One of the main trends in the cryptocurrency market in 2024 has become non-replaceable tokens. With their help, you can make money from digital pictures, music, movies and even memes. Some NFTs bring their creators fabulous income. Prices for them reach tens of millions of dollars. While some are learning how to create artifacts, others have already started investing in NFT tokens. The market supports the trend and offers new opportunities to multiply capital.

Main ways to invest in NFT tokens

The market for non-fungible tokens is experiencing tremendous growth. In December 2021, NFT sales reached $17 billion – 179 times more than in 2020. Analysts say the field will continue to grow.

Despite their immense popularity, NFTs are still an undervalued technology in terms of the long-term development of the internet. They transform cultural value into an investable asset class and can already pay dividends.

However, money should be invested in digital artifacts only with a clear understanding of their meaning. Experts suggest focusing on future distribution (dividend payout format), cultural significance and usefulness of the product. Investing in NFT tokens can be done in different ways. The following ways are the most popular in 2024:

- Direct investment.

- Providing loans secured by digital items.

- Investing in NFT index funds.

- Buying NFT-dependent ERC-20 tokens.

Direct investing

Buying a promising product for resale is the easiest way to capitalize on new technology. Trade in non-mutually exchangeable tokens is conducted on industry marketplaces (OpenSea, Rarible), and settlement takes place in ETH.

5020 $

bonus for new users!

ByBit предоставляет удобные и безопасные условия для торговли криптовалютами, предлагает низкие комиссии, высокий уровень ликвидности и современные инструменты для анализа рынка. Поддерживает спотовую торговлю и торговлю с плечом, а также помогает новичкам и профессиональным трейдерам с помощью интуитивного интерфейса и обучающих материалов.

Earn a 100 $ bonus

for new users!

Крупнейшая криптобиржа, где можно быстро и безопасно начать путь в мире криптовалют. Платформа предлагает сотни популярных активов, низкие комиссии и продвинутые инструменты для торговли и инвестиций. Простая регистрация, высокая скорость операций и надежная защита средств делают Binance отличным выбором для трейдеров любого уровня!

Some platforms offer tools for minting tokenized items.

Different types of NFTs are bought and sold on marketplaces:

- Paintings.

- Playing cards of sports clubs.

- Music tracks.

- Videos.

- Jewelry and more.

To work, you need to connect a browser wallet with support for ERC-20 (MetaMask). Choosing an object for investment, it is worth understanding that NFT is an illiquid asset, its value is subjective. But the efficiency of the market helps to benefit from investments. If the author describes in his work a problem that will become even more relevant in the future, its value will increase manifold.

In some products, there is a possibility of receiving dividends. They are paid in cryptocurrency or other NFT tokens. For example, Punks comic book owners receive PUNKS coins, and holders of tokenized BAKC (Bored Ape Kennel Club) dogs receive serum for creating new breeds.

Providing credit

According to analytics service Nonfungible, 1.9 million lots were sold on OpenSea, the largest NFT marketplace, in Q3 2021. Only 27% of them remained liquid. Another 73% did not move out of the new owners’ wallets. Lack of liquidity is the main problem of the market. It is partly solved by lending platforms secured by NFT tokens.

Decentralized systems offer to directly lend cryptocurrency to owners of digital artifacts and receive interest for it. If the borrower defaults, the pledged asset is transferred to the lender. Since this is a new direction, the interest rate is quite high – 15-20%. But this is a real opportunity to unlock the asset and transfer it into a liquid form.

The popularity of such loans is growing, with transaction amounts reaching millions of dollars. In October 2021, a loan of $1.42 was approved on the NFTfi platform. As a loan, the user provided a digital artifact from Larva Labs – Autogliph 488.

In 2021, several major platforms were present in the NFT lending market:

- Strip Finance

- NFTfi

- Unbanked.

In December, cryptocurrency exchange Kraken announced the launch of its own NFT marketplace. One of the oldest operators will offer clients custodial and lending-related services.

The promising Arcade project will hit the market in Q1 2022. In December, the developers closed a $15 million funding round with backing from Pantera Capital, Castle Island Ventures, BlockFi and Quantstamp funds.

| Platform | Native cryptocurrency | Exchange rate in December 2021 ($) | Capitalization in December 2021 ($) |

|---|---|---|---|

| Strip Finance | STRIP | 0,20 | 11.58 mln |

| NFTfi | The project uses ETH as a means of settlement | – | – |

| Unbanked | UNBNK | 5,71 | 475.7 mln |

Strip Finance

Decentralized platform works on the principle of P2P-lending. On Strip Finance, owners of digital artifacts create lots, and investors offer loans against a certain asset. The offer has a limited validity period. If the parties come to an agreement, the NFT token is locked by the marketplace’s smart contract. After the loan is repaid and interest is paid, the object is returned to the owner.

