The Etherium blockchain was created as a convenient and functional platform for running dApps. The blockchain quickly became popular. Developers created hundreds of new coins on its basis. Processing operations required a lot of resources. In addition, there was a compatibility problem. To simplify the exchange and transfer of tokens, the team created a technical programming standard. The material tells what ERC-20 is, notes its advantages and disadvantages. After Ethereum, the technology was adopted by other blockchains – Binance Smart Chain, TRON.

What is the ERC-20 standard in simple words

Prior to the Ethereum blockchain, a new network had to be created to launch the coin. This is a complex work that requires a team of programmers to implement. After the creation of the Ethereum blockchain in 2014, startups could launch tokens based on it. The work became simpler, but it was still cumbersome. It required writing a smart contract from scratch.

To make the process even easier, the developers suggested creating tokens based on a single template. This significantly reduced the scope of actions. In 2023, any user can launch a token according to the ERC-20 standard. Experience in programming is desirable, but not required. There are templates of key functions in the topic blogs.

Deciphering the abbreviation and essence

ERC stands for Ethereum Request for Comments – “Request for Comments from Etherium.” This is the name of all code update proposals in the blockchain, with 20 being its sequence number. ERC-20 is not the only attempt to standardize Etherium tokens.

But it was the ERC-20 proposal that was accepted by the community and gained popularity. Since 2017, hundreds of thousands of tokens have been created based on it.

History of emergence

Initially, developers created their own tokens on the basis of Etherium. The code for them had to be written from scratch. While the network was young, there were no difficulties, but as it grew, compatibility problems began to appear. In addition, many different smart contracts required high computing power.

5020 $

bonus for new users!

ByBit предоставляет удобные и безопасные условия для торговли криптовалютами, предлагает низкие комиссии, высокий уровень ликвидности и современные инструменты для анализа рынка. Поддерживает спотовую торговлю и торговлю с плечом, а также помогает новичкам и профессиональным трейдерам с помощью интуитивного интерфейса и обучающих материалов.

Earn a 100 $ bonus

for new users!

Крупнейшая криптобиржа, где можно быстро и безопасно начать путь в мире криптовалют. Платформа предлагает сотни популярных активов, низкие комиссии и продвинутые инструменты для торговли и инвестиций. Простая регистрация, высокая скорость операций и надежная защита средств делают Binance отличным выбором для трейдеров любого уровня!

A solution was proposed in 2015 by programmer Fabian Vogelsteller and blockchain founder Vitalik Buterin. They developed a single standard for crypto coins. However, they adopted it only 2 years later – in 2017. The delay arose due to the complexity of the procedure:

- First, the creators introduce the Ethereum Modernization Initiative (EIP). It is necessary to provide a brief presentation and a full description of the protocols used.

- Community members review the proposal.

- If necessary, edits are made.

- Voting takes place.

- If the community supports the idea, the developers start implementing it.

Why it is needed and its functionality

Before the launch of a single standard, developers faced the problem of token compatibility. Each token had a unique smart contract. The application needed a large amount of computational memory to run, so dApps were slow, hung and crashed.

In addition to the standard functions (asset transfer, balance check, platform management authorization), ERC-20 network tokens have the following options:

- Linking the price to the total capitalization of the token. This provides a reserve fund. This is where the tokens are automatically balanced.

- Freezing the asset with the ability to unlock it when needed.

- Flexibility. Developers have the ability to add unique features to the coin.

Is it possible to mine

Standard tokens do not have their own infrastructure for confirming blocks. Transfers in the network are performed using the computing power of the Ethereum blockchain. As a reward for their activity, validators receive ETH coins. Only developers can create ERC-20 tokens. Usually release the entire volume at once and distribute it through an ICO or IEO. The project founders can also provide for the possibility of additional issuance.

Advantages

The development of the ERC-20 standard simplified the creation of cryptocurrencies. On average, an experienced programmer can launch a new coin in 40-60 minutes. The smart contract is written in the Solidity language, which is similar to JavaScript in many ways. Due to high liquidity, it is possible to quickly exchange assets for DEX.

