With the increasing digitalization of the environment and the emergence of new payment systems, it is becoming difficult to understand modern terms. Because of this, there is confusion in terms, and the original meaning is misinterpreted. Cryptocurrency is not electronic money, but a digital asset. Until recently, financial resources existed only in physical form – in the form of paper bills and coins. The word “electronic” was added to them with the development of computing machines and data transmission networks, which allowed rapid settlements between banks.

Cryptocurrency and electronic money are different concepts

Paper bills converted into digital form remain under the control of the authority that issued them. The currency is issued through Central Banks and major payment systems (e.g. PayPal). Proof of identity is required to access the account, and all transactions are subject to international and regional laws. The size of e-money issuance can be unlimited, which negatively affects the purchasing power of the asset, leading to its constant inflation (depreciation).

Cryptocurrency does not refer to electronic money. It removes cross-border barriers through decentralization. It does not have a single server that confirms transactions and stores information.

The distributed ledger runs on many nodes in the network and is protected by cryptography tools to keep the data safe. No one can change or rewrite the information already recorded. There are the following types of digital asset issuance:

- Limited.

- Unlimited.

- One-time.

Bitcoin has a predetermined limit of 21 million units and no one can influence it from outside and issue more coins. This increases its attractiveness because of its limited supply.

Pros and cons of cryptocurrency

The main advantages of tokens and coins:

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

- Security. Blockchain technology reliably protects the integrity of data within the chain with cryptographic encryption.

- Privacy. No identity verification is required to open an account and use it freely. It is enough to simply set up a wallet and buy coins and tokens through exchanges that do not require verification.

- Decentralization. No authority can stop the network or block a transaction.

However, cryptoassets also have weaknesses:

- Irreversibility. If coins were mistakenly transferred as a result of a hack or wrong address of the recipient, it is impossible to return them.

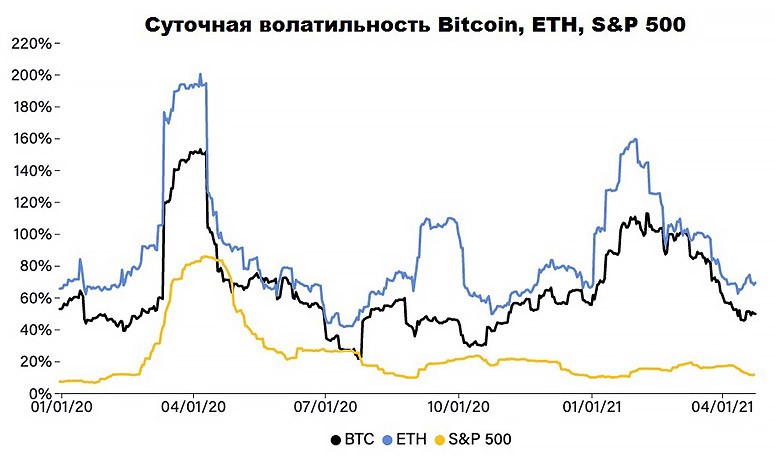

- Volatility. Large price fluctuations make it difficult to use cryptoassets for long-term commercial contracts and cause speculative demand.

- Low bandwidth. The scalability problem is still present in the two market leaders, Bitcoin and Etherium. Ethereum is going to get away from this by moving to the 2.0 protocol and changing the transaction confirmation method.

Development teams are offering new approaches to solve these problems, and soon many weaknesses will be eliminated.

Constant improvement of technologies attracts not only enthusiasts from all over the world, but also ordinary people for use in everyday tasks.

Pros and cons of electronic money

Traditional financial resources in the form of digital records in users’ accounts are currently the dominant means of payment. This monopoly will continue until cryptocurrencies gain mass distribution and legal legal status.

| Advantages | Disadvantages |

|---|---|

| Convenience. One can freely buy goods all over the world. | Centralization. All customer data, including sensitive data, can be disclosed in a hacker attack or at the request of law enforcement. |

| Simplicity. Having reached the age of majority, a person with a passport can open a bank account and not worry about storing private keys. | High commissions. The transfer fee is set as a percentage of the amount sent. |

| Stability of the exchange rate. Prices are supported by the Central Bank, which limits sharp declines in value with monetary instruments. | Political. Authorities can prohibit the operation of payment systems or revoke transactions that have already taken place. |

Virtual currency is another concept

This is a type of digital assets issued by payment systems like WebMoney, YouMoney. When opening an account and replenishing it, fiat money is converted, which simplifies mutual settlements within the systems. However, such currency exists only in a limited virtual environment.

Conclusions

Very often the terms “electronic” and “cryptocurrency” are combined, but there are differences between these types of finances, and it is necessary to use them correctly. Though both are means of payment, but their characteristics are different.

Frequently Asked Questions

💰 What does the price of crypto- and electronic money depend on?

Quotes of digital assets depend on the balance of supply and demand. When sellers outnumber buyers, the price goes down. In addition to this ratio, the exchange rate of traditional money is also influenced by general economic factors, monetary policy and the size of gold reserves of the country that issued it.

💡 How to buy cryptocurrency?

The best way to do this is through exchanges.

💹 How many Ethereum coins will be issued in total?

Issuance in the ETH network is unlimited, but after the London fork, developers began to artificially regulate the circulation of the asset through a mechanism of forced burning when paying for transactions.

❔ What is a decentralized exchange?

DEX-platforms help users exchange through smart contracts directly with each other. This method preserves anonymity (no identity verification is required) and security (coins are stored in customers’ accounts until the transaction is completed).

👛 What are altcoins?

This is the name of tokens and coins that appeared after Bitcoin.

Is there a mistake in the text? Highlight it with your mouse and press Ctrl + Enter

Author: Saifedean Ammous, an expert in cryptocurrency economics.