In the fall of 2022, the largest crypto exchange announced its departure from the Russian market and the sale of its business to CommEX. The process will take at least a year – during this time, Binance clients can continue to trade on the platform. Beginners are more likely to trade on spot. There is no liquidation risk here, so you can sit through any drawdown. Promising coins grow in value by hundreds of percent in months and dozens of times on the horizon of several years. In the article – instructions on spot trading on Binance step by step. To start earning, you need to create an account, go through KYC and fund your account. Clients from Russia can use the P2P platform or make a deposit by crypto transfer.

What is spot trading on Binance

Traders on financial markets use several types of order execution. For example, in the T+2 mode, settlements are made 2 days after the transaction is concluded. In the spot terminal, orders are executed immediately. To place an order to buy cryptocurrency, a trader needs to have the full amount to pay for it.

After the transaction is processed, you can immediately dispose of the asset – withdraw it to another platform, pledge it or place it in staking at interest.

Wallet interface

Binance offers trading on the spot and futures markets, P2P-platform, to place funds in deposits. In each section, customers are opened separate accounts. You can transfer money between them for free in your personal cabinet.

To check the account balance, you need to go to the “Wallets” section. On the “Overview” page, you can see the total amount of assets in fiat or BTC. The balance for each section is displayed at the bottom of the screen. To view the exact distribution by coins, you need to go to the corresponding tab.

5020 $

bonus for new users!

ByBit предоставляет удобные и безопасные условия для торговли криптовалютами, предлагает низкие комиссии, высокий уровень ликвидности и современные инструменты для анализа рынка. Поддерживает спотовую торговлю и торговлю с плечом, а также помогает новичкам и профессиональным трейдерам с помощью интуитивного интерфейса и обучающих материалов.

Earn a 100 $ bonus

for new users!

Крупнейшая криптобиржа, где можно быстро и безопасно начать путь в мире криптовалют. Платформа предлагает сотни популярных активов, низкие комиссии и продвинутые инструменты для торговли и инвестиций. Простая регистрация, высокая скорость операций и надежная защита средств делают Binance отличным выбором для трейдеров любого уровня!

When making a deposit, the amounts are displayed in the “Deposit Wallet”. To start spot trading on Binance for beginners, one should select “Transfer” and send the required amount to the spot account.

By default, the wallet displays all the coins available on the exchange. For convenience, you can click on the “Hide zero balances” button. This will allow you to quickly identify the list of instruments.

Features of spot transactions

On the currency market, TOD orders (execution on the current trading day) and TOM orders (on the next session) are used. On the stock exchange, transactions of types T+1, T+2 are common – settlements are carried out in a day or two. Such types of spot transactions are not used on the cryptocurrency market. Settlements are always carried out immediately after the execution of the order. Delay can occur only in case of lack of liquidity in the stack or failure to reach the transaction price by a pending order.

Analyzing the charts of cryptocurrencies, users can mark levels that are interesting for purchases. Sometimes they are tested by “spikes” – the price reaches and immediately turns around. The trader does not have time to open the terminal and create an order. Therefore, it is necessary to place pending orders in advance. It will not be possible to open many limits on different assets with the expectation that some of them will be executed. If there is not enough money on the account to buy, an error will occur.

How to start trading on spot on Binance

In 2023, you can buy and sell more than 600 coins on the exchange. Access to the section is open to users with a confirmed account. To start trading on spot on Binance, you can do the following:

- Register on Binance and pass verification.

- Fund your account via P2P platform or crypto transfer.

- Open the “Markets” section and go to the “Spot” tab.

- Familiarize yourself with the available assets. You can open cryptocurrency trades with USDT, BTC, BUSD, BNB and fiat currencies. It is convenient to choose an asset from the top 20 or the list of growth/decline leaders for the last 24 hours.

- Open a trade.

Beginners should try their hand on a demo account before opening real trades. By going through Binance spot trading training, users will gain order management skills and be able to practice strategies.

Registering on the exchange

You can create an account on the website or in the mobile application. The procedure is identical – use a phone number, email address or login via Google/Apple profile. The algorithm is as follows:

- Click on the “Registration” button.

- Choose the method of creating a personal account.

- Enter the identifier.

- Think of a password, type it twice.

- If available, enter the referral code.

- Press the “Register” button.

- Add the second method of authentication – e-mail or phone number.

- Customize security settings. It is recommended to add two-factor authentication Google Authenticator, include a white list of addresses for output and anti-phishing code.