If necessary, developers add specific functions to coins – automatic gas replenishment, freezing and others.

Interchangeability of tokens

Creators of standard assets have the right to set the degree of divisibility of units, which is characteristic of all digital coins. For example, bitcoin can be divided into 100 million satoshis. All units of cryptocurrency are identical, have the same value. Therefore, there is no difference in what specific token an investor owns. This allows the use of standardized assets for settlements.

Different ways of application

Tokens are easily customizable, so developers are able to add useful features to them within projects. For example, standard assets can be used for settlements on the platform, as an in-game currency, for participation in voting, for generating income in deposits and liquidity pools.

Popularity

By June 2023, users have made more than 1.26 billion transactions with etherium tokens. The ecosystem is serviced by 41 DEXs. Coins can also be exchanged in wallets – MetaMask, Trust Wallet, Atomic Wallet and others.

Disadvantages

To transfer standard coins, you need to pay gas. The commission depends on the load on the Ethereum network. Vitalik Buterin’s team aims to increase the blockchain’s throughput.

In 2023, the third of 5 updates of Ethereum is being prepared. For now, the transaction processing speed remains small – 13.4 TPS.

Problems with scalability

The main drawback of most blockchains is low throughput. To increase the speed of transactions, developers have to sacrifice security and decentralization of the chain. In 2021, at times of peak demand, Ethereum commissions reached $100, leading to the creation of many clone networks and Layer 2 (L2) blockchains. Despite this, Ethereum continues to lead the blockchain in terms of blocked funds in 2023 (56.8% of total TVL).

Ease of fraud

A single standard makes it as easy as possible to launch assets. To create a cryptocurrency and list it on DEX, all you need to do is enter a contract address and provide liquidity. No documents confirming the reliability of the project are required. This is taken advantage of by fraudsters organizing pyramids under the guise of blockchain platforms.

Other risks

The ERC-20 Ethereum standard has been actively used by developers since 2017. Despite the proven security, smart contracts may have hidden vulnerabilities. There are other risks for users as well.

For example, standard tokens do not have their own tools to process transactions. To do this, you need to run the transfer function (regular transaction) or transferFrom (participation in an ICO).

When trying to deposit money for a preliminary round of sales through the first option, it goes to an unknown address. This caused users to lose more than $3 million in funds.

Another disadvantage of smart contracts is related to their uncertain legal status. In 2023, cryptocurrency is not legalized in many countries. Smart contract technology is in a “gray area”. The main requirement of most contracts is verification of the participants. Because of the anonymity that blockchain technology guarantees, it is difficult to fulfill.

Where ERC-20 is used

Mostly startups use classic cryptocurrencies to finance developments. Investors can participate in an ICO or buy a coin after listing. The functionality of the asset depends on the purpose of the native platform. The more options, the higher the demand for the coin and the better the prospects for long-term price growth. Platforms that use the DAO management model usually add the ability for all holders to participate in voting.

ERC-20 for stablecoins

Developers can run tokens pegged to fiat currencies on the Efirium blockchain. USDT, USDC, and DAI are popular in 2023. It works like this:

- An issuer places a cash reserve in a bank account or in the form of bonds.

- It then issues ERC-20 tokens, the number of which must correspond to the number of dollars in the reserve.

- The cryptocurrency is distributed to users.

Steibloins can be used to pay for purchases (in certain countries), make transfers, use them as collateral on lending platforms or for trading on the futures market. If necessary, the assets are exchanged back to dollars through the issuing platform. After withdrawal of funds from the reserve, the pegged tokens are burned.

Some popular projects issue stablecoins on several networks at once to eliminate the problems of high commissions and compatibility.

