Cryptocurrency is now a lucrative financial instrument. Every year, even investors in traditional markets are paying more and more attention to digital assets. Among the cryptocurrencies that attract them are tokens – virtual money that operate on the protocols of other people’s blockchains like ERC-20 (Ethereum) and BEP-20 (Binance). Networks of such digital assets are overlaid on top of the underlying systems in which native coins operate. In 2024, investors can make good money on tokens. The profitable ways should be broken down.

What tokens can be bought

Digital assets come in several types. There are many types of tokens in 2024. However, only 4 are considered basic and profitable.

| Type | Description |

|---|---|

| Exchange tokens | Created by developers of cryptocurrency trading platforms. Such assets are used in exchange ecosystems to facilitate activity on the platform. Examples are BNB (Binance) and KCS (KuCoin). |

| NFT | Non-Fungible Token – a token that is not interchangeable. Each individual NFT has a unique data set. Technically, it is impossible to replace 1 such asset with another, as it can be done with altcoins. Also, Non-Fungible Token cannot be shared. For example, you can send 0.3 BTC, but 0.3 NFT cannot. This is due to the integrity of Non-Fungible Token. |

| DeFi | Decentralized Finance – decentralized finances managed by peers. DeFi Projects – online platforms that replace the traditional banking system. |

| ICO, IEO, IDO | These terms refer to the initial offering of digital assets from cryptocurrency projects. With these 3 ways, companies get funding from investors to develop and realize their idea. |

Exchange tokens

These cryptocurrencies are developed for the purpose of use only within a platform. An exchange can be an ecosystem with dozens of services and tools. Some of them are usually only available when using altcoins.

Exchange tokens are service tokens, meaning they are needed to pay for the platform’s services. Also, cryptocurrency can be used as an investment asset to hedge against a prolonged decline in the digital money market (bearish trend). Usually in such a trend, exchange-traded altcoins do not lose in price. This allows you to use digital assets to make money on tokens, as well as for hedging – reducing potential losses by opening trading positions that will bring profit or at least will not fall in value.

Exchange-traded altcoins rise in value because platforms utilize mechanisms to reduce or change the overall supply. Here are 2 popular models:

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

- Burning. This algorithm is used by the Binance exchange, for example. Its cryptocurrency BNB was one-time issued in 2017 in the amount of 200 million units. Gradually, the platform plans to destroy half of them. For this purpose, Binance management allocates 20% of its own profits on a quarterly basis in order to buy back a part of the coins from the cryptocurrency market for further burning.

- Freezing. The platform temporarily blocks a part of the assets received by investors after the completion of the initial offering stage. The conditions of the freeze are always different. Users can unblock assets by performing certain actions that are set by the exchange. Such a mechanism is used, for example, for the WRX token (WazirX).

NFT

Non-Fungible Token is usually considered as a unit of data that is stored in a cell of a distributed ledger – a blockchain. NFTs are used to prove ownership of a specific digital object, such as an audio composition, a painting, a video clip. Users of the cryptocurrency network can make a copy of it, but it will have no value. A duplicated digital object is not confirmed by ownership and is not recorded on the blockchain.

Each Non-Fungible Token is non-interchangeable. For example, you can’t just move different pictures around. The information about the pictures will be different, so the illustrations are not the same (from the blockchain’s perspective). The familiar coins and altcoins, on the other hand, are allowed to be exchanged between each other. One user can transfer 1 BTC to another, and the latter will send the former his bitcoin. Nothing will change for the cryptocurrency network, because 1 Bitcoin is equal to itself.

The sale of an NFT token is more like a transfer of ownership. The buyer gets the ability to use the Non-Fungible Token for personal use. The NFT token market is also compared to the world of art, where every investor plays the role of a collector.

DeFi

The workability of cryptocurrency projects like Decentralized Finance is supported by its peers. DeFi is a peer-to-peer network (without an administrator or supervisory body) that performs the functions of traditional financial organizations:

- Banks.

- Payment systems.

- Exchanges.

- Credit centers.

To obtain the right to process applications and transactions within the decentralized network, the user must invest money in the project. In return, he receives DeFi-tokens. It is they that give the right to become a full-fledged equal participant in the decentralized project.

It is possible to earn on Decentralized Finance tokens due to the constant process of their burning. The altcoins that a system participant receives in return for his investment are withdrawn by the platform and destroyed when, for example, the borrower repays the loan. Thanks to this mechanism, the price of cryptocurrencies of DeFi projects almost always rises due to the scarcity created.

