Cryptocurrency traders with experience use the difference in quotes to make money. Such a process is called arbitrage – to buy in one place cheaper to sell in another more expensive. For successful trading it is necessary to take into account the peculiarities, use profile software, as well as special bots. Intra- and inter-exchange arbitrage of cryptocurrencies require large deposits, otherwise earnings will be negligible. Serious earnings are obtained by large investment companies that use robotic schemes and develop their programs.

The concept of arbitrage in the crypto market

This is monitoring the prices of digital assets on one or more trading services with their further purchase and earnings on the difference. Quotes of BTC and altcoins change depending on factors:

- Movement of large volume in the crypto market.

- The actions of major players.

- Features of the token or coin – mining, issuance, other operations.

- The state of the economy of the country or region.

- Political fluctuations.

- Changes in legislation and others.

Knowledge and understanding of the processes taking place in the digital world will help to make money on the difference of quotes.

The essence of arbitrage

The option of gaining profit due to the difference in rates refers not only to the cryptocurrency market. This concept is general, earning on the spread of prices has been known for a long time. The list of assets for monitoring the cost with further purchase and sale is large.

The essence of the process boils down to the sequential execution of trade transactions, linked to each other by logic. The goal is instant income on the price difference. The result depends on the factors:

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

- Shortage and oversupply on different trading services.

- Differences in trading volumes – for intra-exchange quotes.

- Lack of centralized management decisions, disconnected crypto exchanges – decentralization is affected.

This type of trading does not require studying the trend of quotes, technical analysis. The task is to make money on the current difference in the price of cryptoassets. Types of arbitrage trading:

- Intra-exchange.

- Static approach.

- Inter-exchange and others.

There are no market risks here, but you can lose a large sum due to technical problems:

- Interruptions in the work of the resource.

- Low speed or lack of internet.

- Prolonged transfer of crypto assets from one platform to another.

For arbitrage trading, the speed of reaction is important. The faster the coin is sold, the more likely it is to receive the planned profit. In the worst case, you can be at a loss due to a sharp jump in the exchange rate in the opposite direction or equalization of quotes. In the latter case, the participant will lose money at least on the interest paid for the exchange and transfer of digital assets.

To be in the plus, the arbitrageur must:

- Choose a strategy, a tool for work.

- Select software.

- Think through the actions.

- Take into account the payments, the speed of transactions of a particular coin.

It is necessary to think over the options for exchanging fiat currency and digital assets, taking into account the rules of the service. You can get to a site with a good price, but with a problematic withdrawal of funds, which will level the profit.

Legality

Arbitrage trading does not differ much from other transactions with cryptoassets. The legality of the exchange depends on the legal position of the state in which the resource is registered to BTC and altcoins.

The arbitrageur is obliged to study the local legislation, especially tax legislation. In some countries, digital assets are property, in others they are considered as money.

Classical

The classification of arbitrage depends on the number of trading platforms on which exchange operations are performed. Most often, actions are carried out on one exchange when there is a difference in the quotations of 2 coins in relation to the underlying asset and each other (also called temporary). Carry out arbitrage operations can be carried out at simultaneous work on different services (spatial variant).

The classic variant includes the following actions:

- Work is conducted with 1 digital asset on different crypto exchanges, which differs in price.

- Arbitrage actions with 3 pairs of instruments are performed on one platform.

- The procedure is performed one-step at a time.

Temporary crypto arbitrage – related instruments are used here. In it, the quotes of one of the pairs grow or decrease in relation to the other.

A person using time gap trading should be clearly aware of the actions. There are possible risks of losing the deposit due to the existing uncertainty, other problems.

Static

There is another method of income that is related to market inefficiency. It is called static. Prerequisites for the method:

- The multidirectional movement of cryptocurrency.

- Difference between current volatility and historical volatility – too high or, on the contrary, low.

Static types of arbitrage trading differ from the classical ones by increased risk. They are used by experienced traders who are able to identify positive and negative odds, analyze the risks and make a decision. The main task is to identify the regularity of changes in the instrument price.

An example of arbitrage

It is necessary to select an instrument, for example bitcoin. Using CoinMarcetCap, CoinGecko or other services, you need to monitor the prices on popular services.