ERC-20 for Security and Utility tokens

These are the main types of standard cryptoassets. Security tokens are securities and most often give holders a stake in the issuer’s business. At the contract level, they are no different from stablecoins. Utility tokens are not tied to real assets. Long-term growth is ensured by an increase in the number of platform users, positive external background around the project, support of partners, community and other factors. Utility tokens perform the following functions:

- Participation in voting.

- In-game currency.

- Loyalty points (for example, a discount in an offline store).

- Liquidity on DEX.

- Tokenization of real assets (real estate, stocks).

Popular tokens of the ERC-20 standard

Several types of cryptocurrencies function on the Ethereum blockchain. Most developers issue coins according to the rules of ERC-20. By 2023, more than 600 thousand standard tokens have been created. Some of them were abandoned by the founders immediately after launch, while others gained popularity. According to Etherscan, 1.2 thousand ERC-20 tokens appear daily in the summer of 2023. In the table you can compare assets with maximum liquidity.

| Project | Capitalization, $ | Trading volume per 24 hours, $ | Commentary |

|---|---|---|---|

| Tether USD (USDT) | 83.2 billion | 23.86 billion | The first cryptocurrency to achieve stablecoin status. USDT is pegged to the dollar exchange rate. The issuer is Tether Limited. |

| USD Coin (USDC) | 28.19 billion | 3.96 billion | A centralized stablecoin pegged to the dollar exchange rate. It is managed by Circle. |

| Wrapped BTC (WBTC) | 4.82 billion | 150.59 million | A wrapped bitcoin intended for use in DeFi. Conservative investors don’t convert the most reliable crypto asset into stablecoins or ether, but rather leverage WBTC to earn money in liquidity pools or on lending platforms. |

| DAI | 4.71 billion | 163.36 million | Decentralized stable coin that can be obtained on the MakerDAO platform. It requires blockchain BTC, ETH, and other topcoins. |

| Shiba Inu | 4.48 billion | 93.37 million | Meme coin with the image of a Shiba Inu dog |

Storage and transfer of ERC-20 standard tokens

Tokens can be held in any Ethereum wallet. Non-custodial vaults do not require you to create a new account for each asset. Tokens and ether can be held on the same address. But this rule doesn’t work for exchange wallets. Trading platforms create a new address for each asset. If you transfer ERC tokens to an ETH exchange wallet, they will be lost. Instructions for sending coins from a vault to a crypto platform:

- Authorize on the exchange.

- Go to the “Assets” tab.

- Select a coin through the search. If the desired asset is not available, it will not be possible to send it to this exchange. It is necessary to find another platform.

- Copy the address of the wallet.

- Return to the non-custodial interface. Paste the address into the transaction form.

- Specify the network – ERC-20 Ethereum.

A fee in ETH is charged for the transfer. In June 2023, it is 5 Gwei ($1.3).

Coins issued in several networks (BSC, Solana, TRON) are compatible with Ethereum, so they can be stored in one interface and transferred using crosschain bridges.

Wallets

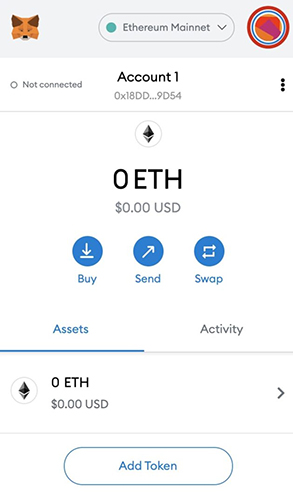

The most popular interface for ERC-20 in 2023 is MetaMask. You can use the browser version (plugin for Chrome, Firefox, Brave, Opera, Edge) or the mobile app (Android, iOS). Inside the wallet there is an exchange of ERC tokens for ether, buying cryptocurrency from a card, access to dApps.

There are other popular wallets for cryptocurrency in ERC-20. These include:

However, not all interfaces have a feature to display custom tokens. If it is required, you can import Seed into another wallet.

