Solana, Ripple, Cardano and other altcoins are virtual money. Their ancestor is Bitcoin. In 2009, this system acted as a revolutionary payment network. Later, newer projects inherited the ideas of Bitcoin and improved them. However, even in 2024, for example, blockchain (distributed ledger) technology is still reaching its potential. This is the answer to the question why cryptocurrencies still haven’t disappeared. They continue to evolve.

Why cryptocurrencies will not disappear

The reasons for the popularity of digital money are not obvious to some users. In fact, such assets are not only interesting for traders and investors. Cryptocurrencies and the technologies on which they are based are even beneficial for entire countries.

Among the more general factors that have driven public interest in virtual assets are:

- The idea of digital gold in Bitcoin.

- Official authorization of virtual assets in some countries, such as Germany, Singapore and others.

- The potential for blockchain technology to be used on a mass scale in various fields of activity.

A great idea of digital gold

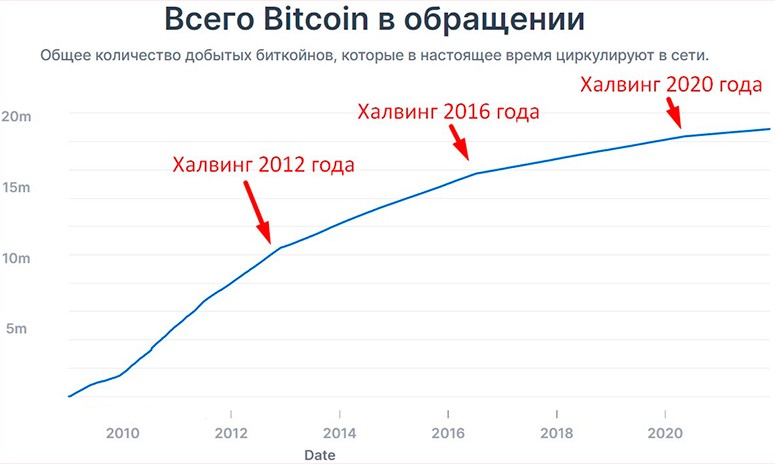

The maximum number of BTC is limited to 21 million coins at the software level. This is how Bitcoin differs from any fiat currencies. Most altcoins are also systemically limited.

In the cryptocurrency community, the coin is called digital gold. Bitcoins are limited in nature, just like precious metals. Miners cannot issue BTC indefinitely. The issuance will end in 2140. At that time, no more than 21 million BTC will circulate in the global cryptocurrency market.

In 2024, digital projects apply 2 main models of supply limitation:

- Gradual automatic slowdown of issuance. With the help of program code, some cryptocurrency projects reduce the reward for the created blocks in the digital chain. This method of slowing down the issuance of new coins is called النصف. The process involves systematically reducing the reward for generating links in the blockchain strictly by 50%. For example, in the Bitcoin network, halving is done every 4 years without the participation of developers. The reward will automatically decrease until the payment is 0.

- Periodic burning (destruction) of cryptoassets. Some projects issue الرموز المميزة one-time in a predetermined amount and do not increase the supply any further. After issuance, virtual assets begin to be burned by developers. At the expense of their own profits, the creators buy back some tokens from exchanges and destroy them programmatically.

The idea of digital gold is great because limiting the supply of specific coins and tokens creates their scarcity on trading platforms. This fact provokes price growth of the assets, which further increases investor interest in them.

5020 $

مكافأة للمستخدمين الجدد!

توفر ByBit ظروفًا مريحة وآمنة لتداول العملات الرقمية، وتوفر عمولات منخفضة، ومستوى عالٍ من السيولة، وأدوات حديثة لتحليل السوق. وهو يدعم التداول الفوري والتداول بالرافعة المالية، ويساعد المتداولين المبتدئين والمحترفين من خلال واجهة سهلة الاستخدام ودروس تعليمية.

احصل على مكافأة 100 $

للمستخدمين الجدد!

أكبر بورصة للعملات الرقمية حيث يمكنك بدء رحلتك في عالم العملات الرقمية بسرعة وأمان. تقدم المنصة المئات من الأصول الشائعة والعمولات المنخفضة والأدوات المتقدمة للتداول والاستثمار. سهولة التسجيل والسرعة العالية في المعاملات والحماية الموثوقة للأموال تجعل من Binance خيارًا رائعًا للمتداولين من أي مستوى!

Cryptocurrency is recognized

In about 20 countries around the world, virtual money is officially authorized as a means of payment and savings. Partly due to this, cryptocurrencies cannot disappear. Governments of different countries are introducing Bitcoin and altcoins into the lives of ordinary citizens. This fact increases the popularity of cryptocurrencies. In 2021, digital money is legal tender in at least 2 states. These countries are presented in the table.

| State | Brief history of recognition |

|---|---|

| اليابان | Cryptocurrencies are legal tender like the local national currency (yen). The government started considering this possibility in 2014. It took the authorities more than 3 years to fully legalize the circulation of bitcoins on the territory of the country. As a result, Bitcoin was recognized as an official means of payment on April 1, 2017. However, Japan takes the regulation of cryptocurrencies very seriously: exchanges are required to officially register with the Financial Services Agency registry; trading in BTC and altcoins is controlled by the local regulator FSA, and so on. |

| El Salvador | In this republic, bitcoins are the official means of payment on par with the US dollar. The decision came into force on September 7, 2021. Three months earlier, members of parliament responded positively to the initiative of the head of state (62 votes in favor, 19 against). The President of El Salvador had 90 days to draft the bill. In the process of its preparation, the state obliged entrepreneurs to implement in their businesses systems for accepting payment with virtual money. |

The potential of blockchain technology

In 2021, not everyone is able to appreciate the prospects of digital blockchains. Blockchain technology is still in the development stage. It was not taken seriously in the late 1990s, but in 2021, more than 60 percent of the world’s population (about 4.7 billion people) use the World Wide Web on a regular basis.

