In the 21st century, more and more countries are striving to achieve grid parity. This is a situation where the normalized cost of electricity generated by alternative sources is less than or equal to the price of grid power produced by traditional plants (thermal power plants, hydroelectric power plants, and nuclear power plants). According to a 2019 report by Global Market Insights Inc. blockchain technology in the electricity industry will grow from $200 million in 2018 to approximately $18 billion by 2025.

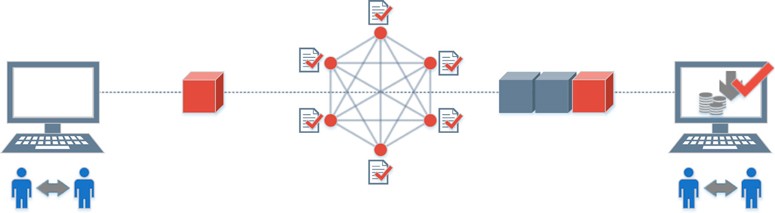

Established as a niche product, blockchain mechanisms have started attracting the interest of experts from various industries for quite some time now. An innovative feature of blockchain is that transactions are no longer stored in centralized databases. All transactions are distributed across participating computers in the network, which store information locally. Since 2015, a number of initiatives have been launched by governments around the world that apply the blockchain principle not only to financial but also to other industries. Distributed registries have also become relevant to the energy sector.

Companies adopting the technology and into wholesale capacity distribution are focusing on direct end-user connectivity. Moreover, increased load from the influx of electric vehicles and the growing number of smart devices will increase the role of blockchain technology within the energy market. People generating their own energy will be able to sell it to their friends, neighbors and colleagues. The market will no longer be controlled by giants.

The essence of blockchain in the energy industry

Big companies, the wholesalers of electricity, see retailers as a source of inefficiency in the consumer market. They own a very small portion of the grid infrastructure, and they only manage the types of services that blockchain technology can perform: billing and metering.

Replacing intermediaries with a distributed ledger-based platform will reduce user fees by about 40%. Once connected to the network, consumers will be able to buy energy at the price they want directly from the grid. The result will be a fairer and more stable market with low electricity costs.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

Case Study

Wholesale power distribution is a core business for many companies. A report by research firm Wood Mackenzie indicates that 59% of blockchain-enabled projects are built on peer-to-peer energy markets (networks of people who buy excess energy from other participants). This makes it possible to buy energy directly from the network, rather than from retailers, to benefit society. This is how the control of central authorities and wholesalers is reduced.

How blockchain is being applied in the power industry in 2024

Innovative companies are using different versions of blockchains, from corporate to public. For example, the Energy Web Foundation platform runs on Ethereum and multi-signature wallets. As the global community strives for grid parity, the cost of renewable energy is becoming equal to the price of traditional retail power and can even be lower. People are generating their own electricity and can legally trade that capacity.

Australian company Power Ledger has connected communities with each other to create microgrids (groups of interconnected loads and distributed energy resources). These systems exist as a layer on top of the national grid. Many companies using blockchain in the energy industry envision a future with larger and fully distributed peer-to-peer networks.

IN THE U.S.

In Brooklyn, LO3 Energy has teamed up with Siemens to create a pilot microgrid using blockchain technology. Residents with solar panels can sell excess electricity to their neighbors through peer-to-peer transactions. Microgrids minimize energy loss during transmission (~5% of the power that is generated in the US is lost in transit).

TransActive Grid has developed software that combines a meter and a computer to measure power generation and consumption. Blockchain has enabled people to utilize alternative green energy. Previously, owners of photovoltaic (PV) panels could sell excess capacity to utility companies but did not profit from it. The use of microgrids eliminated the middleman, leaving manufacturers to control their own electricity generation. The Brooklyn Microgrid is an example of the difference blockchain is making in the energy industry.

Germany

Germany’s Enerchain 1.0 from PONTON, launched in May 2019, is the world’s first blockchain-based wholesale energy provider. The company provides data services to electricity sellers via decentralized platforms. Blockchain mining on the Enerchain network is 1 second. This is very fast compared to traditional Bitcoin (10 minutes) and Ethereum (10-20 seconds).

Enerchain infrastructure can be applied not only in wholesale electricity trading. Blockchain is a potential basis for new decentralized markets for other industrial commodities: coal, oil and others.

