In 2021, the volume of the housing lending market in the Russian Federation reached record levels. According to preliminary data, Russians signed mortgage contracts worth RUB 5.5 trillion. This is 27.9% more than for the whole of 2020 (4.3 trillion rubles). At the same time, mortgage costs amount to 2-5% of the cost of the purchased housing. In order to reduce the time for registration of transactions and simplify the execution of contracts, the government has launched an experiment. From December 1, 2021, Russians can execute a mortgage on the blockchain. The pilot project will last until October 2022. Based on the results, new decisions will be made in the field of regulation of cryptocurrencies.

Launch of a blockchain platform for mortgage transactions

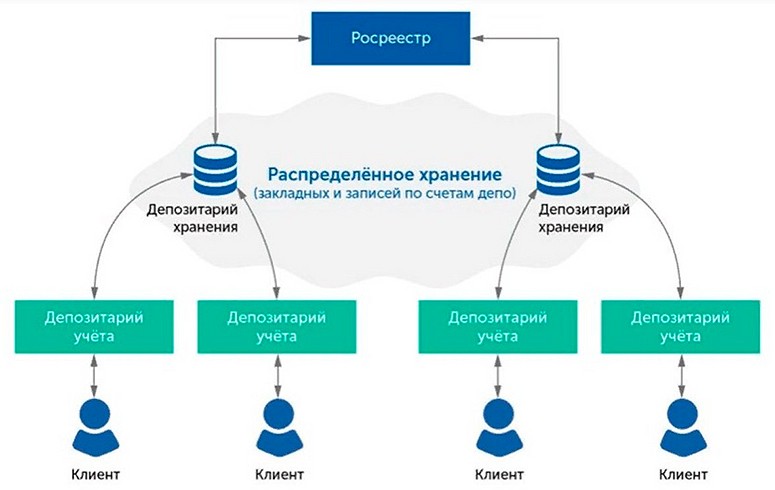

Russia’s largest financial organizations and IT companies are actively working on the introduction of blockchain technology into the banking system. The FinTech Association was established under the auspices of the Central Bank of Russia. Its first project was the Masterchain decentralized system for storing and exchanging financial information, launched in 2018. The platform is built on the Ethereum blockchain and is certified by the FSB taking into account the norms of cryptographic data protection.

The Masterchain system is designed for electronic registration of mortgage transactions in Rosreestr and transfer of contracts to banks’ depositories. This greatly simplifies the execution of loans:

- A mortgage contract with a digital signature from Rosreestr is entered into the blockchain.

- The system automatically registers the smart contract in the bank’s depository.

Mortgage automation has reduced the transaction time from 9 days to 1. Thanks to the network, the security of data storage has increased. Any changes in the contract are confirmed by the parties. The parties to the transaction are identified by the operator – “Distributed Registry Systems”.

The Masterchain network has been put into commercial operation since 2020. More than 95% of electronic transactions are processed by Sberbank. In 2021, Gazprombank and VTB started issuing mortgages on blockchain. So far, electronic contracts are stored centrally – in depositories. However, the government has decided to test the issuance of mortgage loans on the basis of a distributed register.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

In December 2021, a pilot project was launched, which should significantly accelerate the exchange of data between Rosreestr and banks and make digital lending more accessible to citizens. The experiment will end in the fall of 2022.

Project participants

The initiator of the digital mortgage is the Russian government. The decree on conducting an experiment to test the method of interaction between depositories and Rosreestr was published in September 2021. The implementation of the launch is entrusted to the Bank of Russia. The project also involves:

- Rosreestr.

- Mincifry.

- DOM.RF.

- FinTech.

The operator of the Distributed Registry Systems platform has already started working on expanding the available pool of functions. The company sees great prospects for the development of Russia’s digital space using distributed registers. DOM.RF notes that the introduction of technology in the financial sector will not only simplify the receipt of electronic mortgages, but will also reduce mortgage rates by reducing the operating costs of lenders.

During the experiment, the authorities intend to evaluate the efficiency of distributed data storage and transmission on the basis of the Russian Masterchain network. The project’s objectives also include the formation of conditions for the launch of the state information system “Goschain”.