If the spread is more than 3%, you can proceed to the operation.

At the same time, it is necessary to take into account possible risks – problems with Internet access, deposit fees, commission expenses.

For example, on crypto exchange number 1 bitcoin costs $32 thousand, and on the second – $32 900. The discrepancy is 2.8%. A person buys cryptocurrency for the amount of his deposit. He transfers the digital assets to the second site and sells them at a higher rate. One should not forget about the deposit fee.

To give you an example, you can earn on 1 bitcoin:

(1 * 32,900 – 1 * 32,000) * (1 – 0.004) = $896.4,

where 0.004 is the total 0.4% commission for cryptocurrency transactions.

This is a simple arbitrage scheme.

What you need to start

Before you start earning, you need to:

- Choose trading platforms to work on, verify yourself on them. There are more than 250 crypto exchanges, it is better to register in advance on the main ones.

- Find or buy software to monitor the price.

- Determine the amount of funds you can work with. The principle here is simple – the larger the amount, the better. You can work with more than one pair of cryptocurrencies, choose not 2, but more platforms.

Different software is available on the market, which allows you to monitor the rates, as well as conclude transactions in automatic mode. Bots significantly increase the probability of profit.

Choosing an exchange

To carry out trading, you need to seriously prepare. Arbitrage between cryptocurrency exchanges begins with the choice of platforms. It is better to take proven resources with good turnover, which are trusted and work with different cryptocurrencies.

It is worth abandoning such exchanges, even if there are very favorable rates:

- New, unproven and little-known.

- National platforms – possible problems with the withdrawal of fiat.

- With large commissions for replenishment.

The criteria for choosing a service are liquidity, commissions and the number of pairs.

Liquidity

High turnover of digital assets provides a high probability of successful trading. There is no point in a good price in the absence of the necessary volume of assets. In this case, there is no guarantee that it will be possible to close the order in time before the rate drops.

Commissions

The size of the fee for purchase and sale transactions, as well as for input, affects the choice of a crypto exchange. Payments for the transfer of fiat money should be taken into account. It is necessary to make a table with mandatory fees, determine for yourself favorable and refuse expensive platforms with high associated costs.

It is necessary to carefully study the technical documentation, where additional hidden payments are possible.

The number of cryptocurrency pairs

In this indicator, the main thing is the variety of coins, taking into account the cryptoassets from the top-100 rating. The rest of the altcoins are of little interest.

Cryptocurrency with small capitalization, small trading volumes are not suitable. There is a risk of getting to a sharp change in the rate, the impossibility of realization due to lack of demand.

Currency choice

The main criterion for choosing a currency is the speed of transactions in the system. You may not have time to sell or even transfer the asset profitably.

It is not necessary to work with bitcoin arbitrage, it is allowed to use other assets from the list of top-100. These are proven liquid tokens with high popularity and listing on major crypto exchanges.

BTC quotes on different crypto exchanges are presented in the table:

| Source | Pair | Price | Volume | Liquidity |

|---|---|---|---|---|

| Binance | BTC/USDT | $33 823,21 | $1 751 394 374 | 918 |

| Huobi Global | BTC/USDT | $33 828,07 | $471 841 402 | 886 |

| FTX | BTC/USD | $33 838,00 | $344 618 181 | 941 |

| Coinbase Exchange | BTC/USD | $33 832,58 | $298 565 727 | 861 |

| KuCoin | BTC/USDT | $33 849,87 | $124 951 936 | 827 |

| Bitfinex | BTC/USD | $33 829,00 | $113 011 632 | 728 |

| bitFlyer | BTC/JPY | $33 811,53 | $102 743 068 | 502 |

| Coincheck | BTC/JPY | $33 847,45 | $67 481 120 | 492 |

Arbitrage strategies and schemes

There are different mechanisms and methods of work. In this case, there is no ideal solution, everyone chooses for himself a system of actions.

Strategies are divided:

- Intra-exchange – trading takes place on one site.

- Interexchange – the trader buys and sells cryptocurrency on different platforms, earning on the difference in rates.

