The cryptocurrency market offers many opportunities to earn money, but requires continuous monitoring and analysis. Bybit exchange offers to automate the trading process. Bybit’s futures Grid bot works based on a grid trading strategy. It allows you to generate income without the need to constantly monitor the market.

General information about cryptocurrency bots

The digital asset market differs from the traditional one in that it is available for trading around the clock. Traders have to constantly monitor the charts in order not to miss important price changes. This is why cryptocurrency bots have become popular tools for trading. They provide high performance and allow traders to save time on learning different strategies.

Grid bots act according to preset rules. They are set up to automatically buy a coin at a certain price and sell it when a set profit target is reached. They are also used as market makers, for arbitrage and other strategies.

Crypto trading bots eliminate the human factor. They can continuously monitor prices on exchanges and instantly react even to minor changes in the market.

Pros and cons of use

Trading bots are useful tools. However, they do not guarantee profit. You need to test the functions and capabilities of the program before using it. The pros and cons of cryptobots for trading are listed in the table.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

| Advantages | Disadvantages |

|---|---|

Bybit Futures Grid Bot Description

Bybit, a popular exchange, launched automated trading software in 2022. Bybit’s Futures Grid bot utilizes a grid trading strategy. Investors can open 3 types of positions: long, short and neutral. Traders have access to a large number of cryptocurrencies and leverage ratios up to 100x.

The trading tool can be launched in the browser and mobile application of the exchange.

How Grid Bot works

The program buys and sells cryptocurrency using grid trading. This strategy is based on setting up specific price levels to enter and exit trades.

Grid-bot automatically places a series of orders in the intervals specified by the trader. For example, if the current cryptocurrency rate is $10, the tool can place buy orders at prices of $9.50, $9, $8.50, and sell orders at $10.50, $11, $11.50.

When the quotes reach one of the set values, the bot automatically executes the corresponding order. Then the program immediately opens new positions, placing orders at a more favorable rate, and closes old deals. For example, if a buy order at $9.50 has been executed, the tool will set another one.

Grid trading allows traders to earn even when market volatility is low. If the price fluctuates around the set levels, the program will continue to execute trades and make profit.

It should be remembered that the tool cannot predict the future. It is important to constantly monitor trades and adjust settings based on market changes.

Efficiency

The potential profitability of Futures Grid Bot Bybit depends on several factors. See the table for more details.

| Condition | Description |

|---|---|

| This is a key factor that affects the potential yield. The higher the volatility in the market, the more opportunities for earning. | |

| Grid size, stop loss and take profit levels, order spread – all these parameters can affect trading results | |

| More conservative settings can reduce potential profits. Aggressive settings will lead to high returns but increase losses. | |

| Each coin has different liquidity and potential to rise or fall in price. Popular assets (Bitcoin or Ethereum) can offer relatively stable returns and less volatility. New tokens will offer high potential returns, but they are also more at risk. |

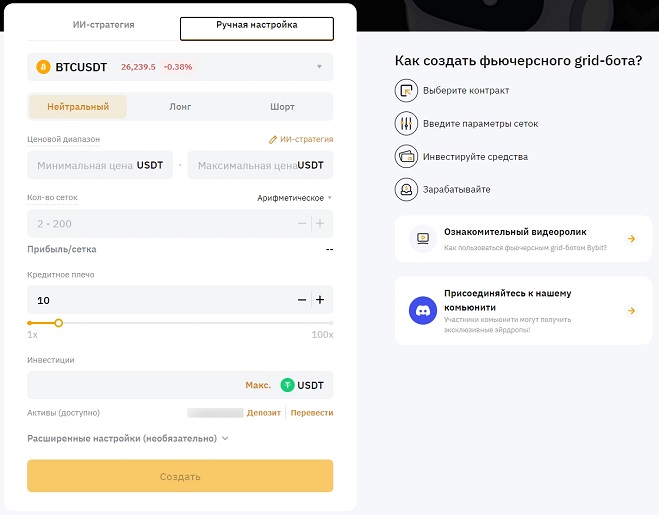

Customizing the Futures Grid Bot

The bot automates the trading of cryptocurrencies. The program has parameters such as:

- Trading Pair. There are many cryptocurrencies available for trading on Bybit. All of them are traded with USDT.

- Position type. There are 3 options – long, short, neutral. The choice depends on the current market conditions. If there is increased volatility – longs and shorts are suitable, in consolidation – neutral.

- Price range. This is the interval within which the instrument will work.

- Number of grids. The more levels, the more orders will be placed.

- Leverage. Bybit allows you to increase the potential profit. For long and short positions, leverage is available with a ratio of up to 50x, for neutral – 100x.

- Investment amount. This is the money that the user allocates for trading.

There are also advanced settings. There you can specify such parameters:

- Entry price. This value determines when the program will place the first limit order.

- Upper and lower stop prices. This is an analog of Take Profit and Stop Loss. When the asset quotes reach this value, the grid-bot will automatically shut down.

Traders can also set parameters according to the recommendations of artificial intelligence. It will automatically set the price range, number of grids, leverage and other settings.