Stages of account verification

You can work on the exchange only after passing KYC. Until the procedure is completed, all sections of the platform are blocked. There are three levels of verification – they differ only in withdrawal limits. To trade on spot, it is enough to pass the first stage. Details – in the table.

| Levels | Requirements | Withdrawal limit per day (USD equivalent) |

|---|---|---|

| State sample document and selfies. Photo should be taken with a phone camera | ||

| Confirm the address of residence. Receipts of housing and communal services or a lease agreement are accepted. Full name in the profile and on the document must match. | ||

| Fill out an investment questionnaire and income statement |

Receive welcome bonuses

In 2023, the exchange launched an action – for completing tasks, newcomers are rewarded with vouchers for up to $100. To participate, you need to register using the Binance client link. From the inviter is required in advance:

- Log in to the account.

- Go to the “Welcome Bonus for $100” page.

- Click on the “Register” button at the top of the page.

- Open the “Referral Program” section and copy the link. It will have a built-in bonus receipt for new customers.

Newcomers need to go to the Binance site using the link or insert the number of the inviter in a special field. Next, the algorithm is as follows:

- Register on the platform.

- Pass verification.

- Go to the “Task Center” and choose an activity. As a reward, you can get vouchers with a discount on the commission. For example, for a $50 deposit in fiat you get $5 in fiat, in cryptocurrency you get $45. You can also get a $50 coupon for opening a deal on a $100 spot.

- Complete tasks within 7 days after registration. You have 5 days to replenish your balance with cryptocurrency.

- Go to the “Rewards Center” and activate vouchers.

Making a deposit

In 2023, 75% of transactions in the crypto market are conducted through CEX. Users appreciate the large number of instruments and the ability to deposit in fiat. On Binance, money is deposited to the balance immediately from the card or through a peer-to-peer service.

The exchange supports more than 50 national currencies, but you can deposit only in banknotes of the country of verification.

Fiat from a bank card

In 2022, the exchange partially suspended service to Russians at the request of the regulator. In October 2023, the payment gateway in rubles was closed. It is impossible to deposit RUB from a card. Only fiat transfers from e-wallets PAYEER, AdvCash are available. The mechanism works like this:

- Transfer rubles from the card to the EPS.

- Log in to your personal account on Binance.

- Click on the “Deposit EUR” button on the main page.

- Change fiat to rubles.

- Choose a payment system – PAYEER, AdvCash.

- Enter the amount.

- Complete the operation on the site of EPS.

In cryptocurrency

You can send any coin from the listing to the exchange. For trading on the spot, it is more convenient to make a deposit in USDT. You can immediately open transactions without additional conversions. The order of actions:

- Log in to your account on the website or through the app.

- Open the “Wallets” section.

- Press the “Enter” button.

- Select a coin and network.

- The cryptocurrency wallet address will be displayed on the screen, it must be copied.

- Open the platform application to transfer money.

- Go to the Wallet menu and click on the Send button.

- Select the same coin and network as when receiving the address.

- Insert the account number in the corresponding field or scan the QR code from the Binance website with the phone’s camera.

- Specify the amount and sign the transfer.

Via P2P.

On the peer-to-peer service Binanc, transactions are conducted between users directly, so you can buy cryptocurrency for fiat with minimal commissions.

The exchange acts as a guarantor of the fulfillment of obligations by participants. There are no fees on the part of Binanc.