Principle of operation

Banks began testing the updated platform in the spring of 2021. Anonymized user data was used to register electronic mortgages. Since December, the project has been in active mode: the system processes real documents.

Financial information is exchanged in the Masterchain network using a simplified algorithm:

- Participants register through the system operator.

- Approved organizations install software on their side.

- The bank sends the loan agreement to Rosreestr.

- The state body fixes the document with a digital signature and transfers it to the network.

Any changes to the contract are recorded in the system and confirmed by the parties to the process.

Benefits of blockchain-based mortgages

Traditionally, obtaining a housing loan is associated with the execution of a large number of documents and the participation of intermediaries (lawyer, notary, financial expert, BCI). Such transactions are non-transparent, require lengthy processing and high associated costs. In a distributed registry, all information is stored digitally and its reliability is ensured by a protocol. Other pluses of the technology:

- Creating a digital identifier for real estate assets allows tracking of their status and increases market liquidity.

- Smart contract fixes the terms of the agreement and controls their fulfillment. This eliminates intermediaries from the process.

- The network ensures data security. Information is stored on geographically distributed nodes. The risk of its loss is minimized.

- The technology increases the transparency of transactions many times over. It is impossible to change or delete data in the blockchain.

Development prospects

According to Oleg Komlik, Deputy Director of DOM.RF, data exchange between banks and Rosreestr on the basis of blockchain will reduce the time of transaction processing from today’s 7-9 days to a few hours or minutes.

According to Rosreestr, in 2021 in Russia the share of mortgage transactions using electronic services is 50%. Given the current trend, the full transition to digitalization will take place by the end of 2022.

Tatiana Zharkova, a representative of the Distributed Registry System operator, notes the convenience of digital mortgages for banks and borrowers. For the former, the technology facilitates data processing. The latter no longer need to independently collect and submit a package of documents for registration. All project participants are convinced: blockchain will make mortgages more affordable for Russians and will have a positive impact on the development of the cryptocurrency industry in general.

| Period (year) | Mortgage lending market volume (RUB) | Number of contracts (pcs) |

|---|---|---|

| 2019 | 2.8 trillion | 1.2 mln |

| 2020 | 4.3 trillion | 1.7 mln |

| 2021 | 5.5 trillion | 2 million |

Summary

In 2020, during the period of strict anti-viral measures in Russia, the Central Bank allowed financial organizations to process mortgages remotely. Experts predicted a downturn in the credit housing market, but it grew to a record 4.3 trillion In 2021, the trend continued. The volume of mortgage loans reached new highs – 5.5 trillion. In December, a new project under the auspices of the Central Bank – digital mortgage – was launched. By the end of 2022, the government plans to move the entire sector to blockchain. This will reduce the cost of processing and servicing loans, which will lead to lower interest rates. Mortgages will become more affordable and faster.

Frequently Asked Questions

❓ Can I get a mortgage via blockchain in Russia?

In 2021, housing lending in the Russian Federation began to go digital. Since December 1, a pilot project aimed at the gradual digitalization of mortgage transactions has been operating. The experiment will last until the fall of 2022.

💡 What is the timeframe for digital home loan processing?

Distributed registry technology reduces transaction registration from 9 days to 1.

🧾 What is the documentation package required to process a digital home loan?

One of the benefits of mortgage transactions on a blockchain platform is the absence of paper contracts. Banks receive information from a distributed registry. The borrower does not need to collect documents and involve intermediaries.

✅ Do the authorities support digital home loans?

Testing of blockchain technology in the mortgage lending sector is taking place on the initiative of the Russian government. The Bank of Russia has been entrusted with the development and implementation of the project.

🔎 Will the housing loan rate change after the transition to the blockchain format?

The use of distributed registry technology will reduce the cost of registration and servicing of housing loans. Accordingly, the rate will decrease.

Is there a mistake in the text? Highlight it with your mouse and press Ctrl + Enter.

Author: Saifedean Ammous, an expert in cryptocurrency economics.