Artificial intelligence offers conservative parameters of trades. This mode is more suitable for new users.

How to create your own bot

To start automated trading on the Baybit exchange, you need to register and undergo identity verification. Further actions:

- Deposit USDT stablecoin to the financial account.

- Open the “Tools” section in the top menu.

- Go to the “Trading Bot” tab.

- Select “Futures Grid-bot”.

- Click “Manual setup”.

- Specify the cryptocurrency.

- Set the price range and grid parameters based on strategy and risk appetite. You can also open advanced settings to set stop loss, take profit, entry price.

- Specify the leverage ratio by moving the slider to the desired value.

- Click on “Create” to activate the bot.

The program will work according to the set parameters. Users can disable it at any time.

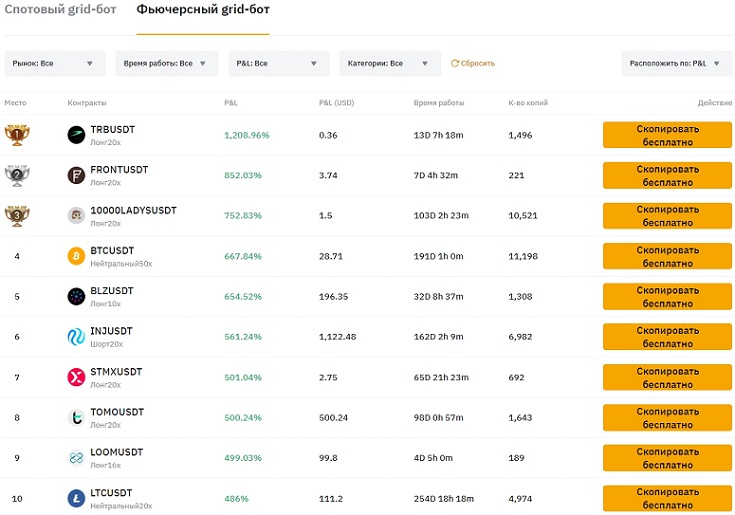

Copying someone else’s program

Exchange clients can trade according to the strategies of other traders. To do this, you need to:

- Open the “Trading Bot” section.

- Scroll down the page to the “Leaderboard” tab.

- Select a grid-bot based on PNL, uptime, number of copies.

- Click on “Copy for free.”

The tool will start working on the ready-made strategy. However, copying other investment solutions does not guarantee good results. It is worth doing your own analysis before making transactions.

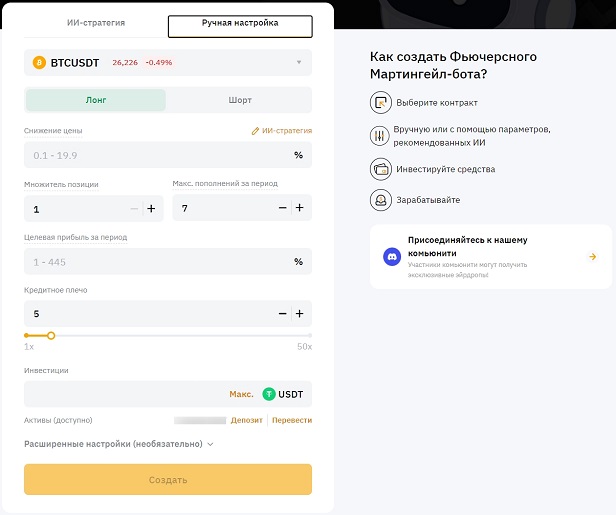

Other Bybit bots

Bybit offers 4 types of automated trading tools. In addition to the Futures Grid Bot, there are the following:

- Spot. The principle of operation is similar to the futures one. Grid-bot allows users to trade digital assets on the spot market using a grid strategy.

- DCA bot. Dollar Cost Averaging strategy is a method of investing in which a market participant buys a certain amount of cryptocurrency at regular intervals regardless of the current price. This is how the trader averages the value of his assets.

- Futures Martingale. This strategy is based on doubling the amount of investment after each unsuccessful trading operation in the hope that the next transaction will bring profits that will cover the losses of the previous ones.

Traders can choose any instrument. Only spot and futures are available for copying.

FAQ

✨ What fees do traders have to pay for using bots?

The exchange does not charge any additional fees. Users only pay a commission for placing orders. Funding interest is also charged.

📌 How many grid-bots can be activated simultaneously?

Baybit allows you to launch no more than 50 tools for automated trading.

📢 What happens if a position is liquidated?

The platform will automatically cancel all orders and delete the bot.

🔔 Are there any restrictions on placing Take Profit and Stop Loss orders?

For Stop Loss, the coefficient of the opening price should not exceed 100%. For Take Profit there is a limit of 500%.

⚡ What will happen if the asset price leaves the specified interval?

The bot will stop placing new orders until the rate returns to the specified range.

Is there an error in the text? Highlight it with your mouse and press Ctrl + Enter.

Author: Saifedean Ammous, an expert in cryptocurrency economics.