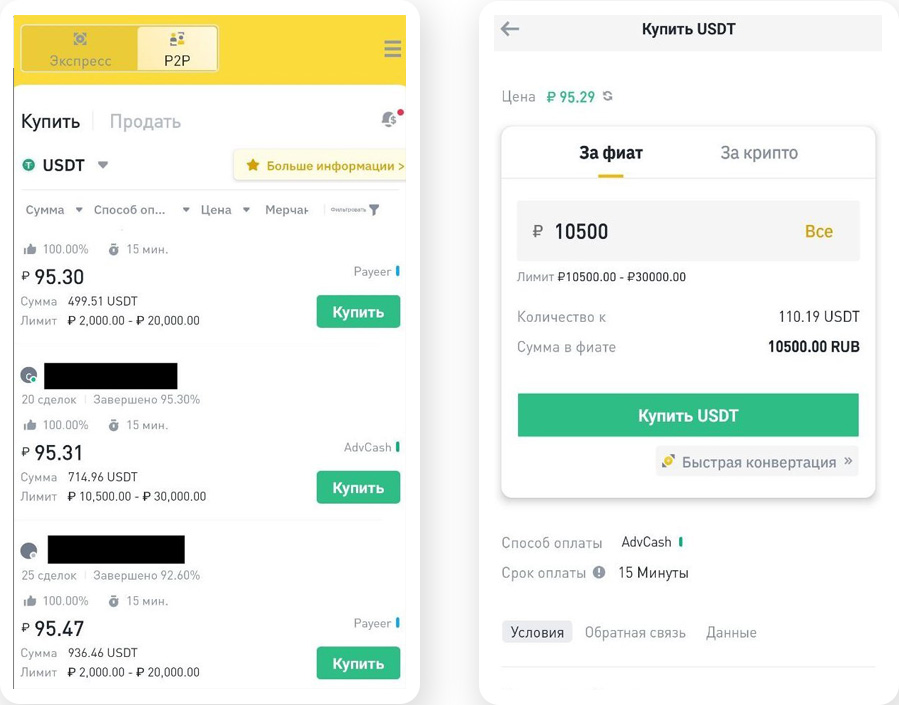

In 2023, users from the Russian Federation can buy USDT, BTC, BUSD, ETH, BNB only for rubles. In the fall, new restrictions appeared – it was allowed to pay applications only from cards of Post Bank, Home Credit, Russian Standard, Renaissance Credit Bank, Raiffeisenbank. Instructions:

- Log in to your profile – “Transactions” section.

- Select the item P2P.

- On the screen will appear a notification about risks and a proposal to activate the anti-phishing code. You need to click on “Start” to set it up, click on OK to decline.

- Select a cryptocurrency at the top of the screen.

- Open the “Payment Methods” menu and check the options.

- Specify the amount of the transaction.

- If necessary, check the box “Show only ads from merchants”.

- Select the offer of a seller with a good rating.

- Enter the amount and click on the “Buy” button.

- The card/ESP number for the transfer will be displayed on the screen. You need to open the banking app / e-wallet and send the money.

- Return to the Binance website and click on “I paid”.

The counterparty will check the balance and confirm receipt of the money. After that, the exchange will transfer the frozen amount on the order to the buyer’s account. On average, transactions are executed in 5-10 minutes.

Creating an order to buy cryptocurrency

You can access the trading terminal from the “Markets” menu by clicking on any coin, or from the “Deals” section. The coin chart is available in the native interface or via TradingView. Indicators and drawing tools can also be added there. At the bottom of the page is the order window. To buy cryptocurrency, it needs to be filled out – enter such parameters:

- Order type.

- Execution price.

- Cryptocurrency volume.

Limit

Users can buy cryptocurrency at the desired price. Levels for the transaction are determined by technical analysis or percentages. For example, altcoins correct by 55-70% after growth. Therefore, it is possible to place several such orders. When buying, you need to specify quotes below the market, otherwise the deal will be executed immediately.

Market

When a signal appears, the trader needs to buy the coin as soon as possible. Therefore, he opens an order at the market. The order is executed at the best current price from the stack.

In moments of peak volatility the situation changes very quickly. The order can be executed 5-10% cheaper/more expensive than the trader expected. That is why it is better to use limit orders. For immediate execution it is necessary to put the price a few points below the current price or above the market.

Stop Limit

Orders of this type are used to fix a loss or in breakout strategies. When placing an order, the user fills in 2 parts:

- Limit. The order execution level can be below or above the market.

- Stop. The pending order is activated only when the given price is crossed. Usually the trade is executed immediately, but it is not guaranteed. If a trader places an order a few pips below the stop price, the order will not be executed in a volatile market. The price rises too fast, there are not even mini pullbacks.

Explanation of futures trading on Binance

When buying coins on the spot market, the user gets all the rights to them. Cryptocurrency can be transferred to a personal wallet, pledged or deposited. These features are necessary for long-term investing and are not necessary for short-term speculation. In such trading, traders use futures. This instrument has peculiarities:

- The user assumes the risk of changes in the exchange rate value of the asset. But he does not own the coins, cryptocurrency can not be transferred to another wallet.

- For trading, it is not necessary to have the full amount of the order, 1-10% is enough. The amount depends on the leverage used.

- When opening a trade, a collateral amount (margin) is blocked on the account. In case of unfavorable market situation the trader’s balance decreases. If it drops below the minimum margin level, positions will be closed by the market.