Transfer details in the browser

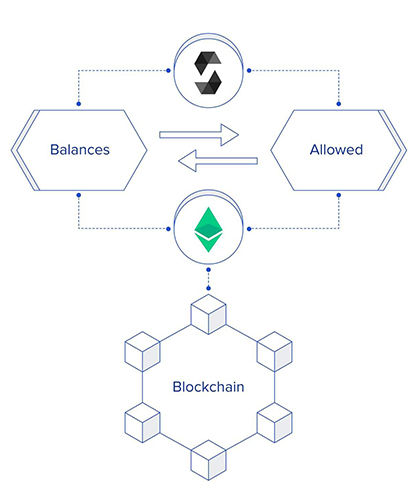

Unlike ETH, etherium tokens exist only inside a smart contract. It is a database that stores balance information of all holders as well as asset properties (name, divisibility). To transfer etherium tokens, you need to send a request to the smart contract. It is placed inside a normal ETH transaction (number of 0 units).

The details of the ETH transaction are recorded in a special block. Even though no ether is transferred, you have to pay a fee in ETH to process the transaction. In the block browser, the transaction will look like a 0 coin transfer with ETH fee. The Interacted With (To) field contains data about the sent etherium tokens. Tokens Transferred contains information about their quantity.

Creating ERC-20 tokens

According to the white paper, standard cryptocurrencies can be defined as blockchain-based assets with value.

The difference from regular coins is that they do not function on their own network, but on the Etherium blockchain.

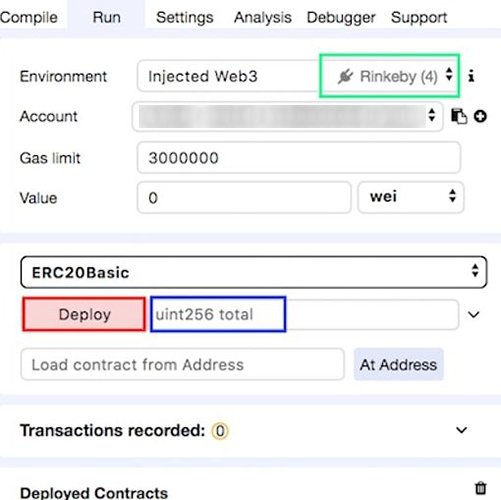

Users can create ERC tokens in the test blockchain (free) or in the main blockchain (need to spend ETH). In the first case, it is required to obtain ether:

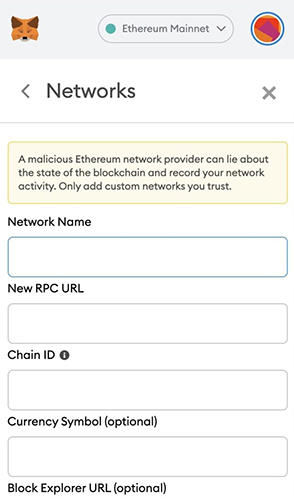

- Download the browser version of MetaMask (or another interface with the ability to add custom coins).

- Create an account.

- Transfer the wallet to the Ropsten Test Network and copy the address.

- Open the Ropsten website and paste the account number. After a few minutes, the balance will be topped up. The operation can be carried out no more than once a day.

Assets are created to practice or to bring the company to the ICO. One technically savvy person is enough to issue an etherium token. But conducting an ICO will require a team effort. A marketing strategy, presentation and technical document need to be worked out. Instructions for creating your own cryptocurrency:

- Go to a development environment (Ethereum Remix IDE, Solidity/Pyethereum or similar).

- The code template can be found in thematic blogs. In it, you need to change a few lines for your project. You need to come up with a name, a ticker.

- Open the development environment, create a new file and start compilation.

- Deploy the smart contract. Coin data and a message about creating a new block will appear on the screen.

- Enter the identifier in the browser search bar and copy the smart contract address.

- Go to the Contract tab and click the Verify button.

To add a custom crypto asset, you need to open MetaMask and click on the Add Token button. Then you should send some coins to another address (you can send them to yourself).

Smart contracts work

The programmer writes the code according to a single template and deploys it on the network. Once launched, the smart contract creates etherium tokens.

