In 2021, the U.S. Securities and Exchange Commission (SEC) legalized the first U.S. digital fund. The profitability of this venture depends on the value of Bitcoin futures. Investments in exchange traded funds are also accepted in Russia. But as of November 2021, cryptocurrency ETFs are not authorized on the MosBirch. This prevents Russian investors from capitalizing on the growth of token and coin quotes.

Why there are still no ETFs for cryptocurrency on MosBirch

Investments in investment funds are made according to the following algorithm:

- The company undergoes registration and receives access from the regulator. In Russia, this role is performed by the Central Bank of Russia (CBR).

- The fund creates a portfolio of stocks, bonds, gold and other assets. In cryptocurrency ETFs, these are tokens, koins or derivatives (futures, options).

- Traders buy shares of promising funds.

- If the price of assets included in the portfolio grows, investors receive profit in proportion to their share.

The most difficult stage of the above is obtaining authorization from the regulator. Large financial markets are controlled by the state. To be allowed to trade, fund founders must go through the procedure stipulated by the legislation. Therefore, ETFs for Bitcoin on MosBirch will appear only after such projects are approved by the Central Bank of Russia. In 2024, there is no legal possibility to launch crypto funds in the territory of the Russian Federation.

The best exchanges for buying cryptocurrency

In 2021, there were about 570 trading platforms in the rating of the portal CryptoProGuide.com. The overall assessment of the crypto exchange is influenced by such characteristics:

- Reputation. Customer reviews and expert opinions.

- The number of available trading pairs and instruments for investment.

- Commissions and fees.

- Terms of registration.

- Average daily trading volume, capitalization of the project (if it has its own ecosystem).

- Reliability, resistance to hacker attacks.

- Convenience of the interface.

Regulation by the authorities

The main regulatory act that guides Russian traders and companies is the Federal Law “On Digital Financial Assets”. There is no mention of cryptocurrency funds in this document. At the same time, the procedure for admitting stocks, bonds and their analogs to trading on exchanges is regulated by the Federal Law “On the Securities Market”. This legal act establishes restrictions for participation of ordinary (unqualified) users in transactions.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

In July 2021, the management of the Central Bank of Russia even sent letters to the heads of exchanges and investment companies, as well as other market participants with a recommendation not to allow cryptocurrency funds.

A few days after the listing of the first U.S. Bitcoin-ETF, journalists asked the head of the Central Bank of the Russian Federation Elvira Nabiullina. The Chairwoman of the Central Bank of the Russian Federation said that she has no plans to allow cryptocurrency funds and is not going to facilitate access of unqualified traders to such operations.

Necessary compromises

The main reasons why the Central Bank of the Russian Federation has a negative attitude to crypto-assets are the decentralization of such projects and risks for investors. But the situation may change. To start trading Bitcoin-ETF, 2 conditions are necessary:

- Admission of non-qualified users to foreign funds. In 2021, such clients could only purchase the safest securities, the yield of which does not depend on currency fluctuations. In the future, the plan is to grant unqualified traders admission to transactions after testing. In theory, the regulator may allow individuals to buy a stake in any exchange-traded funds, including cryptocurrency funds.

- Authorization of the Central Bank of Russia to list ETFs for cryptocurrency on the Moscow Exchange. According to experts, the readiness for such a compromise will depend on the performance of foreign funds. If trading participants are able to receive stable profits, the regulator is likely to approve the listing of Bitcoin-ETF. Probably, the first step will be the removal of restrictions for registration on the Moscow Exchange for companies whose main activity is investment in digital projects.

The emergence of ETFs

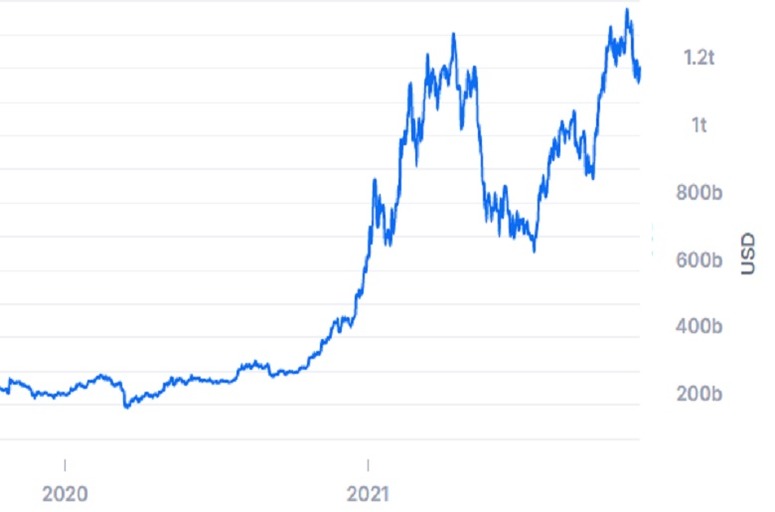

The first exchange traded fund was launched in the United States on October 19, 2021. Two days later, the volume of investments in Bitcoin-ETF exceeded $1 billion. Shortly after the start of trading, BTC quotes updated the previous record and reached $67,276. Analysts suggested that in the coming years the capitalization of the main digital coin will increase 2 times due to the inflow of investments from corporations and other large investors.

