Innovation is transforming society. Business approaches are changing under their influence. Distributed registry is used in different spheres – from investments to data storage. The specifics of technology implementation in the industry directly depend on its nuances. Development is centralized, when the decision is made at the level of business owners, top management or government, and independent – when startups are promoted. Blockchain in the economy is a sector with different directions. Cryptocurrencies play a leading but not the only role in this sphere. There are other applications of the registry, mastered much worse.

The general principle of blockchain operation

Mankind long ago began to create databases. In them, such information was recorded:

- Demographic summaries.

- Historical events.

- Accounting reports.

- Personal data.

- Banking and stock exchange transactions.

- Debt obligations and other information.

With the development of society and the growth of the economy, the amount of information has increased. At the same time, any information still needs to be structured, recorded, stored. For this purpose, different organizations or structural divisions in companies are often used. This is a centralized method of storage. A certain person or group of people is responsible for the reliability, integrity and immutability of data. But intruders can rewrite or delete information.

In the 90s of the twentieth century, scientists (programmers, mathematicians, cryptographers) were studying distributed registries. In such a database, information is stored on the computers of network participants without involving a central server. Registries use cryptographic methods of data protection, as well as hashing technology. The big problem for scientists who studied decentralized bases at the end of the 20th century was double spending. It took 20 years to solve it. In 2009, Satoshi Nakamoto used the developments to create Bitcoin. The technology of decentralized data storage began to develop, and other virtual currencies emerged.

Blockchain is a special case of distributed ledger technology (DLT). There are different types of decentralized databases. Information is grouped into blocks that are recorded sequentially, receiving additional protection by cryptographic methods.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

Distributed Ledger

A blockchain is a database that is held by each of the participants in the network. A computer or storage device contains its own copy of the information.

The peculiarity of a distributed registry is the absence of a single center or management body. Information is stored and recorded independently from other participants of the network. There are algorithms to confirm consensus – users vote for the correctness of the transaction, record it in the block. Developers use different methods, depending on the approaches.

Distributed registries have these benefits:

- Increased trust between service providers and consumers.

- Reduction of costs for organizing storage, processing and delivery of information.

- Change of interaction between government agencies and citizens towards decentralization.

- Reduced dependence on monopoly companies.

Blockchain is a type of distributed ledger. The structure may differ from other formats of decentralized information storage.

Smart contracts

Blockchain enables applications and mechanisms. Among the latter is a smart contract – an algorithm of actions recorded in a distributed registry. It is executed automatically when the participants of the process fulfill the conditions.

Decentralized applications work on the basis of smart contracts. They serve as guarantors of the fulfillment of contract conditions in automatic mode. Blockchain ensures the immutability of the recorded information. Therefore, the terms and conditions are binding for the participants of the transaction.

It is impossible to create full-fledged smart contracts in the Bitcoin network. More complex distributed registries are needed. Vitalik Buterin was the first to realize a smart contract on Ethereum. Further development led to the creation of complex systems, interaction between platforms and applications.

Smart contracts are characterized by such advantages:

- Optimization and acceleration of uniform procedures.

- Minimization of the role of intermediaries in the exchange of information, performance of different operations.

- Reduction of risks of errors, human factor, fraudulent actions.

- Reduction of costs.

Data storage

A distributed registry provides conditions for storing information. At the same time, the reliability and security of data increases. In addition, distributed bases facilitate access to information for network users.

But there is a disadvantage. The immutability of records excludes fraudulent actions. However, it is not possible to delete or correct information, even if users need it.

Areas of technology application

With the development of distributed registries, the role of decentralized databases is growing. Each area applies the technology taking into account the tasks and requirements, current restrictions. The advantages of blockchain are revealed in different ways depending on the field.

Areas of application of the technology:

- Financial sphere, including investment and exchange activities.

- Economics and banking.

- Public administration.

- Elections, voting processes.

- Health care.

- Education.

- Copyright.

- Real estate.

- Jurisprudence and notary public.

- Entertainment.

- Logistics.

- Document management, databases.

- Information storage and distribution.