It is possible to get a loan on Strip Finance in money. The system automatically determines the value of pledged lots taking into account the data received from the popular sites OpenSea, Rarible, SuperRare. The service allows lenders to independently generate offers based on the following data:

- Borrower profile characteristics.

- History of digital token trading.

- Scoring risk assessment of the potential partner.

NFTfi

The service offers simple conditions for effective interaction between borrowers and lenders. NFT token holders can increase working capital by offering their assets as collateral for a loan. Investors earn money by issuing small short-term loans. The transaction can be concluded in a few clicks. The service takes care of lot verification and valuation. The collateral item is locked in the NFTfi smart contract and returned to the owner after the loan is repaid. If the obligations are not met, the asset is transferred to the lender.

All settlements are made in ERC-20 tokens: wETH and DAO. The service charges a commission of 5% of the lender’s profit. For borrowers, the platform’s services are free of charge. NFTfi developers plan to expand the pool of available features. The new version will include:

- Loans against NFT of ERC-1155 format.

- Loans against the collection of artifacts.

- Financing for an unlimited term.

- Prorated loans with early interest payment options.

- Extension and renegotiation of pre- and post-maturity financing terms.

Unbanked

The platform combines traditional banking with blockchain infrastructure. Unbanked expands the use of cryptocurrencies for investments and everyday settlements. The project’s mission is to create full-fledged financial products for those who do not have access to banks. The service provides lending services secured by cryptocurrencies and non-mutualizable assets.

You can get a loan in ETH, USDC, wBTC and UNBNK. The project’s own coin is used for internal settlements. The borrower must repay the principal and interest in UNBNK. The service’s commission is 0.3% of the lender’s profit.

In December 2021, Unbanked released a collection of 10 thousand digital items Bankers NFT. The new product provides:

- Lifetime access to all platform services.

- A set of privileges, including the elimination of transaction fees.

- The ability to monetize the artifact in any way the owner chooses.

NFT index projects

To increase the liquidity of non-mutualizable assets, they are transferred to the ERC-20 format. Platforms that provide this option are now very popular and have significant potential for future development. Some of them (NFTX, NFT20) allow investors to independently translate their NFTs into ERC-20 tokens and create indices from relevant assets. For example, you can track minimum prices on Zombie CryptoPunks and buy only liquid collection items. Others (Whale, Metaverse) offer ready-made products in the form of tokenized shares of a set of assets.

Investing in NFT through the purchase of an index fund is an easy way to diversify your risk by tracking baskets of multiple single tokens.

NFTX

The platform creates index funds backed by digital items. An asset wrapped in ERC-20 has all the characteristics of a regular cryptocurrency: it can be exchanged for other coins or sold on decentralized exchanges (Uniswap, Sushiswap). Sets of such tokens allow you to track the prices of collectibles on all major marketplaces.

On NFTX you can create 2 types of index funds:

- D1 – valued at a 1:1 ratio between any asset of a certain collection and an ERC-20 contract. For example, the PUNK-BASIC index tracks the minimum price of CryptoPunks. This is an ERC-20 token that can be exchanged for any collection avatar.

- D2 – combines D1 funds. For illustration – the D2 AVASTR index consists of 3 first level indicators: BASIC, RANK-30 and RANK-60. Its owner gets access to the full collection without the need to store multiple tokens.

To work with the platform, the collector places a digital item in the NFTX vault, mints an interchangeable ERC-20 token and pays a 2.5% commission. The creator of the fund is appointed as its manager. He can change the parameters of the index: assign fees, determine the terms of participation in the transaction. Developers continue to work on the project and have already announced new features:

- Lending against the collateral of artifacts.

- Increased network liquidity through integration with popular funds.

- Randomized packages with different NFTs and gift cards for new users.

NFT20.

Decentralized digital item exchange offers users to place an asset in one of the pools or create their own index. In return, NFT20 will provide the cryptocurrency MUSE, which can be used in several ways:

- Make a move to purchase a higher-quality artifact at an auction.

- Exchange for another collectible in the pool.

- Buy and sell coins on the decentralized exchange Uniswap.

- Participate in farming and receive daily income in the project’s native money.

The exchange is made in the ratio of 1 NFT to 100 MUSE coins. The service charges a commission of 5% of the transaction. This money goes into the NFT20 protocol and is distributed among the holders. To create an index fund, you need to:

- Go to the Assets section.

- Add the smart contract address to the NFT collection.

- Come up with a name for the pool and a token symbol.

- Start a transaction.

