната компания Bloomberg през първата половина на 2022 г. е възможно да се започне търговия с акции на борсово търгуван фонд(ETF)), чийто капитал се състои от фючърси на Етериум.

Определяне на цената

Цифровите валути се характеризират с висока волатилност (динамика на промените в котировките). При спот сделките (сделки при условията на незабавна доставка) търговците могат да печелят само от ръста на цената. Фючърсите върху ETH оказват влияние върху обменния курс на базовата валута. Благодарение на ливъриджа търговците имат на разположение големи къси сделки - операции с прогноза за понижение на котировките на актива.

Според някои експерти дългият и интензивен спад на обменния курс на биткойна през 2017-2018 г. е бил причинен именно от въвеждането на фючърсите върху биткойна. Появата на деривати, обвързани с етериум, би могла да има подобно въздействие върху пазара.

5020 $

бонус за нови потребители!

ByBit осигурява удобни и безопасни условия за търговия с криптовалути, предлага ниски комисиони, високо ниво на ликвидност и модерни инструменти за анализ на пазара. Поддържа спот и ливъридж търговия и помага на начинаещи и професионални трейдъри с интуитивен интерфейс и уроци.

Спечелете бонус 100 $

за нови потребители!

Най-голямата криптоборса, където можете бързо и безопасно да започнете пътуването си в света на криптовалутите. Платформата предлага стотици популярни активи, ниски комисиони и усъвършенствани инструменти за търговия и инвестиране. Лесната регистрация, високата скорост на транзакциите и надеждната защита на средствата правят Binance чудесен избор за трейдъри от всяко ниво!

ETH, ETFS

Популярна инвестиционна дестинация за големите инвеститори са борсово търгуваните фондове. Това са дружества, чийто уставен капитал се състои от един или повече активи, а акциите (дяловете) се разпространяват на пазара подобно на акциите на дружеството.

През октомври 2021 г. първият ETF, базиран на фючърси върху биткойн, беше допуснат до търговия на Нюйоркската фондова борса (NYSE). Малко след началото на търговията обменният курс на BTC в криптоплатформите актуализира високата цена.

Според редица експерти следващата стъпка в развитието на пазара на цифровата валута ще бъде приемането на ETF-и, базирани на фючърси върху Ethereum. Експертите смятат, че това ще се случи в началото на 2022 г. Нещо повече, според анализаторите Ethereum-ETF ще бъде одобрен преди регулаторите да разрешат на фондовете, чийто капитал се състои от спот криптовалута, да търгуват.

Инструмент за големи инвеститори

Обикновените търговци на криптовалути търгуват на спот пазара. Това им позволява да печелят от ръста на котировките на цифровите валути. Но големите търговци и инвеститори често смятат, че е по-изгодно да работят с деривати: опции и договори. Това може да се дължи на причини като например: 1:

- Доверие към фондовите и стоковите борси. Криптоплатформите се появиха неотдавна, но правният им статут все още не е определен в много страни. Това спира институционалните клиенти, за които е важно да работят в правната област.

- Възможност за хеджиране на рисковете. Притежателите на големи обеми токени и монети могат да загубят пари, ако обменният им курс се срине. Фючърсите върху Ethereum намаляват рисковете, свързани с волатилността на ETH, тъй като при сключването на договора се взема предвид текущата цена на базовия актив.

Прогнози за стойността на етериума

През 2020-2021 г. курсът на ETH и други алткойни беше във възходяща тенденция. Но бъдещите перспективи на втория по капитализирани криптовалутата може да бъде повлияна от такива фактори.

| Положителен | Отрицателен |

|---|---|

| Преминаване към протокола Ethereum 2.0. Очаква се новата версия на блокчейна да увеличи скоростта на проверка на трансакциите и да намали потреблението на енергия. Освен това таксите за преводи ще намалеят. | Появата на конкуренти. Етериум беше първият блокчейн с възможност за сключване на интелигентни договори. По-късно се появиха алтернативни мрежи: Avalanche, Polkadot и други. Възможно е да се наблюдава отлив на инвеститори към нови алткойни. |

| Етериум остава базовият протокол за интелигентни договори и dApps. С развитието на пазара на децентрализирани приложения търсенето на ETH ще се увеличава. | Риск от срив на световния пазар на криптовалути. Токените и монетите поскъпват от дълго време в очакване на приемането на блокчейн технологията. Но от 2021 г. криптоактивите се използват предимно като спекулативни инструменти за търговия. Това може да доведе до разочарование на инвеститорите. |

| Големи обеми на търговия на борсите. Двойки с ETH и деривати са налични на повечето криптоплатформи. Това предпазва котировките на монетата от резки колебания. | Двусмислен правен статут. В някои държави криптовалутата все още не е призната за законно платежно средство. Освен това властите в Китай и редица други държави са наложили ограничения върху трансакциите с токени и койни. Ако криптоактивите не могат да бъдат легализирани, това ще доведе до отлив на големи инвеститори. |

Резюме

Чикагската стокова борса одобри фючърси върху ефира през 2021 г. Този дериват се прилага по подобен начин към договорите за Биткойн като инструмент за самоинвестиране и хеджиране на риска. Според експерти първият Ethereum-ETF може да бъде допуснат до търговия през 2022 г.

Въвеждането на фючърси и други деривативни инструменти увеличава интереса на големите търговци и инвеститори към криптовалутата. В същото време много фактори влияят върху обменния курс на токените и коините, така че е трудно да се предположи как сделките с деривати ще се отразят на пазара на цифрови активи.

Често задавани въпроси

🔍 Могат ли начинаещите да търгуват с фючърси?

Да, този инструмент е достъпен за всички търговци. Но сделките с деривати се различават от спот сделките, така че начинаещите трябва да проучат особеностите на търговията и да не рискуват големи суми.

⌚ За какъв срок се сключва фючърсният договор?

По принцип дериватите са валидни за едно тримесечие. Но на криптоборсите има и безсрочни договори. Те могат да бъдат обменени за валута по всяко време.

❓ Сделките с деривати достъпни ли са само на CME?

Не, начинаещите могат да купуват деривати на борсите за криптовалути. Сделките на фондовия и стоковия пазар по-често се извършват от големи търговци.

📌 Безопасно ли е да инвестирате във фючърси на Етериум?

Не, никой инвестиционен инструмент не гарантира доход. Всяка финансова транзакция може да доведе до загуби. Ето защо не се препоръчва да се използват взети назаем или последни пари за инвестиране.

💰 Колко мога да инвестирам в деривати?

Минималната граница на инвестицията зависи от правилата на криптоплатформата. Например, на Binance през 2021 г. можете да закупите фючърси на Ethereum, започвайки от $40.

Грешка в текста? Маркирайте я с мишката и натиснете Ctrl + Въведете

Автор: Saifedean Ammous, експерт в областта на икономиката на криптовалутите.