The Central Bank of Russia is developing a new form of settlement. The relevant amendments to State acts have been adopted in the first reading and will be introduced in the near future. In April 2023, testing of the digital ruble among ordinary citizens began. The focus group included selected users of applications of different banks. After the tests, the new form of the state currency will be massively introduced into circulation – for purchases, accrual of wages and pensions. However, not all residents of the Russian Federation are optimistic. In the article – what threat the digital ruble poses to people, whether the tracking of payments will be simplified and whether banks will be able to easily impose restrictions on settlements.

What is the digital ruble

The government is going to introduce another form of state currency issued by the Central Bank. The digital ruble will not replace, but rather supplement existing (cash and non-cash) monies. Another form of currency will have the following features:

- Exchange for non-cash money at a 1-to-1 exchange rate via banking apps.

- Payment for purchases in online and offline stores.

- Fast and cheap transfers abroad.

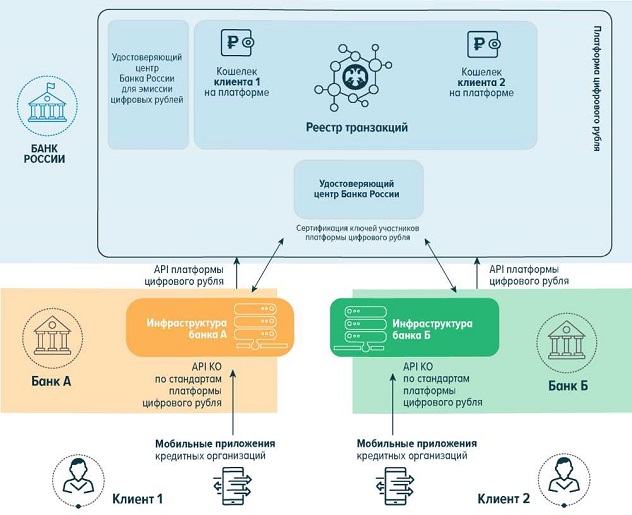

Operations will be performed on the platform of the Bank of Russia. You can enter the personal cabinet through the application of any financial organization.

Why it is needed

The popularity of cryptocurrency is growing. To maintain control over the circulation of money, the Central Bank is carrying out reforms. The digital ruble can become a more convenient and secure alternative to existing forms of payment. It has these advantages:

- Accessibility. You can enter the personal cabinet from the application of any bank. If the financial organization goes bankrupt, it will not affect the safety of funds.

- Security. Data are encrypted in a cryptographic way. The Bank of Russia regularly updates the security system.

- The possibility of offline settlements. An analog of a physical wallet will be available on the platform of the Central Bank. You can transfer some funds to a special account and spend them without access to the network.

- Convenience. Transactions will be carried out with the help of smart contracts. This will simplify the calculations and make them safe. The seller will receive money only after the terms of the transaction are fulfilled.

The idea of the project appeared back in 2018, and in 2020 the Bank of Russia presented a report with the basic concept. The table summarizes the advantages of introducing the tool for different categories.

| Participants | الإيجابيات |

|---|---|

You can send money offline. Good technical support. Access through any bank. | |

Development of payment infrastructure. Increasing competitiveness. | |

Reduction of expenditures on budgetary payments. |

Implementation

The Ministry of Finance promises to put the new form of money into circulation as early as 2023. In May, a bill defining the status and procedure for the use of such a ruble will be adopted. Representatives of the Central Bank noted that there are no specific deadlines for the mass introduction of the currency. This is a large-scale project, which will be implemented in stages.

5020 $

مكافأة للمستخدمين الجدد!

توفر ByBit ظروفًا مريحة وآمنة لتداول العملات الرقمية، وتوفر عمولات منخفضة، ومستوى عالٍ من السيولة، وأدوات حديثة لتحليل السوق. وهو يدعم التداول الفوري والتداول بالرافعة المالية، ويساعد المتداولين المبتدئين والمحترفين من خلال واجهة سهلة الاستخدام ودروس تعليمية.

احصل على مكافأة 100 $

للمستخدمين الجدد!

أكبر بورصة للعملات الرقمية حيث يمكنك بدء رحلتك في عالم العملات الرقمية بسرعة وأمان. تقدم المنصة المئات من الأصول الشائعة والعمولات المنخفضة والأدوات المتقدمة للتداول والاستثمار. سهولة التسجيل والسرعة العالية في المعاملات والحماية الموثوقة للأموال تجعل من Binance خيارًا رائعًا للمتداولين من أي مستوى!

First of all, it is planned to work out banking operations with financial organizations and real clients. The platform should work without errors, be convenient and understandable for most users.

The next stage is to expand the circle of persons with access to the tool and to introduce payment for purchases. Based on the results of the work done, it will be possible to draw conclusions about how bad or good the project is and whether it is ready for the realization of the next stage.

Platform testing

The Bank of Russia proposed this project in 2020. Since then, work on the mass implementation of the digital ruble has been underway. The prototype of the platform was launched in 2021, since 2022, financial organizations have been testing the service. Banks are modernizing their software for clients. They are also solving compatibility problems.

In April 2023, a focus group of ordinary bank customers was formed. Participants are asked to perform standard operations – transfer and receive funds, as well as exchange them in the mobile application. The goal of this stage is to create a simple interface and eliminate bugs.

The next step to the mass introduction of the virtual ruble will be payment for purchases. In the future, it is planned to transfer public sector employees’ salaries and pensions in the new form of currency. It may take up to 5 years to implement the product.

