Cryptocurrency technology is evolving rapidly, but blockchains cannot yet interoperate directly. For that, bridges are needed. Binance Bridge contributes to making blockchains more cross-compatible. Users can transfer any cryptocurrency to the Binance Chain or BSC and vice versa. You don’t have to be a client of a crypto exchange to do this. In the article – about how Binance Bridge works.

Description of Binance Bridge

The interchain bridge of the largest exchange began working in 2020. It connects blockchains with each other and allows investors to convert any cryptocurrency into wrapped tokens for use in the Binance Chain and Binance Smart Chain networks.

The following chains are supported:

The service is synchronized with the exchange of the same name. Therefore, traders can withdraw cryptocurrency from an account in the selected network. This option is built into the wallet of the trading platform.

In addition, Binance Bridge supports NFT transfers between blockchains and cross-chain liquidity deliveries. Investors have the right to place funds in DeFi pools without being tied to the blockchain. This greatly expands the opportunities for making money in the crypto space.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

The overall advantage of bridging is that assets don’t need to be sold to get tokens from other networks. Instead, the protocol blocks cryptocurrency on one side and issues wrapped tokens. These can be used to make money on the other chain.

Security

The reliability of the Binance interchain bridge is confirmed by the company’s reputation. Transactions undergo multi-stage verification. This provides protection from fraud and unauthorized access.

But the technology of bridges is not yet perfect. Therefore, Binance Bridge users bear the risks inherent in interconnect projects.

| Risks | Comments |

|---|---|

| Technical failures or errors occur in the operation of the platform. Hacker attacks can also lead to loss of funds. According to Binance Square, attackers stole $1.92 billion from crosschain bridges between 2021 and 2023. | |

| A Binance bridge connects multiple networks. Scaling difficulties in a single blockchain can hinder overall interoperability. | |

| Users may experience time delays and transaction errors during updates | |

| The overall security of interoperable blockchains is reduced by the least trusted chain |

Fees

The service does not charge token transfer fees. Users only pay network fees. For transactions in BSC it’s $0.12, in Ethereum it’s $8.36 as of November 22, 2023.

How the Binance firewall works

The main function of the platform is to transfer assets. In a normal transaction to send BNB coins to the Ethereum blockchain, you must first sell the cryptocurrency and then buy ETH. At the same time, you will have to pay a commission.

The service allows you to transfer assets between blockchains without selling. The general algorithm is as follows:

- Select the source blockchain and the recipient network.

- Specify the amount of the transaction and the address for crediting.

- Transfer the cryptocurrency to the address generated by Binance Bridge.

- The program will then send an equivalent amount of wrapped tokens to the address in the desired blockchain.

To exchange cryptocurrencies through Binance Bridge, an account on the exchange is not needed. Registered users can use the platform to withdraw coins in different blockchains.

Peg-in and Peg-out functions

Users of the service can convert any cryptocurrency into BEP-2/BEP-20 tokens. These are inbound transactions – Peg-in. The reverse conversion of BC/BSC tokens into other blockchain assets is performed by the Peg-out function.

The transaction will require a compatible wallet. Among the popular ones are Binance Wallet, MetaMask, Trust Wallet.

Instructions on how to use the bridge

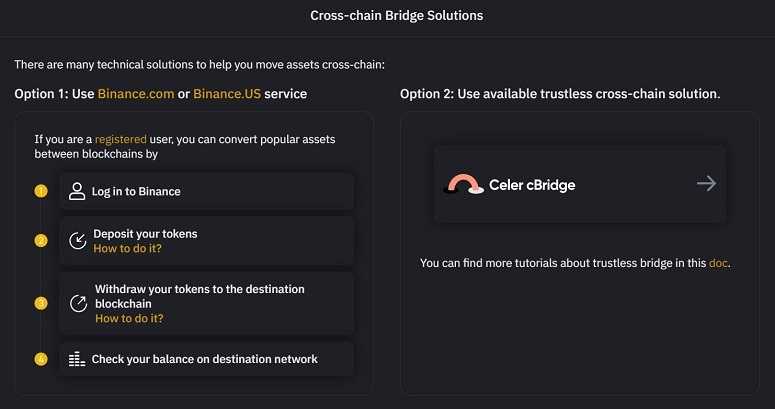

Anonymous cross-network transfers take place with the help of the integrated Celer cBridge service. Instructions on the example of sending USDC token from the BSC network to the Ethereum blockchain:

- Go to the platform.

