With the development of the digital asset market, there are new opportunities for making profits. Reselling bitcoins on exchanges is one of the popular ways of earning money. There are different methods of generating income: arbitrage, trading, investing, derivatives trading. Each of them has its own nuances, which you need to understand for successful earning.

What a beginner needs to know

Arbitrage is an activity related to trading digital assets on different exchanges. A few years ago, such transactions could be conducted in exchanges. However, in 2022, arbitrage on these platforms has lost relevance. Like other ways of earning cryptocurrencies, interexchange trading requires certain knowledge from a novice trader.

Finding a favorable deal

The current rate of a digital currency is the price at which its seller and buyer came to an agreement. This is how the value of assets on the crypto exchange is established. According to the service, there are 572 trading platforms in February 2022. On each exchange, the rate of the same cryptocurrency will differ.

This is used by arbitrage traders. First, they find the lowest price for the digital asset. Then they sell the purchased coins or tokens on another platform at a higher price, making a profit.

Commission

Cryptocurrency exchanges collect fees for most services. More often, fees are charged for trading transactions and for transferring to another platform. Some platforms set fees for replenishing the wallet. The size of the commission should be taken into account, because the arbitrageur loses a part of the profit on it.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

Transaction time

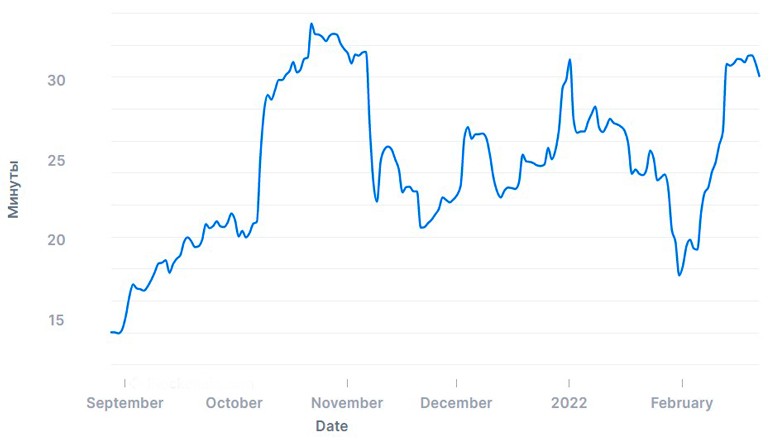

In February 2022, Bitcoin remains the most popular digital coin. The blockchain on which BTC operates takes a long time to conduct transactions relative to new networks. The average wait time is 20-40 minutes. Coin and token rates change quickly, so when reselling cryptocurrencies, you need a high speed of transfers.

Useful tools

Programs and bots make it easier to make money on the digital currency market. Simplify the process of reselling coins and tokens on different platforms allows special monitoring software. One of them is “Spread Scanner for interexchange arbitrage”. It analyzes cryptocurrency prices from 37 major trading platforms in February 2022. The program is paid, its price is 24.5 thousand rubles.

An auxiliary tool for spot trading is a trading robot (example: HaaS Bot). Such programs work with exchanges via API and automatically conduct transactions. They have different capabilities and cost (more often trading by subscription).

A mistake in the settings of a trading robot can lead to a complete loss of deposit.

Effective strategies for making money from reselling cryptocurrency

The principle of success in trading is stability. To make money on reselling cryptocurrency, you need to follow a trading strategy. There are different algorithms for achieving a stable income:

- Inter-exchange arbitrage.

- Spot trading.

- Trading on the decline in the exchange rate.

- Trading derivatives (derivatives from the underlying asset).

Inter-exchange arbitrage

Differences in the current exchange rates of cryptocurrencies allow you to make money. For effective arbitrage it is necessary to store coins and funds for their purchase on different exchanges at the same time. It is also necessary to monitor the quotes on each platform. You also need to consider the commissions that platforms charge for transfers and trades.

Inter-exchange arbitrage works like this: when there is a sufficient difference in prices on the platforms, the trader buys coins cheaper on one exchange and at the same time sells more expensive on another. The amount of profit must cover the commissions from trading transactions. Sometimes it is necessary to transfer coins or funds to buy them between platforms.