Blockchain has great potential in the future. Even in 2024, distributed ledger technology has already been implemented in healthcare, real estate, land registry and so on.

Blockchain has at least 5 advantages over traditional systems:

- Privacy of personal information. The data of digital network users are reliably protected, because cryptocurrencies are almost impossible to hack.

- Anonymity of identity. In a general sense, an attacker cannot obtain the data of a particular system participant without possessing his private cryptocurrency key.

- Security of funds. It is impossible to access the user’s assets without the private key that belongs to him.

- High speed of operation. In 2024, there are digital projects in which any transactions are processed in just a few seconds, such as Ripple.

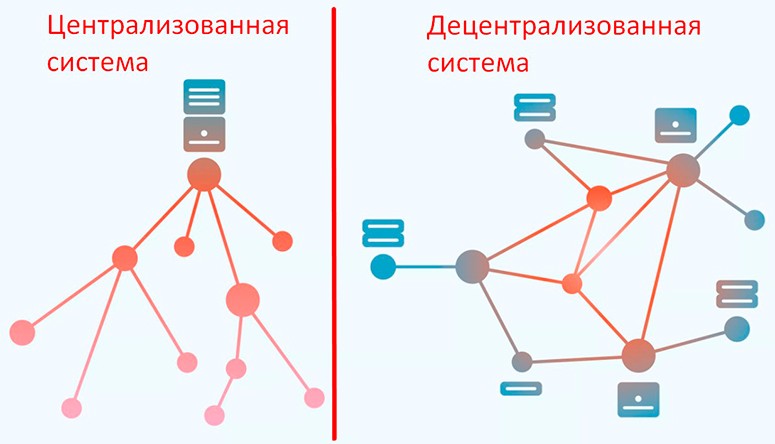

- Resilience of the network to attacks. Blockchain is a decentralized system. The network is managed by many nodes, rather than a common administrator (server) that can be easily hacked.

If the cryptocurrency does disappear

This outcome is theoretically possible. The most realistic scenario for why cryptocurrencies could disappear is a widespread ban. If countries around the world take turns declaring virtual money illegal, it would create a wave of panic.

Traders and investors will start selling off and withdrawing their assets, and trading platforms will start closing down en masse due to bankruptcy. There will be no one to check the validity of transactions in cryptocurrency networks. It will be pointless for miners to work for remuneration in digital money because of their widespread ban. As a result of the sown panic, the market of virtual assets will collapse, and investors and large companies will lose almost all their money.

Scenario for the creation of a quantum computer

In 2024, hacking the Bitcoin blockchain, for example, is virtually impossible: it would require gathering incredible computing power in the same hands to do it.

Hacking Bitcoin makes no sense. An attacker would spend far more money to buy mining equipment than they would be able to gain from an attack on the cryptocurrency network.

In the community of coin and token users, fears have formed about the use of quantum computers against the digital money market. However, even in the near future, there is an ambiguous situation with them. Quantum computers are based on the principle of superposition, which allows an unlimited amount of data to be processed simultaneously. But the result is distorted when a person tries to fix it (observer effect). For this reason, even if a quantum computer does manage to hack the blockchain, each time the attacker will get one random solution, including the wrong one, out of an unlimited number of different outcomes. Thus, the chance of gaining control of the cryptocurrency network tends to 0 infinitely.

الأسئلة الشائعة

❓ How do cryptocurrencies benefit countries?

For example, an increase in government budget due to attracting investment in a new economic sector.

💡 Which cryptoassets have adopted the idea of digital gold from bitcoin?

Zcash, Bitcoin Cash and Litecoin. The last 2 cryptoassets came from global updates to the BTC coin blockchain and its split into 2 parallel chains.

🔥 Why use the token burn model?

To create their scarcity on cryptocurrency exchanges and increase investor interest in the asset.

✅ Which countries may soon recognize BTC as an official means of payment?

In September 2021, the authorities of Panama and the Argentine government expressed their desire to follow the experience of the Republic of El Salvador. They reported that they are already drafting bills to legalize cryptocurrencies.

⏱ How long does it take to crack Bitcoin?

According to Bitcoin Core software developer Luke Dash Junior, it would take an attacker 38 nonillion years on an average personal computer.

هل يوجد خطأ في النص؟ قم بتمييزه بالماوس واضغط على السيطرة + أدخل

المؤلف: سيف الدين عموسخبير في اقتصاديات العملات الرقمية.