Although blockchain is characterized by decentralization, transactions do not always remain anonymous. Trading platforms check cryptocurrency for purity. There are two reasons for this. First, it is necessary to comply with international laws. Secondly, according to the official version, verification helps to reduce the financing of criminal activities. However, ordinary users may not suspect that their cryptocurrency has been seen in illegal transactions and suffer the consequences. How services detect “dirty” assets, as well as ways to independently verify coins is described in this material.

Security measures on exchanges against fraud

Recently, regulators have become more strict about the control of cryptocurrencies. This led to the introduction of additional verification procedures. Some of them need to be compulsory. In 2023, exchanges must identify users and track their cryptocurrency transactions. Otherwise, regulators will suspend their work, and in the worst case scenario – law enforcement will start a criminal case, and the service will act as an accessory to crime.

The latter measure is rare, as exchanges carefully fulfill the terms and conditions. Services collect visitor data and, if necessary, pass it on to third parties. For users, the introduction of mandatory verification is inconvenient, time-consuming and almost completely eliminates anonymity.

To protect themselves from sanctions, exchanges apply several measures:

- KYC.

- AML.

- Multi-factor authentication (MFA).

- Withdrawal limits.

KYC and AML procedures are mandatory. Multifactor authorization is set up at the user’s discretion in the account management menu.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

It is a confirmation of withdrawal of funds using two or more tools – for example, phone number, email, authenticator application and others.

Withdrawal limits help the exchange perform more thorough transaction verification and identify suspicious activity. Enhanced security offers several benefits:

- Legal cleanliness and legality of transactions.

- Protecting users from fraud.

- Improved reputation of the exchange.

However, it costs users anonymity. There are also risks that the exchange will block the account at the slightest suspicion.

AML

The abbreviation hides a system of measures and laws to combat the illegal circulation of funds. AML is an abbreviation for Anti-Money Laundering, which means “against money laundering”. The main purpose of such checks is to track and stop the entry of illegally obtained funds into the legal economy.

However, the effectiveness of such checks is debatable. In the 11 years since its mass introduction in 2011, the procedure has not brought significant results.

According to a report by the Basel Institute of Governance, the AML-index has not changed much and remains at 5.25 out of 10 (data for 2022).

Nevertheless, the noble purpose of the inspection allows supervisory authorities to impose requirements on exchanges. In essence, AML consists of several steps:

- Customer Identification. The financial institution must verify the identity of the user and check his documents.

- Transaction monitoring. Money exchange services must monitor a customer’s transactions to detect suspicious activity.

- Suspicious Activity Reporting (SAR). Financial institutions are required to report suspicious transactions to regulatory authorities.

KYC

The first step in AML verification is related to the identity of the user. Services collect data when a customer registers with an exchange under the Know Your Customer (KYC) standard. User identity verification involves the following steps:

- Information gathering. For example, full name, date of birth, address, passport number and other identifying information. A driver’s license or other official documents may also be requested. In a particularly thorough check, you need to provide proof of address – for example, a utility bill.

- Data verification. The institution analyzes the information for authenticity.

Unlike AML, KYC verification offers several advantages to users. The main one is protection. It is possible to restore access to the account in case of its loss. Large exchanges with mandatory verification provide more financial options and trading instruments. Also, users can safely exchange assets in P2P format. In disputable situations, the exchange acts as an intermediary and helps to resolve the problem. In conclusion, there are fewer fraudsters on KYC-checked exchanges.

What is the threat of “dirty” cryptocurrencies?

The turnover of funds previously involved in illegal or suspicious transactions can lead to trouble. One transaction with their use promises a blocked trading account without refund. Sanctions are strict, as the turnover of criminal money can undermine the reputation of the exchange and even lead to legal consequences.

How to check the purity of coins on your own

Users can analyze assets on their own. Online services and AML-bots (for example, in Telegram) are suitable for this. They check wallets and transactions against global databases of suspicious addresses. A special algorithm quickly identifies links between assets and illegal or prohibited activities under AML/CTF rules.

As a result, bots and services provide a final risk score:

- 0% – the asset is completely safe.

