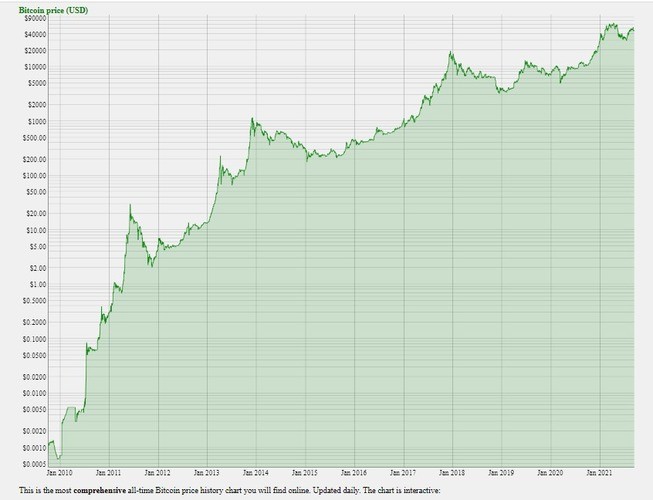

The exchange rate of the main cryptocurrency has increased by thousands of percent in the first decade since its creation. According to the CryptoProGuide website, Bitcoin’s price was less than $1,000 dollars at the beginning of 2017 and rose to $19,000 in December. Then there was a drop in the rate to $3400. But eventually in 2020, the price of BTC returned to a steady rise and eventually reached the $64,000 mark. The main question that many people are concerned about is whether Bitcoin is secured and why its capitalization has increased over the previous years. Understanding these processes is important for traders and investors, as the profitability and security of investments depends on Bitcoin dynamics.

What Bitcoin is secured by today

Not everyone understands the value of Bitcoin or any other cryptocurrency. There is even a myth among everyday people that Bitcoin is a pyramid scheme. However, cryptocurrency has had a serious impact on the global economy. A commodity gains its price if people are willing to pay for it. Suppliers accept any fiat currency because they realize that they can get other things or services for that money. The same thing is happening with Bitcoin.

Comparison to fiat currency

Bankable metals (gold and silver) have intrinsic value. In contrast, conventional currencies are not backed by anything, so they are called fiat currencies. The issuance of money is regulated by the government, which sometimes leads to inflation (depreciation).

Bitcoin, on the other hand, is mined by miners. This asset will always be in short supply, as obtaining new coins is a complex and energy-intensive process. The maximum number of bitcoins is limited by miners. Only 21 million BTC can be issued in total.

The shortage of coins and investor demand have turned the main cryptocurrency into an attractive asset. In 2021, its rate exceeded $60,000. However, Bitcoin is currently not backed by anything but trader interest.

Comparison with other cryptocurrencies

If Bitcoin is digital gold, then Ethereum (the second most capitalized coin) is similar to oil. The value of the koin is related to its practicality in the real world. The Ethereum blockchain is the foundation for developments in digital assets, from NFT art to decentralized peer-to-peer lending. However, widespread use has not made Ethereum a mainstream cryptocurrency.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

Ethereum has more use cases than Bitcoin, but this does not guarantee a future increase in its price. Cryptocurrencies are considered speculative assets. It is difficult to make predictions on how the coin’s rate will change in the future.

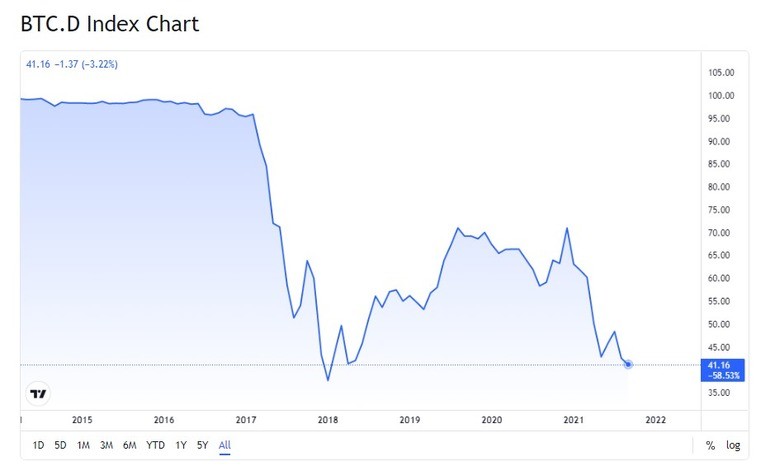

Bitcoin dominance is the ratio of Bitcoin’s total value to the capitalization of other cryptocurrencies. This index tells you how the value of altcoins increases or decreases in relation to BTC:

- The index rises if other coins lose value relative to Bitcoin.