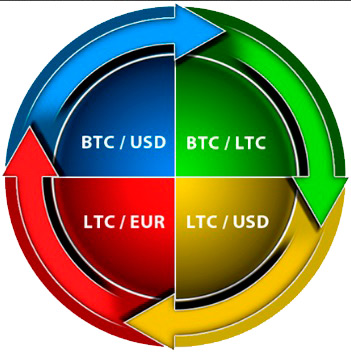

Intra-exchange

The scheme works within one platform. 3 assets are used – hence the name “exchange triangle”. The scheme looks like this:

- Buying cryptocurrency #1 for fiat money.

- Selecting a pair, exchanging koins between each other.

- Selling cryptocurrency #2 for fiat.

- Withdrawal of money.

Earnings consist in using the divergence of the rates of cryptocurrencies to fiat. Which digital assets to choose, decides the participant, applying software and analytics.

Example of income calculation

There is bitcoin, ether and the US dollar. Initial data for the example:

| BTC/USD exchange rate | 32 000 |

| ETH/BTC quotes | 0,055 |

| ETH/USD ratio | 2077 |

| Commission for entering USD | 4% |

| Interest for buying cryptocurrency | 0% |

| Withdrawal fee | 5% |

For example, there is $1000. Expenses in stages:

- Entering fiat into a crypto exchange – $40.

- For the amount of $960 purchased 0.0299 BTC with a commission of $1.92.

- Ether was purchased for bitcoins – 0.543 ETH.

- Ether converted into dollars – $1129.13.

- Profit – $129.13.

- Withdrawal of fiat outside the service – 5% commission, the balance is $1072.67.

As a result of the consecutive exchange, the profit of $72 was obtained.

Advantages and disadvantages

The advantage of the intra-exchange scheme is the absence of a commission for the transfer of cryptocurrency. Considering the additional costs, this is a significant advantage. Experienced traders use other ways to circumvent commission costs.

The disadvantage is the risk of changing the quote of the pair during the period of entering fiat or exchanging cryptocurrency. The speed of transactions, responsiveness, lack of program, technical problems are important. A number of crypto exchanges apply delays for orders, which can affect profits. It is necessary to use trading bots, which exclude the human factor, provide fast decision-making.

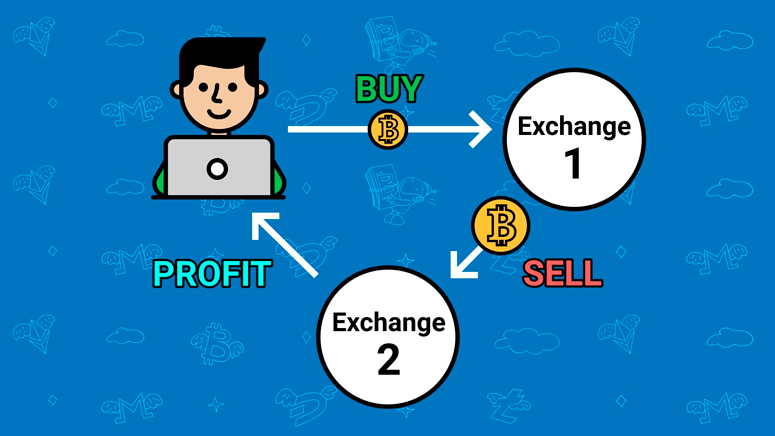

Interexchange

Unlike the previous scheme, the interexchange variant is performed on different platforms. Algorithm of actions:

- The trader buys crypto cheaper.

- Transfers assets to another platform.

- Sells the cryptocurrency more expensive.

- Withdraws the profit in fiat or continues the operation again.

This is a simple description, which in practice is complicated by commissions, changes in quotes, technical problems. Mandatory payments must be calculated in advance, otherwise instead of profit you can get a loss

Complicated variant

In practice, a deeper mechanism of inter-exchange arbitrage trading is used. The scheme looks like this:

- On the first exchange, the trader has crypto-assets A and B on his balance.

- On the second – a similar cryptocurrency in the same ratio (equally).

- If the price differs by more than 5% on one platform pair A / B is sold, on the second – bought.

- At the end of trading on the first platform 100% A, on the other – 105% B (or vice versa).