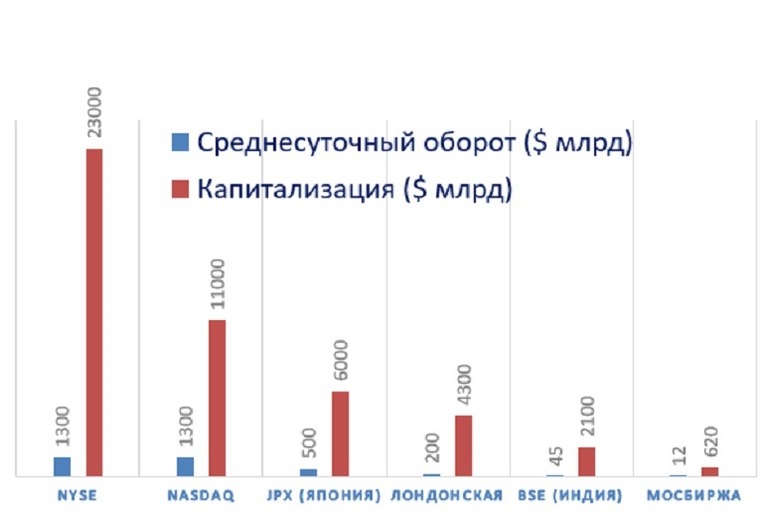

At the same time, it is difficult to say whether cryptocurrency funds on the Moscow Exchange will have a similar impact on the market. The main Russian platform is outside the top 10 trading platforms. In 2018, the average daily turnover on the Moscow Exchange was about $12 billion. At the same time, the amount of daily transactions on the US platform NASDAQ exceeded $1.3 trillion.

Some analysts doubt that the record growth of bitcoin in October 2021 is due to the launch of Bitcoin-ETF. In particular, experts at JPMorgan Bank said that the dynamics of the BTC rate was more influenced by inflation statistics in the United States and other countries. Due to the depreciation of fiat money, users had to buy digital assets.

Therefore, the launch of cryptocurrency ETFs on the Moscow Exchange will not cause the same effect as similar processes in the United States. At the same time, if the Russian regulator shows loyalty to digital money, it could be a positive signal for traders from other countries.

Investment opportunities today

Despite the inadmission of exchange-traded funds to the Russian market, operations with cryptocurrencies are not under a ban. Residents of the Russian Federation have several ways to generate income with the help of digital assets. Each of them has pros and cons:

| Method of earning | Advantages | Disadvantages |

|---|---|---|

| Long-term storage of crypto-assets | Passive type of investment. | Low and unstable profitability. The rate of tokens and coins can fall. In addition, the owner risks losing savings due to a hack of the wallet or a forgotten access code to it. |

| Trading | Profitability depends only on the skills of the user himself. With competent market analysis, it is possible to get high profits. Most crypto exchanges provide services to Russian citizens. | High volatility of bitcoin and altcoin quotes. At any moment, a trader can open an erroneous transaction and incur losses. |

| Mining | The amount of income (in bitcoins) does not depend on their rate. Usually, miners receive profits regularly. | This method will require not only startup capital, but also good technical knowledge. The investor needs to buy and set up the equipment. |

| Lending and crypto-loans | Usually, digital loans are given at a fixed interest rate. | There is a risk of loan default or fraud on the part of the recipient. The interest rate of bitcoin lending is usually slightly higher than the yield on a bank deposit. |

| ICO, IDO and IEO | Opportunity to invest in the most promising startups. | Many projects turn out to be unsuccessful. |

| DeFi and liquidity pools | High interest rates. | The exchange rate of DeFi tokens is very volatile. Investors risk losing money if the currency deposited in the pool depreciates. |

Frequently Asked Questions

❌ Are all ETFs banned on the Moscow Exchange?

No. The restriction applies only to cryptocurrency investment companies. The regulator does not prohibit the registration of regular stock ETFs.

💰 Can Russians invest in crypto-assets abroad?

Yes. The law does not prohibit purchasing digital currencies or securities in other countries. But American and European exchanges set strict requirements for ordinary users. Therefore, it may not be profitable for Russians to invest in foreign ETFs.

🔎 What is the return on investment in crypto projects traded on stock exchanges?

The investor’s profit depends on the quotations of tokens and coins. In October-November 2021, investing in the first Bitcoin-ETF BITO brought security holders about 0.9%.

❓ Why don’t large companies trade on conventional crypto exchanges?

Large corporations and institutional traders are not profitable to work on digital platforms. The main capital of such companies is concentrated precisely in the stock market. Therefore, ETFs consisting of crypto assets are bought primarily by large investors.

💼 What does a crypto fund portfolio consist of?

In November 2021, the capital of the first BITO ETF included Bitcoin futures and U.S. Treasuries.

💻 What is the interest of exchange-traded funds for ordinary users?

The main advantage of ETFs is the ability to invest in a balanced portfolio. Crypto fund managers take on the job of analyzing the market and selecting the most promising tokens and coins.

🔗 What capital is needed to trade on US exchanges?

It depends on the particular intermediary (broker). The minimum deposit amount is $5000.

Is there a mistake in the text? Highlight it with your mouse and press Ctrl + Enter.

Author: Saifedean Ammous, an expert in cryptocurrency economics.