- On the homepage, select Option 2: Celler cBridge.

- Connect a wallet. Available methods are MetaMask, Coinbase, Wallet Connect, Clover.

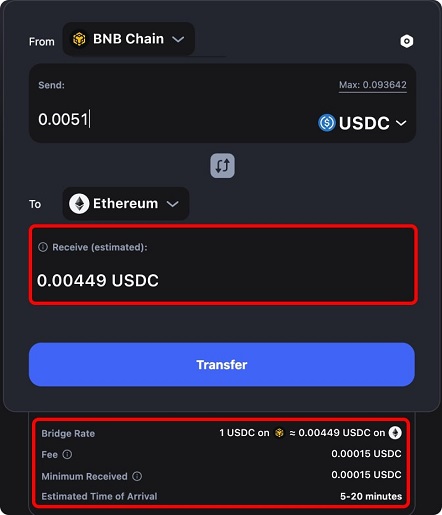

- Form a transaction – select the sending (BNB Chain) and receiving (Ethereum) networks, token (USDC), outgoing amount. The expected amount of cryptocurrency to Ethereum will be displayed in the Receive field.

- At the bottom of the form, the exchange rate, commission and transaction time will be indicated. It is necessary to verify the data and click Transfer.

Most crosschain transfers are completed almost instantly. Sometimes it can take up to 20 minutes to complete the operation. It depends on the amount of traffic in the chain.

Binance exchange clients can transfer popular cryptocurrencies between blockchains directly in the account. The instructions are as follows:

- Authorize on the website or mobile app.

- In the upper panel, click on the “Wallet” button, then “Overview”.

- Click on the item “Withdraw”.

- Specify the coin to be transferred.

- The program will offer to choose a network.

- Specify the withdrawal amount. The network commission will appear below. It will also be necessary to select the wallet from which the assets will be debited (spot or for replenishment).

- Press the “Withdraw” button.

- The program will offer to confirm the choice of network. In case of incorrect choice, the funds will be lost. You will not be able to return them.

- Click on the “Confirm” column.

- Check the finished transaction form. If everything is correct, click on the “Continue” button.

- Confirm the transaction using 2FA.

- Wait for transaction confirmation and check the balance in the receiving network.

FAQ

📢 What are LP-tokens?

They are derivative assets that investors receive to replace those locked in liquidity pools. They can be used to make money in DeFi apps.

🔔 What should I do if an interchain transfer has hung for more than 30 minutes?

First, you need to check if the transaction is confirmed in the blockchain. If not, you can increase the fee to speed up the processing. Otherwise, you need to wait for the transaction to complete or contact support staff.

📌 What is SGN?

This PoS chain is part of the Celer Network architecture through which cross-chain transactions are conducted in Binance Bridge. SNG is used for transaction monitoring and accurate data transfer.

✨ How are new chains added to the bridge?

The decision is made by a quorum of validators of the Celer Network partner network. Chains are added after the necessary smart contracts have been deployed in cBridge.

⚡ Transfer in the status “Completed”, but there are no tokens in MetaMask. What to do.

The asset is probably not added to the wallet in the destination network. You should click on the MetaMask icon in the transfer history. Then – add a token according to the instructions.

An error in the text? Highlight it with your mouse and press Ctrl + Enter.

Author: Saifedean Ammous, an expert in cryptocurrency economics.