The Binance exchange is considered one of the best platforms for experienced traders and beginners. The advantages of the platform are a simple interface, a large number of functions and the availability of a demo account. In this article, readers will learn how to use the Binance trading simulator. The training platform will help beginner traders to master the terminal without financial risks. Demo service will be useful for experienced users. They will be able to test strategies and improve their trading skills in a safe environment.

What is Binance Trading Simulator

This is a demo version of the crypto exchange. Trading takes place on a virtual server that fully mimics the real Binance Futures terminal.

Clients can work with any open-ended contract from the listing and use the full functionality of the platform. The options are similar to real trading. However, quotes may differ slightly.

Pros and cons

On the training platform, beginners can familiarize themselves with the terminal interface and evaluate the impact of high leverage without financial risks. The table summarizes the main advantages and disadvantages of the Binance trading simulator.

| Pros | Cons |

|---|---|

| A good way to learn how to place orders and set stops | Works only on the futures market |

| Advanced users can test automated and manual strategies | Users do not learn discipline due to no losses |

| Available to deposit in any cryptocurrency when the balance drops below $1000 | Quotes are slightly different from the real figures |

| You can try different leverages – in multi-asset mode and when trading with one coin without financial risk | To access the functionality you need to register and confirm your account |

How to access a demo account on Binance futures

Traders in the trading simulator and the real terminal see the same interface. Therefore, after working in demo mode, you can move on to real trades. To access the training platform you need to:

- Authorize on the crypto exchange’s website.

- Go to the Binance Futures section.

- Click on the “Trading Simulator” button in the upper right corner.

- Click on “Continue.”

The program will create a test account with the same data as in the real profile. By default, the demo account has 3000 USDT. This is enough to test different strategies and create a balanced portfolio.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

Users can also log into the market trading simulator on Binance in the mobile app. The algorithm is as follows:

- Authorize in the Android or iOS program.

- Select the “Futures” section.

- Log in to the profile and click on the “Trade Simulator” button.

Account funding

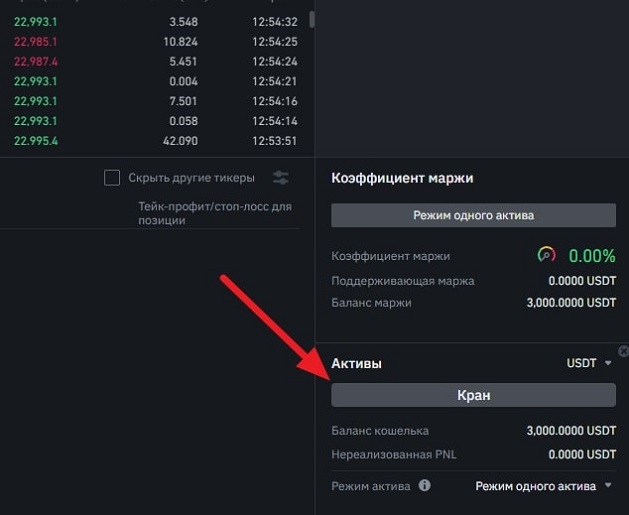

Any cryptocurrency can be added to the balance if the number of coins has dropped to $1000. The interval between requests should not be less than 72 hours. Instructions for funding the account:

- Log in to the simulator account on the website or mobile app.

- Click on the “Crane” button. In the program for smartphones, it is represented in the form of an icon.

- Select a cryptocurrency.

- Click on the “Add asset” button.

- Confirm the request.

If the conditions are met, 1000 units of cryptocurrency will be instantly deposited to the account. In case of an error, an information window will appear with the reason for rejection.

Platform simulator functionality

When logging into the demo account for the first time, a description of the main fields of the terminal and a guide to opening a transaction will appear at the bottom. Users can view or remove the prompts. The page for trading contains the following blocks:

- “Selecting the type of futures. USM-M and COIN-M contracts are available.

- “Cryptocurrency.” Users can trade perpetual and quarterly contracts. To select a cryptocurrency, users need to click on the field and enter the ticker in the search box.

- “Order Creation Window.” In the form you need to enter the type of order, the amount of cryptocurrency and the direction of the transaction. Additionally, you need to specify the stop and take.

- “Exchange stack.” Users can view the order book, the depth is 20.

- “Open orders”. The window contains placed and executed orders.

- “Menu”. Clients can view the history of transactions and customize the interface. Changing the color and location of the stock exchange stack, activation of K-Line on the trading page are available (by clicking on the chart the price is filled in the order form).

The functionality of the simulator does not differ from real trading. Users can:

- Place orders.

- Change the leverage (from 1 to 125).

- Switch between isolated and cross-margin.

- Set stop and take positions.

- Close trades manually. To fix all orders you should click on the Close all positions button.

- View the history of deals.

- Refill the account.

- Add indicators to the quotes chart, use drawing tools.

- Work in one-way or two-way mode. The latter allows you to open long and short on one coin at a time.

- Use single format or multi-asset mode. In the first case, you can not compensate losses on one coin with profits from another cryptocurrency.

Tips for trading on the simulator

The demo account for futures trading on the exchange is called Binance Testnet. The focus on the futures market exists because of the high risk of this type of trading. Users can add leverage up to x125, and the volatility of cryptocurrencies reaches 100% per trading session. Therefore, one mistake when opening a position is capable of draining the deposit.

On a trial account, you can learn how to place orders, adjust the size of the leverage and fix losses. However, after practicing you need to move to the real market.

Too long trading in a simulator does not contribute to successful work on the stock exchange. Because of the lack of financial losses, the trader does not learn to cope with emotions and clearly follow the plan.

Strategy testing

The training format is also useful for experienced traders. Testing new strategies on a demo account is an important stage of testing trading efficiency. Historical data does not take into account spread, commissions and delays in entering a deal. Therefore, the final result may differ significantly. Users open trades manually or run a robot.

Other exchanges with the possibility of using a demo account

Training tools are not only available on Binance. Other major platforms offer a demo mode not only on futures, but also on the spot market.

The simulators work on the same principle. Differences can be in the method of replenishing the account.

In some terminals, coins need to be requested in the tap, in others it is required to write to the support chat. Demo account is available on such exchanges as:

FAQ

⚡ How to switch from the trading simulator to real trades?

You need to click on the Back to Live button at the top of the screen. To open trades, you will need to fund your account and transfer money to your futures account.

✨ What is the minimum amount needed to start live trading?

You can buy a perpetual contract for a volume of $0.5 or more. For profitable diversification and the use of competent risk management you need to deposit $50 or more on the balance.

📌 Why do strategies that are profitable on a demo account make losses in real trading?

A common reason is the emotional instability of the trader. The user is not ready to be tested by fear and greed. He closes profitable trades too early, and does not get out of unprofitable ones until liquidation.

🔔 Why do quotes on a demo account differ from real ones?

Cryptoasset prices change according to the law of supply and demand. In the futures market, there are squeezes. These are manipulations in which the levels are broken and the rate instantly returns to the initial indicators. On the virtual server, quotes are calculated by an algorithm. It cannot repeat such movements of the real market.

📢 How to make sure that the trading simulator is active?

The terminals are identical. Therefore, clients who often switch to the training platform to practice their strategies may mistakenly open a trade on the real balance. You need to check the page address (Testnet Binance) or make sure the “Real Trading” button is available in the upper right corner.

Is there a mistake in the text? Highlight it with your mouse and press Ctrl + Enter

Author: Saifedean Ammous, an expert in cryptocurrency economics.