At the beginning of 2022 cryptocurrency arbitrage manually is more often unprofitable due to the high speed of exchange rates. You need to use programs to automate the process.

Spot trading

Earning money on the resale of cryptocurrency is a classic method of spot trading. A trader purchases digital currency and holds it in his wallet for a certain amount of time. Some speculators keep the coins for several years.

When buying assets for a long period of time, it is necessary to ensure their safety. It is better to choose non-custodial wallets. In them, the private key of access to coins is stored on the user’s device.

Buying digital assets in a long position should be done during the correction of exchange rates. The best moment is a bad news background. When the media constantly talk about negative events, the quotes of coins and tokens fall. This period is a great time to buy them.

Down play

Digital currency is a volatile financial instrument. Coins and tokens have floating quotation rates. After the growth of the asset value, a correction begins. Therefore, traders apply the “game” on the downside. This allows increasing the balance in digital assets.

For example, a speculator has 0.9 bitcoins in his account at the price of one coin of $50 thousand. He sells his $45k worth of BTC at market value on the expectation that the rate will start to decline. The trader’s predictions come true and bitcoin falls by 10%. Now he buys 1 BTC for $45 thousand, increasing the number of coins in his account.

Derivatives trading

These are financial instruments whose price is linked to the underlying asset. Among the derivatives used in the digital currency market are:

- CFD contract – an open-ended agreement with an exchange on the movement of quotes for an asset. The trader can close the transaction at any time. If the price has increased, he gets profit from the difference, and vice versa. CFD allows you to work with leverage, which increases profitability according to its size.

- Futures is a contract to deliver an asset at its current value until a certain date. One party commits to buy it and the other party commits to sell it. If the price of bitcoin has increased by the closing date of the futures contract, the exchange must deliver it at the rate it was at when the contract was made.

- ETF-fund – its value is tied to the quotes of one or more cryptocurrencies.

- Binary options. Contracts on the growth or decline of the rate by a certain time on the principle of “all or nothing”. If the trader is wrong with the forecast, he loses the bet.

Purchasing an asset during a rate correction

Derivatives allow you to profit in any market situation. When the bitcoin rate falls, a trader borrows it from the exchange against collateral and then immediately sells it at the current price. At the end of the correction, the speculator buys BTC back and gives it to the trading platform. The difference is the trader’s profit.

Such earnings on the resale of cryptocurrency is more risky than spot trading. However, this strategy is used by traders together with a long position in case of a wrong forecast. This allows you to average out the trade and potentially avoid losses.

Recommendations when trading short are as follows:

- Open a trade with confidence in the fall in value.

- Use no more than 10% of the available balance.

- Apply stop-loss. It is needed to automatically close the deal at a certain price level.

Pitfalls and risks

Trading on the market of digital assets brings traders great profits. However, it also carries high risks of losing money. To make money on reselling cryptocurrency, a novice trader needs to be aware of the pitfalls. The main nuances are presented in the table.

| Risk | How to reduce |

|---|---|

| Malicious programs (wallets, trading bots and others) | Read reviews, download from official sites |

| Fraud on the part of exchanges | Use trusted trading platforms (Binance, Currency.com). |

| Asset depreciation | It is better to trade coins with large capitalization |

| Strong spikes in cryptocurrency rates | It is impossible to reduce their volatility, so you need to constantly monitor quotes to avoid large losses |

Frequent questions from users

❓ Can a digital asset depreciate?

This has happened more than once in the cryptocurrency market. For example, the Bitconnect project raised over $2 billion from investors and closed.

🔎 What is scalping?

This type of trading involves a large number of short-term transactions with small profits. It is often more than 100 transactions in a day.

📉 How to reduce the trading commission on the exchange?

Some platforms (Binance, Huobi) issue their own tokens. Transactions are paid for with them. Holders of native cryptocurrency get a discount on trading commissions.

📝 What is the easiest way to make money on the digital currency market?

Airdrop – giving out tokens for simple actions (subscriptions, comments, registration and others). This is how new projects attract users.

👛 What coins are used for inter-exchange trading?

There are no restrictions for arbitrage. The main thing is that the assets can be transferred with a low commission.

Is there a mistake in the text? Highlight it with your mouse and press Ctrl + Enter.

Author: Saifedean Ammous, an expert in cryptocurrency economics.