ICO, IEO

Initial Coin Offering – initial token offering. ICO – stage of initial offering and sale of cryptocurrency. It is conducted by developers of digital projects in order to obtain funding from investors for the development and realization of the idea. Investments are collected in native coin, in the blockchain of which the system plans to function. For example, an investor sends 1 ETH to the developers and in return receives 10000 tokens of a new cryptocurrency company.

In the context of an ICO, altcoins can be considered as a unit of account. In the initial asset offering, this cryptocurrency plays the role of shares, as it happens in traditional financial markets. However, the investor does not always receive a part of the project’s profit, as, for example, in the case of securities. It all depends on the purpose of the coin.

Initial Exchange Offering – Initial Exchange Offering. The process of obtaining funding for cryptoprojects is fully controlled by the trading platform. But the exchange manages Initial Exchange Offering on behalf of the startup, which collects investors’ investments. Also in the cryptocurrency community, IEO is considered safer than ICO, as new projects are thoroughly vetted.

Issuers pay a listing fee to the platforms. In return, the project’s altcoins are sold on the exchange. Users can buy them by having funds on their balance inside the trading platform. The cryptocurrency company receives the collected money only after the end of the IEO.

IDO

Initial DEX Offering is an initial decentralized offering. This method of collecting investor funds was first applied in 2019. At that time, it received a second name – tokensale. IDO is considered an effective way to raise funding. Like IEO, Initial DEX Offering is conducted within the framework of a cryptocurrency exchange. However, there is one difference – the platform must be decentralized.

ICO, IEO and IDO are methods of initial cryptocurrency offering. They have the same goal, but the concepts differ significantly.

| Features | ICO | IEO | IDO |

|---|---|---|---|

| Mandatory project verification | No | Yes | No |

| Regulation | Depends on the jurisdiction of the project | Cryptocurrency exchange regulations | No |

| Who attracts investors | Issuer | Centralized exchange | Decentralized trading platform |

| Liquidity of issued altcoins | Cryptoproject independently seeks an exchange for listing | The issuer receives liquidity on the exchange where the altcoin is traded | |

| Restrictions on listing on third-party services | No | Yes | No |

| Who holds the assets | Issuer | Exchange | Investor |

| Listing fee | Yes | Yes | No |

In 2017, 80% of ICOs were recognized as fraudulent. However, most of the successful coins today started their journey with this method of fundraising. The list includes ETH, which was launched at a price of $0.31.

Liquidity – the ability to instantly sell a digital asset without a loss in market price. This parameter depends on the demand for cryptocurrency. Also, the indicator is characterized by a large trading turnover. If the user can at any time sell an altcoin without loss in value, then such an asset is called liquid.

The best exchanges for buying and selling tokens

By the end of 2021, more than 550 cryptocurrency trading platforms are functioning. Part of the platforms work locally – only in the countries where they are registered. Russian users of cryptocurrencies can not use them to buy and sell altcoins. However, below is a list of the best exchanges that work in the Russian Federation, according to CryptoProGuide.com.

How to make money from tokens

Altcoins have the potential to bring investors high returns. But putting money into a random digital asset is not a good idea. It is important to analyze the cryptocurrency project and its business model before doing so.

To get profit from the assets allow:

- Trading on exchanges.

- Investments.

- Airdrop.

- Bounty.

- Creating your own token.

- Buying for a fee.

Trading on exchanges

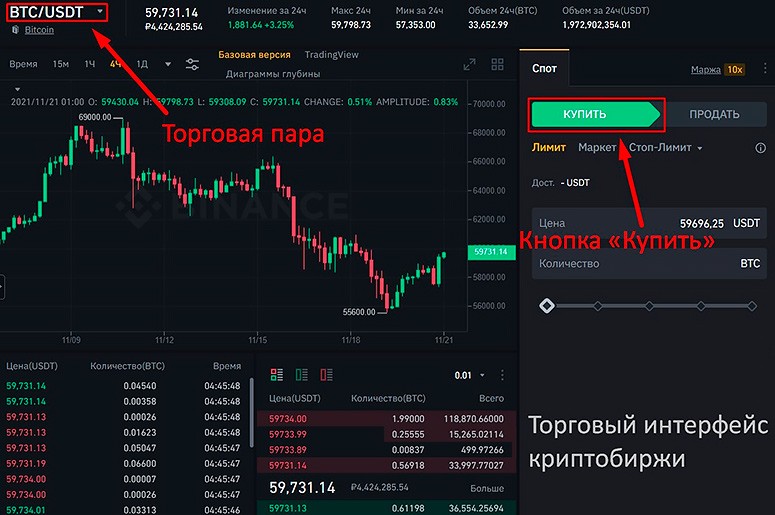

Trading on cryptocurrency exchanges is a popular way to profit from altcoins. The trader’s task is to buy the asset cheaper and sell it more expensive after some time. Trading positions are opened for a couple of hours, days or weeks. The main thing is to generate income from the purchase of cryptocurrency.