- The Bitcoin Dominance Index decreases when the price of altcoins increases relative to the main crypto asset.

This index is used by traders and analysts to understand the situation in the digital money market. When choosing between BTC and altcoins, users evaluate the prospects of growth in the value of the asset and the risk of investment outflow to other projects.

Economic features

Unlike traditional currencies, Bitcoin’s value depends on investor confidence in the blockchain on which it is built. Bitcoin is used as a unit of account and has the characteristics of money. However, unlike fiat currency, the value of this digital koin is based on mathematical calculations. Bitcoin is tied to a growing base of users, investors, sellers, and startup owners. Like any other cryptocurrency, Bitcoin’s value comes from people and companies willing to accept it as payment.

Limited issuance

The supply of coins plays an important role in shaping the market rate. The scarcer a crypto asset is, the more valuable it can be. Bitcoin’s issuance has a limit of 21 million coins (as of September 2021, there are 18.8 million bitcoins in circulation). This asset is considered deflationary (when the supply of units of account gradually decreases).

Mining is the process of verifying transaction blocks and issuing new bitcoins. As of May 2020, Bitcoin rewards users who validate transactions at a rate of 6.25 coins per block generated. The payout is halved approximately every four years. Consequently, even an increase in demand will not increase the supply of bitcoins or the rate of coin issuance.

Decentralization

Bitcoin’s value is also determined by its blockchain. Bitcoin has no central authority to regulate coin issuance and circulation. No bank or government influences the processes within the network.

Demand

Bitcoin’s economy is based on a classical model. One of the key drivers of the BTC exchange rate is the relationship between supply and demand.

The market price decreases when buyer interest decreases. At this time, sellers cash out their investments by transferring them to other assets. If demand increases, Bitcoin quotes rise due to limited supply.

Rate volatility

Volatility is the change in the price of an asset. Volatility in the exchange rate creates opportunities for profit. For example, changes in the price of cryptocurrencies allow traders to buy digital assets cheaply and sell them expensively. Volatility occurs when the koin exchange rate rises or falls rapidly within a short period of time.

The total price of bitcoins in circulation and the number of companies accepting BTC as a medium of exchange are still small. Therefore, any large Bitcoin transactions or increased activity on the network can significantly affect volatility.

Spread

Mass adoption depends on the extent to which cryptocurrencies are used by a wide audience. For example, as a common and regular method of payment at various retail outlets or online shopping sites. The proliferation of digital assets is the main goal of many blockchain companies. Market experts believe that widespread acceptance of Bitcoin as a mainstream payment method is only a matter of time.

Factors affecting the price of Bitcoin

There are several aspects that determine the market rate of Bitcoin:

- BTC supply and fixed issuance. The rate at which new coins enter the market is limited. Bitcoin appears in circulation only when miners process transactions in the blockchain. The Bitcoin algorithm allows one block to be mined every 10 minutes.

- The number of bitcoin buyers determines the demand in the market. When users start actively investing in BTC, prices rise.

- The media influences people’s decision making. The demand for Bitcoin increases if the media promotes it. This allows more people to learn about the cryptocurrency by indoctrinating them to buy.

- Inflation. A situation where the prices of goods are rising and the value of the currency is falling. In such a case, the demand for bitcoins increases. This is because BTC and many other coins are not subject to inflation.

- Legalization of cryptocurrencies by the government. Confidence among people will increase if laws allow them to buy coins without any restrictions. Then investors will start putting more money into digital assets.

- Instability in the economy causing an increase in the demand for bitcoins. People try to preserve their savings by buying independent assets.

- Competition between different cryptocurrencies. Bitcoin holds its popularity among investors, but it is not the only coin on the market. Cryptocurrencies compete to grab the attention of users. When competition is high, prices fall. In this scenario, Bitcoin has leverage over other cryptocurrencies because of its long history and investor acceptance.

- BTC mining costs. Among all the costs, energy consumption is the most important. The higher the cost of electricity, the lower the income of miners. In addition, bitcoin mining is a competition in which the winner gets a new block and a fee for its creation. When a large number of miners enter the competition, the profitability decreases.

- Availability on exchanges. Cryptocurrencies have their own trading platforms. The popularity of an exchange is determined by the number of participants. More users – wider popularity of the platform. Consequently, the more accessible the platform is, the higher the demand for coins that are traded on it.