In Japan

As measures against global warming, Japan has introduced a green tariff (FIT) system to allow power companies to buy electricity generated from solar and other renewable energy sources at fixed prices. Every commercial consumer had to find alternative capacity suppliers to sell surplus capacity by 2021.

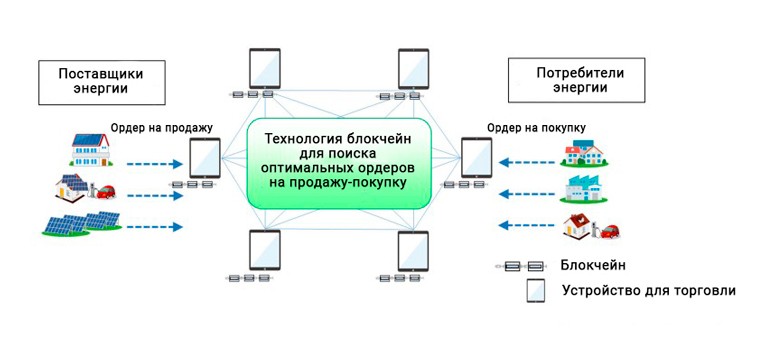

In 2019, energy companies Marubeni and LO3 Energy launched a pilot project in Japan aimed at managing the market using blockchain. For this purpose, they released a transactive energy platform, a system where traditional consumers can generate power and sell excess power back to the grid.

The mechanism uses standard meters combined with computerized devices on the blockchain. This helps to capture data on energy quality. The devices also connect participants with other nodes in the network to activate transactions involving electricity consumption. Sellers set their parameters through a special mobile app, giving buyers the ability to choose their preferred sources and cost of electricity.

In Russia

The total amount of debts for electricity as of September 2021 reached 309.2 billion rubles. At the same time, the share of the population accounts for 68.8 billion rubles. The main reasons are related to the fact that people do not pay their bills, payments do not reach producers, data is often disjointed or inaccessible, and intermediaries provide inaccurate payment amounts. If properly implemented, blockchain can help overcome these obstacles.

Russia’s Waves project has attempted to eliminate the potential for data manipulation in the electricity market. The developers created a blockchain-based application that was directly integrated into electricity meters. To establish an end-to-end payment chain between consumers and power suppliers, Waves partnered with Alfa Bank. About 400 families from the Kaliningrad and Sverdlovsk regions participated in the first tests.

The Russian retail electricity market involves many players: generation and distribution companies, grid suppliers, consumers and banks. The transmission process is accompanied by technical power losses.

Conclusions

Blockchain in the energy industry offers consumers greater efficiency of electricity sources and control over them. In addition, an immutable registry provides secure, real-time updates of capacity utilization data (market prices, marginal costs, regulatory compliance and fuel prices).

In the energy sector, blockchains are considered a promising tool for recording and facilitating transactions between energy producers and consumers and include a variety of use cases.

| Peer-to-peer trading | Selling excess renewable electricity to other grid participants through automated smart contracts |

|---|---|

| Renewable energy certificate management | Automated registration and issuance of renewable certificates in real time to avoid double counting |

| Grid management | Automatic control of all electricity flows and aggregations on the grid to balance supply and demand in the context of increasing intermittent renewable integration |

| Electric vehicle charging and sharing | Peer-to-peer electric vehicle charging applications and network services |

Frequently asked questions

🔧 How can we reduce the energy consumption of the blockchain itself?

To do this, you need to use alternative Proof-of-Work consensus algorithms.

⌛ How long will it take Russia to integrate blockchain into the energy market?

Integration depends on whether the government is ready to eliminate intermediaries in the form of state-owned energy supply companies. Also, the country lacks the technological base: solar panels, windmills and other devices for generating electricity.

📅 When was the very first electricity transaction between individuals?

In 2016, an American in Brooklyn sold excess renewable energy to his neighbor via the Ethereum network.

❓ Which blockchains are most commonly used in the electricity industry?

Private purpose-built networks.

📝 What is the purpose of tackling surplus electricity?

This is being done as part of global warming initiatives.

Is there a mistake in the text? Highlight it with your mouse and press Ctrl + Enter

Author: Saifedean Ammous, an expert in cryptocurrency economics.