How to use

Representatives of the Central Bank said that digital payments will be voluntary. Citizens will decide for themselves what kind of money to pay with – traditional or virtual. Fifteen major banks (Tinkoff, Alfa-Bank, SberBank and others) have already joined the project. Users can create a personal wallet in the mobile application of any of the financial institutions. It is allowed to have only one digital vault.

Next, it is worth replenishing the wallet in the application of the financial institution. Users can also receive transfers from other customers. At the moment, only online transactions are available. You can send funds or pay for goods by QR code.

What is the threat and danger of the digital ruble for Russians?

Many professional market participants believe that the new form of money will benefit the banking system. However, there is another opinion. Critics call for a fight against the innovation. Here is what the digital ruble threatens and is dangerous for Russians:

- The state will track each banknote by number and know what it was spent on. This may include allowing spending only on certain groups of goods. Experts are already calling it digital slavery.

- High risks of deformation of the economy. With the mass introduction of virtual money, it will become impossible to hide income. During crises, many people try to survive by receiving “gray” income and subsidies from the state. In the pandemic of 2020, the share of cash in circulation grew by 22%, and the liquidity of banks – only by 6%.

Impact on the population

Representatives of the Central Bank assure that ordinary citizens will not feel serious changes. Operations will be simplified, they will not differ from a standard transfer in the bank’s application.

Users will be able to choose in what form of RUB (cash, non-cash or digital) to make settlements.

In many ways, transfers will become more convenient – it will be possible to pay for purchases via QR code, send money abroad quickly and safely. The disadvantages and dangers of the digital ruble are also obvious: there will be no income for storing funds and no cashback, and all transactions are subject to state control.

Impact on pensioners

After the end of the first stages of testing, public sector employees’ salaries and pensions will begin to be paid in digital units. However, the citizen will be able to refuse, if he is against it, and receive money in the usual ways – at the post office or through the bank to the Mir card. To credit benefits with virtual banknotes, you need Internet access and a modern smartphone. The catch is that many pensioners do not have such devices or do not know how to use them.

Implications for banks

Retailers pay a commission of up to 7% for cashless payments. The cost of transferring in virtual rubles is much cheaper. According to the forecasts of the consulting company “Yakov and Partners”, after the introduction of a new form of money, retailers will be able to save 250 billion rubles in 5 years. But for this to happen, it is necessary to achieve widespread payment for purchases with digital coins.

Analysts believe that with the growing popularity of the new form of transactions, there will be an outflow of funds from the banking system.

Some critics say that the digitalization of monetary settlements will strangle Russia. However, this will, on the contrary, lead to financial organizations being forced to raise deposit rates.

Main differences between digital currency and cryptocurrency

One technology is used for storing and transferring assets – blockchain. The rules of issuance are strictly prescribed in the code. Additional issuance of cryptocurrencies can be carried out only by developers or the community (if the coin is managed by a DAO). In the case of the virtual unit, these functions have been transferred to the Bank of Russia. However, the digital ruble also has differences from crypto coins.

Which countries use digital money

The growing popularity of cryptocurrencies has forced the world’s Central Banks to completely change their attitude towards them and start developing their own projects. According to the IMF, in 2023, more than 100 countries are showing interest in developing CBDC (Central Bank Digital Currency). Some are just exploring the possibilities for launching blockchain coins and the pitfalls. Others are already implementing them into everyday life.

The degree of Central Bank activity depends on the level of development of the physical system, inflation and the amount of money circulation in the country. CBDC has been launched by the Central Banks of states such as:

- Bahamas (Sand Dollar).

- Eastern Caribbean (DCash).

- Nigeria (e-Naira).

- Jamaica (JamDex).

In early 2023, the US Federal Reserve issued a report on the benefits of adopting digital assets for the country’s economy. CBDC development is underway in other nations as well:

- كندا

- Netherlands

- France

- اليابان

- South Korea

- الصين

- Indonesia

- الإكوادور

- Kazakhstan.

Whether it is obligatory to switch to digital payments

In 2023, Russian residents can use cashless transfers or pay with cash. One more method of payment will appear, but nothing will change in principle. It will still be possible to choose the form of payment. At the same time, if virtual money arrives on a personal account, it will be allowed to instantly transfer it to a card of any bank or cash it out.

الأسئلة الشائعة

✨ Will banks issue loans with the new money?

This form of currency is being created as a means for quick and easy transfers. Financial organizations will issue loans in cash or to the bank’s card as before.

📌 Do you need to go through KYC to create a wallet?

No additional documents are required to be submitted. You need to log in to the mobile app to create the vault. All the details are already in the bank’s system.

📢 Can I earn on the exchange rate difference of virtual RUB?

According to the idea of the project developers – no. Quotes will be strictly tied to the rate of the national currency. Assets can be converted at any time in the ratio of 1 to 1. However, some analysts believe that there will be a market with other exchange rates.

⚡ Can the new money be used via a desktop computer?

In the testing phase in April 2023, there is no such possibility. The platform is tied to the mobile applications of banks. Perhaps the developers will add a PC version in the future.

💳 Will it be possible to cancel an open virtual account?

There is no information about the order of account deletion yet. The project is being tested. Perhaps, this feature will be added later.

🔔 Are transactions with virtual RUB safe?

The control of transactions on the platform has been transferred to the Bank of Russia. Transactions will be conducted through a secure channel using cryptographic mechanisms. For a transfer it is worth signing the transaction with a private key.

خطأ في النص؟ قم بتمييزه بالماوس واضغط على السيطرة + أدخل

المؤلف: سيف الدين عموسخبير في اقتصاديات العملات الرقمية.