Blockchain in the economy

The first direction of registers is cryptocurrency. It is a means of payment, a tool for trading, an object of investment and a method of solving many other tasks. However, blockchain in the economy has other functions. Interest in the distributed registry is shown in the financial sphere and the banking sector. At the same time, manufacturing enterprises pay almost no attention to blockchain.

There are 3 types of distributed registries:

- Public.

- Private.

- Exclusive (multi-level).

Representatives of the economic sector apply public blockchain, develop private networks. At the same time, they can abandon the principle of decentralization, if the specifics of the task require it. Sometimes a single management body helps to get the job done faster. Blockchain improves business efficiency and makes processes transparent to participants, partners and customers.

Banking sector

Finance is one of the main areas of blockchain application in the economy. Representatives of banks have considered the advantages of distributed registers in time. Consortia have been created for joint research and development. For example, in 2014, several banks joined forces in a single company R3. The goal is to research the possibilities of blockchain implementation. The consortium includes world-renowned banks:

- Barclays.

- Credit Suisse.

- Bank of America.

- Citigroup.

- Deutsche Bank and others.

In addition to R3, there are other organizations exploring blockchain adoption in the banking sector of the economy. Among the leaders in this field are:

- Ripple.

- Oracle.

- Circle.

- BitFury.

- AWS.

- Digital Asset Holdings and others.

Some companies operate on a non-profit basis. For example, the Linux Foundation’s Hyperledger organization. Blockchain in the banking sector can:

- Increase the speed of cross-border payments. In a traditional system, transaction time is at least 3 days.

- Reduce the cost of transfers. The current cost of a cross-border transaction in a bank with a traditional approach is from 1% of the transaction. Globally, these are large sums paid by customers.

- Create an alternative to SWIFT. The system has been in use since 1973, it provides interaction between banks and other related entities. It is often criticized for low speed, poor data protection.

- Eliminate intermediaries. When making interbank transactions.

- Automate many procedures. The bank can get rid of complex document flow, optimize the identification of customers, the procedure for issuing loans and so on.

Blockchain in the bank increases the efficiency of work, reduces operating costs. It makes it impossible to make changes to transactions, eliminates the risk of fraud by employees. However, a dilemma arises. The basic paradigm of blockchain is decentralization. The banking environment is based on tight control, a single governing body. Development vectors, interest rates and other key parameters of a financial institution are determined by the owner or top management. The implementation of blockchain in the banking environment is possible in certain directions that do not require control and responsibility for the decision made.

There are 2 directions for implementing distributed ledgers in the economy:

- Niche application for point tasks under the existing structure.

- Revolutionary change in the model of bank construction, management approaches.

In 2023, the implementation takes place according to the first scenario. Cardinal changes are impossible due to the unwillingness of business owners to change the existing order of things.

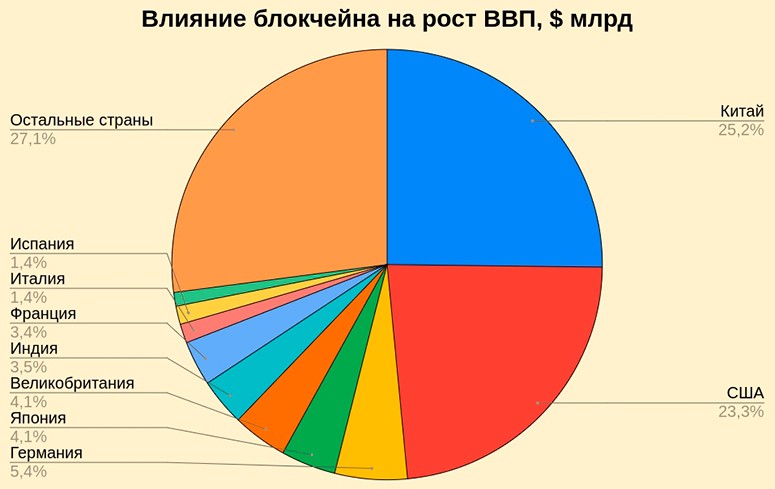

PWC suggests that by 2030, blockchain technology could boost the global economy by $1.86 trillion by increasing tracking and trust.