- Cryptocurrency is again divided in half, the profit is withdrawn or participated in trading further.

Example of calculating the income

| Rate A on resource 1 | $10 000 |

| Rate A on platform 2 | $10 500 |

| Input fee | 4% |

| Purchase interest | 0% |

| Transfer fee | 0% |

| Sales commission | 0% |

| Withdrawal fee | 5% |

The calculations look like this:

- A trader transferred $10,000, with the commission taken into account, there is 9600 USD left.

- For example, bitcoins were bought for the whole amount. It turned out to be 0.9581 BTC (taking into account the exchange fee of 0.2%).

- When transferring to platform 2, the trader lost another part of assets, leaving 0.958.

- Reverse exchange on exchange 2 – 0.958 BTC at the rate of 10,500 USD, it turns out to be 10,038.88 USD (taking into account the commission of 0.2%).

- When trying to withdraw the earned money outside of the site 2, the amount of 9536.94 USD is received.

The example shows that the trader has lost a part of his deposit on exchange expenses without making a profit.

Advantages and disadvantages

Advantage – a large exchange rate difference between platforms for the same pair. This is due to the impact of different factors.

The negative side – an additional fee for inter-exchange transfer, a different amount of commission for the deposit of fiat money. Some platforms set a delayed confirmation of the transfer of cryptoassets. During this time, the price of coins can change, and the profit will disappear.

Exchange deposits

This is an interexchange variety aimed at reducing commission costs. The scheme works for a long period of time.

Advantages:

- Deposits are already in internal exchange wallets.

- You can diversify your income, work with pairs of digital currencies on different platforms.

- The trader only needs to monitor the difference in exchange rates to make a decision.

Disadvantages:

- Commissions remain and take away part of the income, even if the deposit is made in advance, the input is paid.

- It is dangerous to keep money on the exchange wallet.

- It is difficult to guess in advance a couple of cryptocurrencies to work with.

Playing on the inter-exchange spread

The difference between the price of a coin when buying and selling is called the spread. Thanks to it, you can make a profit, choose the right strategy and calculate all the risks.

Arbitrage trading in cryptocurrencies is performed according to different schemes, one of which is the use of the inter-exchange spread. The price of the coin depends on the service. If you quickly buy it at a low cost, transfer it to another exchange and sell it, the difference will provide a profit. One should not forget about the fees when entering and other operations with coins on exchanges. In sum, these costs can zero out profits and even bring losses to the trader.

Differences in rates on inter-exchange arbitrage

Valuations of one token can differ on different platforms. The main reasons are listed in the table:

| Reasons | Comments |

|---|---|

| Political, economic situation in the country where the crypto exchange is registered | Legislative regulation of cryptocurrency affects the rate. Attention should be paid to the features of withdrawal, you can get your profit in Zimbabwean dollars. |

| Features of fiat withdrawal | Evaluation depends on the ease of getting money – the easier it is, the additional costs are less. |

| Speculation | The popular strategy of pump and dump can sharply raise and then collapse the exchange rate. It is necessary to monitor the possible “pumping” of cryptocurrency. |

| Other | Actions of hackers. Changes in the cryptocurrency blockchain, issuance. |

Commissions on transfers

The disadvantages of any cryptocurrency arbitrage are fees. Because of them, it is possible not to make a profit even on a favorable pair. The size of the mandatory payment differs on each site. The trader is faced with such percentages:

- Entering fiat currency on the trading service.

- Transactions with cryptocurrency – buying, selling.

- Sending digital assets from one exchange to another.

- Withdrawal of fiat money.

It is necessary to carefully study the rules for additional hidden fees and interest. It is worth calculating all fees to determine for yourself the limit of the spread at which it is profitable to invest in this crypto asset.

Minimizing risks

Trading on the exchange implies certain risks. Some of them are known and easily predictable. They can be avoided if you are prepared:

- It is necessary to register in advance, verify accounts. Otherwise, there may be problems with receiving funds.

- It is necessary to control the fees for transactions with cryptocurrency, deposit of funds. On some services they are dynamic, change over time, depend on the volume.

- It is desirable to understand the mechanism of deposit crediting or transfer.