- 25% – the coin is safe but is often linked to payment services.

- 50% – risk level is undefined and is associated with exchanges with insufficient KYC verification.

- 75% – asset is not safe. Probably related to the field of gambling and betting.

- 100% – the asset is very risky. For example, it is connected with darknet.

The main disadvantage of such services is the high cost of the service (about $25). In addition, you can run into fraudsters and not wait for verification even after payment.

How to get clean bitcoins

As a rule, you can get clean bitcoins by 3 methods:

- Buying already verified cryptocurrency on popular exchanges.

- Self-mining of coins or purchase of mined assets with a clean transaction history.

- Using reliable mixers.

Buying pure bitcoins

Large exchanges verify cryptocurrencies before receiving and trading. Therefore, it is safe and secure to buy assets on such services.

However, doing it anonymously will not be possible in most cases. Large exchanges like Binance do not allow unverified users to trade.

Mining

The purest bitcoins are those that have not had time to go into circulation. That is, those that have just been mined. Mining is a process where computers solve complex mathematical problems to earn cryptocurrency. However, digital mining is financially costly. You need to have technical skills and expensive equipment. But even this doesn’t guarantee that mining will generate more income than costs.

Using mixers

One of the most effective ways to generate net worth is through cryptocurrency mixing services. These are referred to as mixers. Such tools mix cryptocurrencies of some holders (for example, bitcoins) with coins of other users. In this case, you can maintain complete anonymity and protect yourself from transaction tracking. The main disadvantages are the presence of a commission for using the mixer and a long time to conduct the transaction.

The choice of the site requires careful study and caution. It is important to consider several key factors.

| What to pay attention to | Comment |

|---|---|

| For example, it is important that the service has mostly positive reviews and high ratings. | |

| The degree of anonymity after mixing can be full and partial. The level is chosen by the user depending on the purpose. | |

| Cleanliness evaluation and mixing requires patience. The deeper the mixing, the higher its cost and the more time spent on the procedure. | |

| In 2023, mixers are working to mix BTC, ETH and other coins. | |

| It is important that the service ensures that the assets are securely transferred to the correct address. In this case, it is necessary to carefully study the mixing technology on several platforms, as well as to familiarize yourself with the reviews already published on independent sites. |

About Mixer.Money

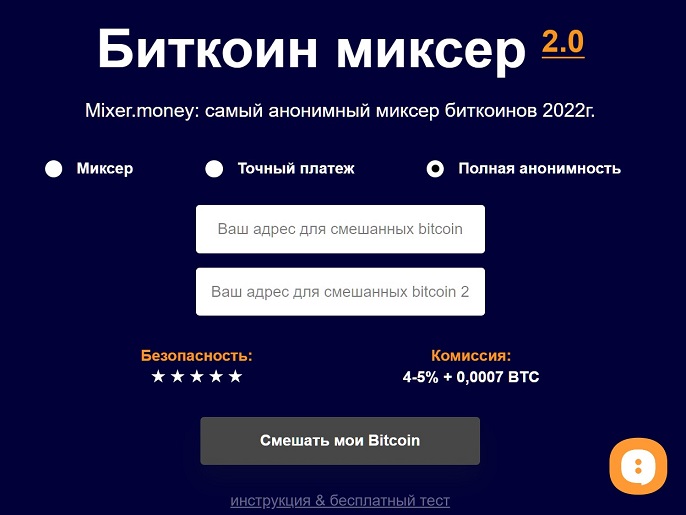

One of the largest bitcoin mixing services appeared in 2016. Like other mixing platforms, Mixer.Money makes BTC transactions anonymous. The service launched one of the most secure versions of the mixer – on the Tor network.

Using Mixer.Money, it is possible to conduct partial clearing in the “Exact Payment” mode. However, there is another function. The “Full anonymity” tool allows you to make crypto coins completely clean.

The conditions and the amount of commission are shown in the table.

| Name | Commission | Clearing time | From where BTC | Security level |

|---|---|---|---|---|

Error in the text? Highlight it with your mouse and press Ctrl + Enter

Author: Saifedean Ammous, an expert in cryptocurrency economics.