Possible risks

Many large companies invest in Bitcoin, but the main cryptocurrency remains an insecure asset for the following reasons:

- Restrictions and regulations. Bitcoin, like other digital assets, has grown significantly in value in recent years. Regulators have increased restrictions on transactions involving the main digital coin. The U.S. Securities and Exchange Commission now equates Bitcoin with stocks and other stock assets. This worsens the sentiment of large investors, as the future of Bitcoin depends on the status of the cryptocurrency and the decisions of regulators.

- Stability management and forks. Changes in the Bitcoin blockchain are made by miners and developers, as there is no central authority in this network. Users themselves ensure that transactions are completed and the blockchain is protected from threats. Due to misunderstandings within the community, hardforks (chain splits that give rise to new cryptocurrency projects) can occur. During such periods, the market becomes very volatile.

- Manipulation by speculators and large investors. About 1,000 people own 40% of the bitcoin market, and the number of addresses that hold more than 1,000 BTC is 2,334. Transactions made by large coin holders can cause changes in the price of Bitcoin, suppressing any movements by smaller investors. Ilon Musk caused an intense rise in February 2021 when he announced that Tesla was buying $1.5 billion worth of BTC and accepting the cryptocurrency as payment for its cars. At that time, the price of bitcoin reached $46,000.

Where you can pay with BTC

Bitcoin is growing and some corporations in the US are becoming market participants, accepting Bitcoin as payment:

| Company | Scope of business |

|---|---|

| Microsoft | The IT giant became one of the first bitcoin users in 2014 when it began accepting BTC as payment for digital content. |

| PayPal | In March 2021, added a form for US customers to pay with cryptocurrency for goods and services. |

| Overstock | The US online retailer became the first major retailer to accept bitcoins. |

| Whole Foods | In May 2019, payment startup Flexa partnered with cryptocurrency exchange Gemini to create a platform that converted BTC into dollars when making purchases. One of the first major retailers to adopt the technology was Whole Foods. |

| Starbucks | In March 2020, the corporation announced that it began accepting payment in BTC through the Bakkt Cash option in its app. |

| Rakuten | The Japanese e-commerce company began accepting BTC in 2015. It later developed Rakuten Wallet, which users can top up with digital currencies. |

In 2021, Bitcoin was not accepted as payment for goods and services by most offline services. That is, users do not actually transfer BTC from their bitcoin addresses to vendors’ wallets to make mutual payments. However, providers of goods and services are adapting the market by creating opportunities for consumers to instantly exchange digital currencies for fiat money to make quick payments.

Predictions for the future

Despite its shortcomings, Bitcoin is still the driving force behind the digital market. In simple terms, the BTC cryptocurrency is unsecured, yet it has driven global economic change. The acceptance of digital money by the masses opens the door for financial transformation and gives people more control over their assets. Price volatility and government bans are factors hindering the adoption of digital currencies.

Crypto asset trading is still banned in some countries as it promotes criminal activity. Tokens and coins still have a long way to go before they are accepted by the masses. Nevertheless, there is an ongoing global effort to make digital assets available to the general public.

Collateralized cryptocurrencies

Stablecoins are digital currencies that have the value of an underlying asset posted as collateral. Designed for the convenience of traders as they have a fixed price. This allows the assets to be used as the base currency for settlements on exchanges and investment platforms.

Most stablecoins have a 1:1 collateral to certain fiat currencies: the US dollar, euro. It is also possible to link these tokens to other assets: gold and precious metals. The difference between a secured cryptocurrency and BTC is that the rate of stablecoins is backed by real assets, while Bitcoin quotes are backed only by investors’ expectations.

Frequently Asked Questions

❓ Can cryptocurrency be used as collateral?

Yes. This practice is common on exchanges and in the DeFi sector for cryptocurrency loans.

💵 How to cash out BTC?

With the help of a cryptocurrency exchange, P2P exchange or private intermediary.

🔍 Can the government take your bitcoin?

In some countries, the law stipulates that BTC is property. In that case, the crypto asset can be confiscated by court order. But governments don’t have physical access to the blockchain. Government agencies cannot cancel or stop a transaction on the network.

🔗 Is it legal to trade bitcoins?

You can buy and sell BTC legally only in countries that have adopted the main cryptocurrency at the legislative level.

📌 Can the price of Bitcoin collapse?

Investing in bitcoin is associated with high risk, but the uptrend speaks about the positive dynamics of the main cryptocurrency.

Error in the text? Highlight it with your mouse and press Ctrl + Enter

Author: Saifedean Ammous, an expert in cryptocurrency economics.