To start trading, you need to:

- Choose a cryptocurrency exchange.

- Register on the trading platform.

- Make a deposit to a digital account inside the crypto exchange.

- Select promising altcoins.

- Analyze them.

- Select the desired cryptocurrency pair in the trading interface of the platform.

- Specify the number of assets to be purchased and click on the “Buy” button.

Investments

Investing in cryptocurrency is very similar to trading. Users usually confuse these 2 concepts. Investment means investing money in digital currency in the short term (from 1 to 12 months) or long term (from 1 year). Trading, on the other hand, refers to opening trading positions for up to 30 days.

An investor-analyst can make good money on tokens. However, in the cryptocurrency community, short- and long-term investing is considered a more complex craft than trading digital assets. An investor should be able to perform an in-depth analysis of a project to estimate the approximate real price of an altcoin, for example, in 2 years.

AirDrop

The term refers to the procedure of giving away cryptocurrency for free. Digital projects use Airdrop as an advertising promotion tool. Developers apply 2 models:

- The investor receives assets for storing (hold) a native coin, on top of the cryptocurrency network of which the new project plans to operate. This model became more popular in 2021.

- The user receives free cryptocurrency (in a small amount) for simple actions. For example, the project can ask Airdrop participants to repost a post on their Facebook and subscribe to their Twitter account. This model was popular in 2017-2018. After a while, the token can grow in value. Then the user will get a good profit from Airdrop.

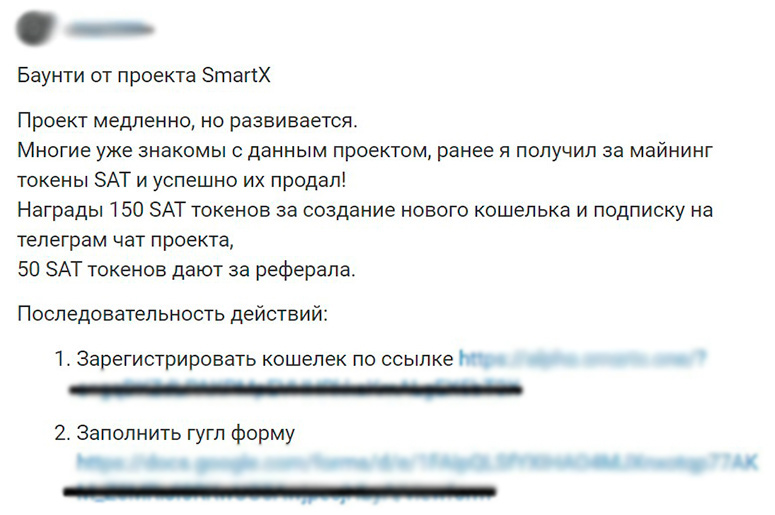

Bounty

This term also refers to the distribution of cryptoassets, but in larger quantities. However, in Bounty there are also complex tasks, such as translating technical documentation of the project or searching for bugs and errors in the program code. But usually this type of distribution, like Airdrop, involves performing simple actions with one difference – users are asked to do something for a long time. Among the tasks are the following:

- For a month, make reposts and put likes to publications from the project in social networks.

- For a week, create tweets on Twitter about the new crypto asset.

- Long test the features of the digital project.

Creating your own token

Users can easily issue their own altcoins. You don’t need to be a programmer to secure such token earnings. In 2021, it is possible to quickly create a cryptocurrency through the CryptonoteStarter service on the Waves blockchain. The method with Solidity, the programming language for Ethereum smart contracts, is also popular. To create an altcoin, you need to follow the algorithm:

- Download the files NewToken.sol and ERC20Standard.sol via GitHub (a top site for storing and collaborative project development).

- Select the name, cryptocurrency ticker, number of altcoins to be issued and the number of decimal places to be able to send (e.g. 0.01 assets).

- Specify the selected values in NewToken.sol.

- Compile the smart contract through the editor.

- Select an Ethereum test network, for example, Ropsten.

- Launch the altcoin after paying the fee.

After step 6, you need to wait for the smart contract to be accepted by the blockchain. It is processed in the same way as a regular transaction. When the smart contract is included in the cryptocurrency network, the asset will become available on the wallet from which it was launched.