- It is better to check the work of the trading platform by conducting a transaction for a small amount, to determine the time of sending money.

- It is necessary to make tables of costs for each trading platform. So it is easier to determine the feasibility for yourself.

- When using trading robots, it is necessary to understand the principle of their work and features.

The main thing is to understand the essence of all processes, do not do anything at random.

The best robots for cryptocurrency arbitrage

Experienced traders do not work manually – it is inefficient and unprofitable. To increase productivity, optimize trading, special programs are used:

- Bots – can conduct a transaction independently, using the laid algorithms.

- Scanners – search and process information.

Scanners

These are special programs that monitor, register information, display it on the screen. Based on the data received, the arbitrator decides whether to conduct the operation manually or with the help of software.

Scanners for real monitoring are paid, free versions do not provide all the features.

Programs and services for comparing rates

To compare quotes of cryptocurrencies on different exchanges, special services are used. They can be focused on certain tokens, platforms, allow you to customize the search and comparison parameters. You should not completely trust such programs. The problem lies in the update period, coverage, reliability of information. Popular comparison services:

- Bitcoinity – focused on working with bitcoin.

- BitInfoCharts.

- Cryptowatch.

- Other options, including for mobile platforms.

Bots

Automation of the trading process, including with the help of arbitrage on crypto exchanges, is achieved with the help of special software. Its advantages include:

- 24/7 operation.

- Automation of the process of searching for an interexchange spread.

- Instantaneous decision-making on the conclusion of transactions.

- Exclusion of the human factor.

Arbitrage bots can support the statistical method of trading by detecting price correlation. There are paid and demo versions. The former are preferable for serious projects. With free programs, you can try your hand, understand the mechanism.

Criteria for choosing software

Software, scanners and bots help traders automate the process and earn more. However, there are risks. The bot gets access to the cryptocurrency wallet, funds on exchanges, fraud on the part of developers is possible.

Criteria for choosing software:

- Cost.

- Integration with cryptocurrency platforms – the main exchanges must be connected, otherwise there is no point in working.

- Software only from well-known teams of programmers – the quality of development is higher, fraud risks are minimal.

- Presence of a community – they give consultations, advice.

- Speed of work.

- Simplicity.

Pros and cons of cryptocurrency arbitrage

Getting income on the difference in the price of cryptocurrencies has its strengths and weaknesses. Advantages:

- Instant profits.

- Risks are minimal – the income can be calculated even before the start of trading (taking into account the problems).

- Simplicity – in manual mode is available even for beginners.

Disadvantages:

- Starting capital – it is impossible to earn with a small deposit amount, fees level out the profit.

- Low liquidity of an attractive cryptocurrency in terms of value.

- Exchange restrictions on withdrawal.

- Labor-intensive process – just make a deposit, choose a coin and get profit will not work. You need to carefully study strategies, select software, analyze the situation.

Conclusions

Arbirtage is a good source of income. You can work on the difference of quotes within the exchange, use several sites to analyze the value of coins. Before working, it is necessary to carefully study the possibilities, prospects, select software.

Any investment is a risk, realized, carefully calculated and controlled. Otherwise, there will be no profit.

Frequently asked questions

💻 What is better: to work manually or with the help of software?

You can try to work without software, but you should not count on serious income. Large investment funds use robots.

📱 Is it possible to work on a smartphone using Android bots?

There are programs for mobile platforms. Their functionality does not differ from the desktop versions.

❓ Is it profitable to engage in intra-exchange trading or is it better to consider inter-exchange trading?

It depends on the amount of investment, pairing, programs to automate the process. You need to calculate everything and make a decision.

💰 Fiat withdrawal fee “ate” the income, where is the profit?

Interest costs, fees for transactions with cryptocurrency are negative sides of the process. It is necessary to calculate in advance the peculiarities of working with each platform, determine the optimal deposit size.

❔ Which program is better for the interexchange variant?

There is no single opinion on the trading robot. The choice is influenced by tokens, exchanges, strategies. It is worth trying out each program on small amounts, study reviews on profile sites.

A mistake in the text? Highlight it with your mouse and press Ctrl + Enter.

Author: Saifedean Ammous, an expert in cryptocurrency economics.