- Futures are available on Binance in pair with USDT. It is not necessary to have stablecoins to open a transaction. You can transfer top coins (BTC, ADA, ETH) to the Futures wallet and use them as collateral. Losses will be written off in the collateral coin, and profits will be accrued in USDT.

What is conversion on the exchange

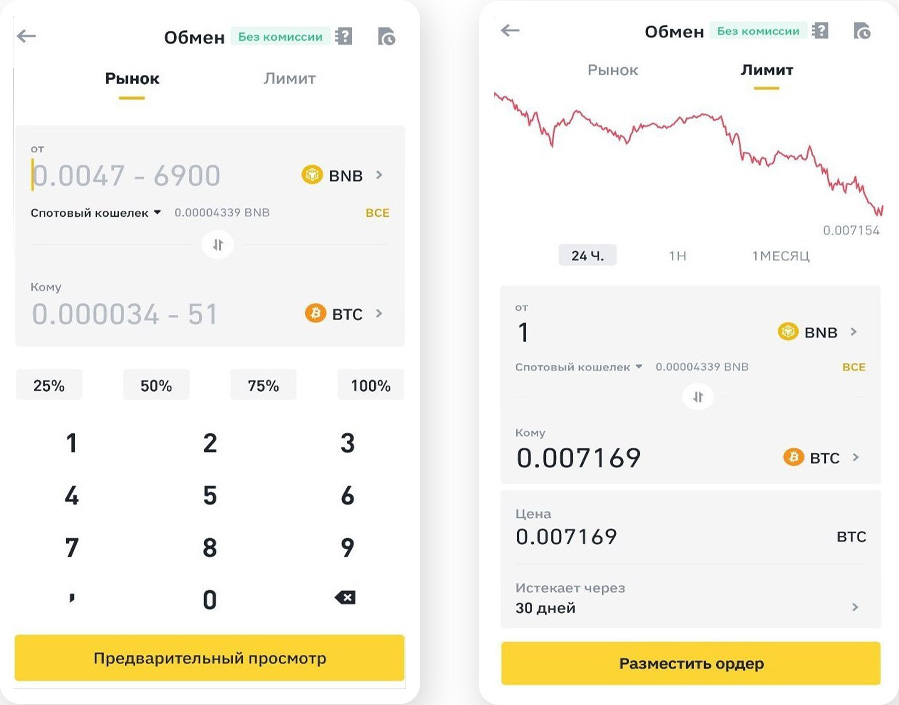

You can trade on the Binance spot market in USDT, BTC, BNB, BUSD, ETH pairs. This means that to convert TRX to ADA, you need to conduct 2 transactions – sell TRX for USDT and then buy ADA for stablecoin.

Transactions take a lot of time and lead to additional expenses. To avoid spending, traders use the “Conversion” tool. It allows you to exchange cryptocurrencies available on the exchange in one transaction. There is no commission for the operation, but the rate is slightly different from the exchange rate. The exchange algorithm is as follows:

- Log in to your personal Binance account.

- Open the “Transactions” section and then – “Conversion”.

- Select the coins to be exchanged and specify the volume.

- Familiarize yourself with the terms of the transaction and click OK. The rate is fixed for 8 seconds. If the user does not have time to confirm the operation, it is necessary to select “Refresh” to get the actual quotes.

Automated trading

Most of the time traders perform routine operations – open and close trades according to signals, set stops. To simplify trading, these operations can be delegated to robots, and they can be connected via API. Robots are written independently on special platforms (Veles Finance, 3Commas, RevenueBot) or ordered from programmers.