Purchase for a fee

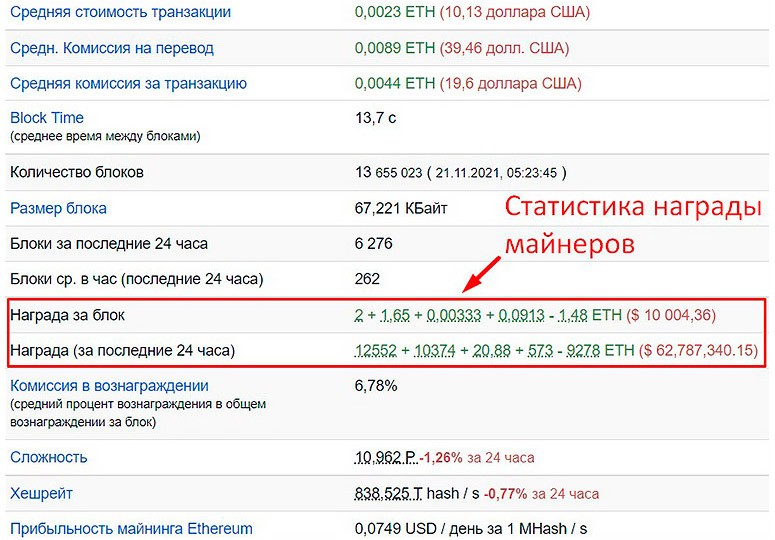

The work of the blockchain is supported bynodes (nodes). In the Ethereum network, they are called miners (before the transition to the ETH 2.0 version). They use the processing power of their computers to process data within the system – generating blocks and confirming transactions. For such activities, miners receive remuneration from the network – ETH coins. A node can spend them to buy cryptocurrency based on the ERC-20 protocol.

How to choose an asset

It is impossible to invest in a random altcoin. Such an investment may not pay off. It is important to analyze each asset. The research of cryptoprojects allows you to find more favorable offers. Also, the analysis reduces the risk of losing investments, since unpromising tokens are immediately eliminated.

To study the business model of a digital project and more accurately predict the price of cryptocurrency will help fundamental analysis. Within its framework, it evaluates:

- The project team and its competence.

- The experience of developers.

- Ways of using the altcoin.

- Marketing of the digital project.

- The cryptocurrency company’s development plan and other metrics.

Possible risks

Investing and trading cryptocurrency is not 100% earnings on tokens. It is hard work, in which analytical mindset and equanimity are important. An investor takes a big risk if:

- Does not analyze the project and the entire cryptocurrency market.

- Gives in to emotions under stress.

- Treats his investments negligently.

- Ignores the preconditions for an approaching bearish trend.

- Thinks that investing and trading is easy.

- Puts money into unpromising projects.

The best platforms to earn money on tokens without investment

You can get altcoins for free through Airdrop and Bounty events. In 2021, Airdrops are posted on special platforms, for example, TokenDrops. Users find the interface of this platform the most convenient.

The site also allows you to see the list of completed eirdrops. Information about the number of tokens that users received is displayed there.

To search for bounties, the cryptocurrency forum BitcoinTalk is suitable. Here, users constantly post the actual events they have found. It is better to try to perform only popular bounties. A large number of active users indicates an increased interest in the altcoin and its possible growth in the future.

Summary

Token is a sub-species of altcoins. Such cryptoassets operate on other people’s blockchains using native coin protocols. For example, they can function on BEP-20 (Binance) and ERC-20 (Ethereum). Altcoins come in:

- Exchange-traded.

- NFT.

- DeFi.

- ICO, IEO, IDO (as units of account).

You can get altcoins for free by doing simple work for a cryptocurrency project. Such events are called Airdrop and Bounty. They are usually used for advertising promotion of a digital project.

Cryptocurrency users can invest in altcoins or trade them through exchanges. Trading and investing provide earnings from tokens. However, trading and investing is a complex activity. It requires the cryptocurrency exchange user to have a cool head and an analytical mindset.

Frequently Asked Questions

❓ Which exchange-traded altcoins are better?

Tokens that actively participate in the functioning of the trading platform and have a burn mechanism.

💰 Which way of earning money on altcoins is more profitable than others?

Much depends on the user’s skills in the field of cryptocurrencies. For example, if you successfully launch your digital asset, maintain it and improve the project, you can become a dollar millionaire in a fairly short period of time.

✅ What to choose: ICO, IEO or IDO?

The user should rely on personal preferences. However, Initial DEX Offering is considered to be the best option, as it incorporates only the positive qualities of ICO and IEO.

🏢 Which exchange to choose?

In the cryptocurrency community, Binance is considered to be the best platform. However, the user should look for an exchange according to the trading conditions that suit him.

💡 What is the easiest way to earn money?

Airdrop. It allows you to receive tokens for free for simple actions.

Is there a mistake in the text? Highlight it with your mouse and press Ctrl + Enter.

Author: Saifedean Ammous, an expert in cryptocurrency economics.