The developer can release all units at once or schedule a linear issue. Subsequently, any action with the assets will require the smart contract to be initiated. It is necessary to send a transaction to the network for 0 ETH. In the additional field specify the desired option.

By default, ERC-20 smart contracts are written immutable. However, if necessary, developers can activate the function of making edits to the code or part of it. This reduces community trust. But sometimes static code can harm a project. For example, after The DAO hack, the founders failed to roll back, so an Ethereum hardfork was needed to repair the damage.

Parameters and characteristics of the ERC-20 protocol

To create an Ethereum token, you need to write code for 6 main and 3 additional options. For this purpose, the Solidity language is used, which is very similar to JavaScript. Many developers write in it.

You can learn Solidity on your own using video tutorials or thematic blogs.

Total Supply and Balance of

Developers are able to limit the issue of cryptoassets. To do this, you need to prescribe the maximum number of coins in the Total Supply function. Later, the value can be changed if additional funding is needed. Sometimes teams burn the smart contract after launch to guarantee stability.

The Balance of function shows the number of coins assigned to a specific wallet. Most often it is owned by the developers. Further by calling this function, the balance on any address can be determined.

Transfer transfer and transferFrom

The standard uses 2 functions to send assets. Transfer is responsible for transferring coins to other addresses, transferFrom – for participation in ICO. Calling the last function allows you to program the algorithm for automatic transfers according to the condition.

Restrictions (approve) and permissions (allowance)

These functions are needed to determine whether assets can be transferred. Approve checks the rights of the smart contract to issue tokens, allowance looks if the address has coins to send.

Optional features

There are also optional options for tokens of the standard. Developers use them for the convenience of users:

- Name. Specify a name that users will understand.

- Ticker. Short name. This is how the asset will be labeled on exchanges.

- The number of units after the decimal point. Determines the minimum lot. For example, 2 means 0.1 coins. The maximum number is 18.

Once created, developers cannot add features to the smart contract. But if they include the SELFDESTRUCT option in the program code, it will allow them to delete it and start a new one.

The Ethereum ERC-20 token standard is different from others

Payments in ERC-20 digital coins are protected by cryptographic methods. Standard assets differ from others in a number of properties:

- Do not have their own blockchain.

- Use an approved address format.

- Are transferred as an ether transaction in the amount of 0 units.

- Are not mined. They are launched by a specific development team.

- Transactions are validated by Ethereum operators.

- Can play the role of a discount or bonus in the project.

- Are managed by smart contracts, which ensure the fulfillment of obligations embedded in the code.

ERC-20 is the first and most popular technical protocol for creating tokens in Etherium. However, there are other standards (ERC-1155, ERC-223, ERC-721). Some of them contain a set of functions to run NFT. Others are similar to the prototype, but with additional options. These are needed to improve the security and usability of the asset. For example, ERC-827 allows the holder to authorize token transfers to a third party.

Frequent questions

👛 How do I add Ethereum tokens to my wallet?

Popular assets can be found via search. If the digital currency is not on the list, you need to click on the Import token button. You will need to enter the address of the contract and the ticker.

❓ What is the difference between the ERC-20 and BEP-20 standards?

From a technical point of view, they are identical. The first one works in the Ethereum blockchain, the second one works in the Binance Smart Chain.

🉑 Can I exchange Ethereum tokens for coins of other blockchains in MetaMask wallet?

This option is not available through the built-in service. Ethereum standard assets can only be exchanged for ETH.

💡 How to transfer tokens from the ERC-20 network to BEP-20?

You can send them to an exchange and withdraw them in the right chain or use a bridge (Celer cBridge).

💵 How to buy ERC-asset via MetaMask?

You should go to the main page and select “Exchange”. In the tab, you can convert ether into any network crypto asset.

Is there an error in the text? Highlight it with your mouse and press Ctrl + Enter

Author: Saifedean Ammous, an expert in cryptocurrency economics.