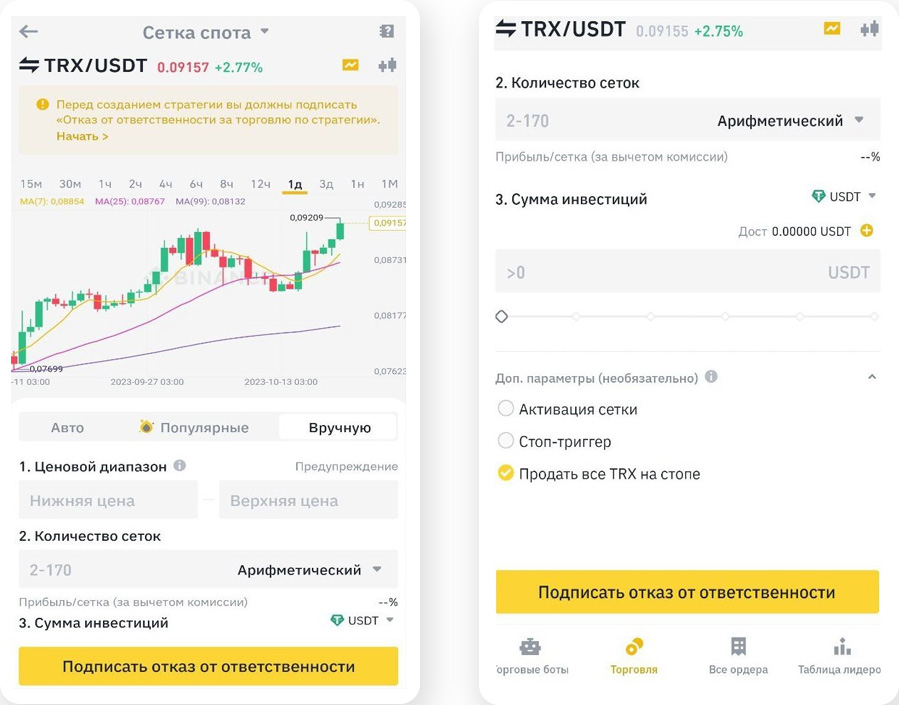

On the spot market, a popular strategy is to buy assets in installments (grid) – by time (for example, every Monday) or in a range after a fall/growth. Binance offers to use a native solution to implement the grid strategy. To do this, you need to:

- Log in to the spot terminal.

- Select a coin. Open the “Spot Grid” tab.

- You can select one of the popular strategies and click on “Manual”.

- Specify the range to buy, the number of orders, the step and the amount of the transaction.

- Click on the “Sign the disclaimer” button.

Features of trading on spot in the application

Transactions can be opened on the site and through a smartphone. The functionality of the versions is identical. You can view historical charts, place orders on the market and create limit orders. But there are peculiarities of working in the application:

- The chart is displayed with a slight delay (200-500 ms). For an ordinary user it does not matter, but it can cause losses in scalping and arbitrage.

- The chart is displayed only in the native interface. To view the data via TradingView, you need to go to the browser version.

- The chart is hidden in the trading terminal. To view the quotes history, one should click on the icon at the top of the screen.

Ways to save on trading commissions

Beginning traders pay 0.1% per executed order, but the fee can be reduced. The Binance exchange offers these ways to get a discount:

- Use a native BNB token to pay the fees. A 25% discount is available for this. You should keep an amount sufficient to pay the fee on your spot balance.

- Increase user status to VIP. Privileged clients receive benefits based on the level. There are 9 of them in total, but on the last one the commission on spot for market orders is 0.024%, for limit orders – 0.012%. To increase the status, you need to increase trading turnover in 30 days or hold BNB (minimum 25 coins).

- Use only limit orders. Regular users pay the same commission for orders. But VIP clients have a difference in fees for limit and market orders. The higher the level of the program, the more significant it is. For VIP-9 it is 100%.

Frequently Asked Questions

✨ How should a beginner choose coins for spot trading?

Exchange clients invest in top and niche assets. Investments in the former will not bring more than 500% profit, but they are more reliable. New crypto coins can grow hundreds of times or depreciate. Therefore, beginners are recommended to start investing with bitcoin and ether.

📌 How does the spot averaging strategy work?

It is based on the theory that quality assets always grow in value. Bitcoin has fallen over 70% three times in its history and then rewrote the highs. When averaging, the user does not record a loss, but continues to build up the position. Therefore, a small price bounce is enough to get into the plus side.

🛒 What is Martingale buying?

According to the strategy, the trader should increase the volume of the position after each wrong trade. The danger is that he will run out of money with a prolonged non-stop movement. But if used correctly, the strategy can bring profit.

⚡ Where to store cryptocurrency?

Coins intended for speculation, it is convenient to keep on an exchange account. You can place them in a deposit to get additional profits. Investors are better off transferring coins to non-custodial wallets, such as Trust Wallet, the official decentralized storage of Binance. Users can link accounts and transfer coins from the exchange with a single button.

🔔 Why build a cryptocurrency portfolio?

Investors diversify their investments. By creating a balanced portfolio, in a negative scenario, the user receives a smaller loss. Profitable assets compensate for the drawdown. It is recommended to invest at least 30% of capital in the top coins, and to allocate no more than 10% to new projects.

A mistake in the text? Highlight it with your mouse and press Ctrl + Enter.

Author: Saifedean Ammous, an expert in cryptocurrency economics.