- Find the created pool on the assets page and enter it.

- Click “Make a deposit” at the top of the screen to add the item to the pool.

- Transfer the NFT token to the service’s wallet.

The cryptocurrency will be credited to the user’s internal account immediately after the transaction is confirmed.

To purchase any collectible asset, just find its avatar and click on the Uniswap button next to the TRADE$MASK20 option.

Metaverse Index

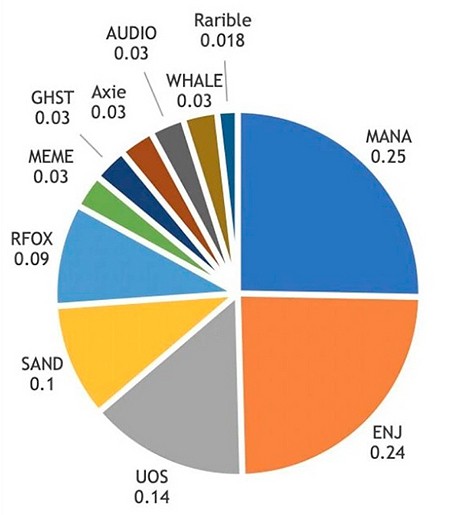

The index fund on Index Cooperative’s platform reflects entertainment, sports and business trends in a virtual environment. The index is calculated using a formula that extracts the square root of market capitalization and liquidity weighting. The Metaverse Index basket includes the largest tokens in the NFT sector that are used in meta-universes (MANA, ENJ, SAND and others).

An asset is included in the basket if it:

- Is created on the Ethereum blockchain.

- Has a market capitalization of more than $30 million.

- Has been operating for at least 3 months. Similar requirements are made to the trading history.

- Has stable liquidity on decentralized Ethereum platforms.

- Is safe according to the results of an independent audit. If the study was not conducted, the platform methodologist independently assesses the reliability of the project.

Index Cooperative analysts recalculate the index twice a month:

- In the last week, they determine the assets to be added and removed.

- In the first days of the next month, they change the composition of the basket to the new weights.

Buying NFT tokens

The ERC-20 standard allows any type of assets to be converted into cryptocurrency. In the sphere of NFT, they perform several functions:

- Managerial. Allow the community to participate in the development of the project and jointly own it. Investing in NFT tokens with the expectation of growing popularity is a good way to profit from the development of the market. For example, the RARI coin from the Rarible platform rose in value more than 8 times in 2021 (from $1.65 in January to $14.35 in December). At its peak, the cryptocurrency’s exchange rate reached $41.33. Axie Infinity’s AXS rose 191 times during the same period (from $0.57 to $109.27).

- Services. Expose holders to additional service options that are not available to other users. For example, SAND is used to purchase in-game gear in the Sandbox meta universe.

- Shared Ownership. They give an opportunity to sell and buy small parts of NFT-items, increasing their liquidity. This direction is being developed by NIFTEX and Metapurce. The former allow you to divide artifacts into more liquid ERC-20. The latter work on the same principle and sell small shares of paintings from the Beeple 20 Collection.

Prospects of earning on NFT through investments

In 2021, the economy of non-replaceable tokens grew at a record pace. Experts expect the market to continue to develop and capture new areas. According to Andrey Podolyan, CEO of Cryptorg crypto exchange, in the future, own digital art collections will become a common practice among celebrities, sports teams and businesses. Advanced crypto investors should think about how to capitalize on this wave of popularity. At the same time, investing in NFT tokens should take into account possible risks. Vladimir Smetanin, CEO of the analytical company Newsent, warns: you should buy collectible tokens with the realization of their value and confidence in the further growth of their popularity.

Frequently asked questions

💻 Where can I buy NFT tokens?

There are now dozens of platforms on the market trading digital art, real estate and other items. The largest of them are OpenSea, Rarible, and Binance.

❓ What is the NFT index?

NFTI is a financial tool on the DeFi marketplace that can be used to track the prices of individual groups of NFT tokens.

💰 How much money do I need to invest in digital collections?

The market for NFT items offers many opportunities to make money. One of the trends is shared ownership. You can buy a part of a lot and get income from its growth in proportion to your investment.

🔎 What is the difference between Level 1 and Level 2 funds on the NFTX?

D1s value assets and ERC-20 at a 1:1 ratio. D2 combine tier 1 funds, giving the user access to the full collection without having to purchase multiple tokens.

💡 Where can I get a loan secured by NFT collectibles?

NFTfi, Strip Finance and Unbanked platforms are popular right now.

Is there a mistake in the text? Highlight it with your mouse and press Ctrl + Enter

Author: Saifedean Ammous, an expert in cryptocurrency economics.