The popular cryptocurrency exchange offers customers the opportunity to earn money on storing and borrowing digital assets. APR on Binance is a metric that determines the approximate return on such investments. Market participants should know what this metric is for and how to use it to maximize profits.

Definition of APR in cryptocurrency

Annual Percentage Rate refers to the annual interest rate that can be earned on invested funds. Traditional financial institutions apply the metric to mortgages and other types of loans. In the crypto space, this metric is mostly found in DeFi products.

Purpose of the annual percentage rate metric

The APR in cryptocurrency indicates the yield that a user can get from their digital assets. The metric is associated with products such as:

- Залагане на колове. The investor blocks coins and in return receives interest in the form of tokens.

- Farming. Remuneration is earned for lending assets to liquidity pools.

- Предоставяне на заеми. Market participants can lend their cryptocurrency to other clients at a certain interest rate.

Differences from APY

Both are used to estimate the annualized return on investment. However, there are differences between them.

APR does not take compound interest into account. The return is based only on the initial investment. APY (from the English Annual Percentage Yield), on the contrary, takes into account the indicator. The metric includes interest that accumulated in previous periods and was reinvested in the initial amount. This allows for a higher yield.

The APY metric will always be higher due to compound interest.

5020 $

бонус за нови потребители!

ByBit осигурява удобни и безопасни условия за търговия с криптовалути, предлага ниски комисиони, високо ниво на ликвидност и модерни инструменти за анализ на пазара. Поддържа спот и ливъридж търговия и помага на начинаещи и професионални трейдъри с интуитивен интерфейс и уроци.

Спечелете бонус 100 $

за нови потребители!

Най-голямата криптоборса, където можете бързо и безопасно да започнете пътуването си в света на криптовалутите. Платформата предлага стотици популярни активи, ниски комисиони и усъвършенствани инструменти за търговия и инвестиране. Лесната регистрация, високата скорост на транзакциите и надеждната защита на средствата правят Binance чудесен избор за трейдъри от всяко ниво!

For example, if a user decides to lend 10 ETH at 30% APR, at the end of the year they will take back 3 ETH. But if the platform offers to lend 10 ETH at 30% APY with monthly accrual, the investor will receive 3.45 ETH. With compound interest, the APY rate will be almost 34.49%.

Calculating APR on Binance

The exchange offers clients to receive rewards for staking, farming, bi-currency investments, placing Binance Coin tokens in BNB Vault and deposits in Simple Earn. The amount of annual returns depends on the coin selected and the investment term. Some of the offered assets are presented below (data is current as of September 8, 2023).

| Криптовалута | Product | Annual interest rate, % |

|---|---|---|

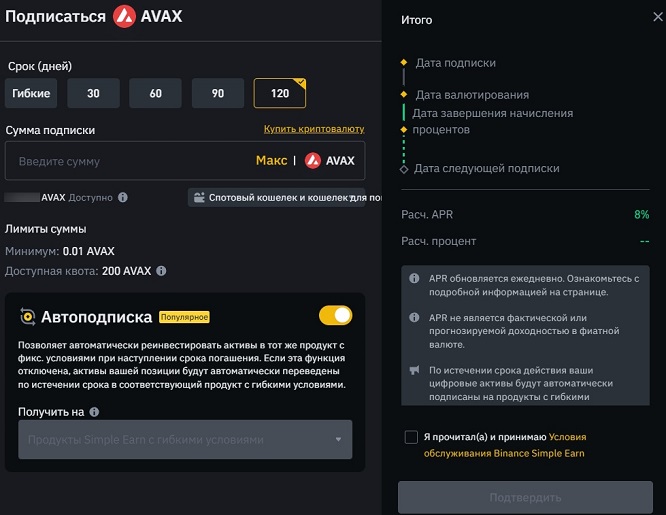

The value of the index is also affected by the type of investment. For example, Avalanche holders can place assets in Simple Earn with flexible terms at 0.42% per year, and with fixed terms – at 8% for 120 days.

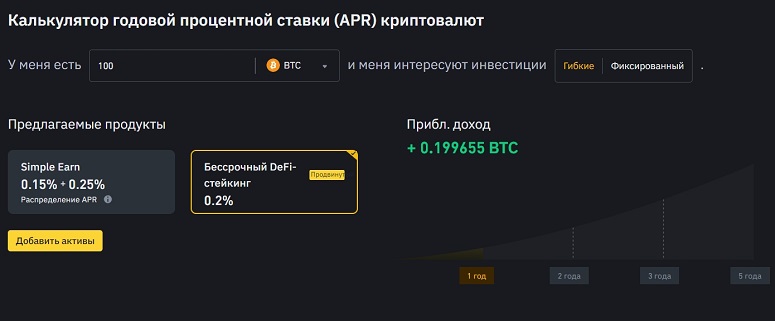

The developers of the platform added a calculator that helps to determine the approximate yield based on APR on Binance. The tool allows you to set parameters – the amount and term of investment, cryptocurrency. After entering all the necessary data, the calculator performs the calculation and shows the expected return. With the help of this tool, users can compare different options and choose the most favorable offer.

Calculation example

Calculating the interest rate allows you to determine the return on investment (ROI) from transactions with digital assets and evaluate the overall efficiency of the crypto portfolio. With this metric, a market participant understands which strategies are working and when it’s time to abandon those that are not profitable.

The Annual Percentage Rate can be calculated manually. The calculation is made by the formula: Accrued rewards / principal amount of investment × 100. If the user for a year of steaking 1500 USDT received 14 coins, the interest rate was – 14 / 1500 × 100 = approximately 0.93%.

You can also determine the potential profit. For example, if the platform offers to place 1200 USDC at 16%, the trader will receive the final amount of 1392 USDC. The calculation is as follows: 1200 × (1 + 0.16) = 1392. The same 1200 USDC placed at 16% per annum will bring 1200 × (1 + 0.08%) = 1296 coins in the first 6 months.

Keep in mind that the Annual Percentage Rate is a rough estimate of rewards.

The value may change over time due to several factors. These include:

- Demand. If a lot of people are interested in using the platform’s services, the yield will increase.

- Economic situation. The size of the indicator also depends on common factors – inflation, federal reserve rates and global financial events.

- The riskiness of the investment. New and questionable coins tend to offer higher returns.

Често задавани въпроси

🔔 Is it worth investing in an asset with a high yield?

The decentralized finance sector has seen scammers issue coins and set APRs on them, often exceeding 100%. This attracted investors who wanted to maximize their profits. However, the attacker could remove the cryptocurrency from the liquidity pool after some time. In this case, it became impossible to sell the coins, and their value fell to zero. Therefore, you should be careful when choosing products with excessively high rates.

📣 Why is the APR in cryptocurrency higher than in the traditional financial sector?

This is because the digital asset market is more risky. In addition, the demand for borrowing and lending cryptocurrency exceeds the supply.

⚡ Does every platform have the same APR for the same products?

The platforms have different rules for posting percentage of return.

📌 What are the differences between products with flexible and fixed terms?

In the former, the user can withdraw assets at any time. With fixed terms, tokens are assumed to be locked for a certain period.

✨ How often does the APR on Binance change?

It is adjusted on a daily basis.

Има ли грешка в текста? Маркирайте я с мишката и натиснете Ctrl + Въведете

Автор: Saifedean Ammous, експерт в областта на икономиката на криптовалутите.