A means of payment

Blockchain in the economy has many implementation options. Cryptocurrencies, an innovative means of payment, have been created based on the technology.

Bitcoin provides settlement within an hour. It works on a slow network of the first generation. In 2023, there are fast altcoins that can replace traditional banking systems.

The volume of cryptocurrency transactions is growing. At the beginning of 2023, the amount of Ethereum transfers has already exceeded $1 trillion. Such turnovers are a force to be reckoned with.

Investments and trading

There are projects that integrate blockchain technology into the stock market and connect exchanges with banks. For example, Nasdaq and its Stellar project have formed a collaboration with financial structure R3. They jointly developed a platform to implement the Corda enterprise blockchain. The distributed ledger will help financial companies and banks manage digital asset markets.

Cryptocurrency exchange trading takes place on centralized platforms. After the development of smart contracts, blockchain technologies started to be actively implemented in this sphere. Since 2018, decentralized exchanges (DEX) have been appearing. They do not have a management body, serve as intermediaries between users, work without the participation of third parties.

Crowdfunding is also moving to blockchain. Public offering (IPO) and initial coin offering (ICO) are examples of raising money for projects without intermediaries.

Cryptocurrency market development

Despite the application of blockchain in different areas, the main focus is the financial sector. The cryptocurrency market is developing, new projects appear, the first digital assets change.

Thecapitalization of coins and tokens at the beginning of 2023 is $2.2 trillion. Of these, bitcoin occupies 40% of the market. At the same time, the share of the first cryptocurrency is decreasing, and new projects continue to develop.

Energy market

The growing consumption of electricity makes the sphere of production and accumulation in demand. In the energy sector, blockchain will allow control over distribution and trading. Smart contracts will provide transparency of consumer access. Load can be managed, flows can be allocated during peak conditions in real time.

Blockchain also enables coordination of electricity supply and demand data.

Companies that operate in the energy market and use distributed ledger offer customized solutions for users. Also, the adoption of blockchain is associated with the use of renewable sources of electricity such as solar panels. A distributed registry allows inputs to be recorded for metering and sorting. Among the developers of solutions for the energy market it is worth mentioning:

- IBM.

- Microsoft.

- SAP SE.

- Infosys.

- Accenture.

Manufacturing and logistics

Different industries use raw materials and finished components. The timeliness of their delivery affects production, sales, and profits. Blockchain solves problems in the logistics chain:

- Enables monitoring and traceability of goods.

- Helps identify counterfeits and counterfeit products.

- Provides identification of goods.

- Serves as a mechanism for quality control.

- Helps to comply with regulations.

Current state of blockchain development

Corporate interest in distributed ledger and solutions based on it is growing. Large companies and banks are investing part of their funds in the development and implementation of blockchain technologies. More research is being done in the financial sector. However, other sectors of the economy are also realizing the prospects of using distributed databases.

The global arena

An analysis of the top 100 publicly traded companies showed that 81 of them are showing interest in blockchain. These include:

- Conducting research (16).

- Testing pilot versions (14).

- Developing (24).

- Using it (27).

- Have negative experience, abandoned (19).

Some companies invest in their own development, others use ready-made solutions. All realize that investing in blockchain applications will bring benefits in the future.

There are such popular platforms:

- Hyperledger Fabric – a share of 26%.

- Ethereum – 18%.

- Quorum – 11%.

Hyperledger Fabric is a project of the non-profit organization Linux Foundation, in the development of which IBM, Digital Assets participated. The platform is modular and represents a standard for the corporate sector. Linux Foundation managed to develop a secure application that allows private use. The platform provides scalability and adaptation for all industries.

Ethereum is a decentralized network. It has an open source program code, allows running applications and smart contracts.

Quorum is a platform based on Ethereum. Modernization of the existing blockchain was performed taking into account the use by corporate business.

In addition to the leaders, there are other platforms:

- Corda – for financial and banking sectors.

- Mediledger – for pharmaceutical business.

- AxCore – a set of tools for the capital market.

Blockchain in Russia

According to PricewaterhouseCoopers analysts, China (825) and the United States (648) are the leaders in the development and implementation of distributed ledger in the economy. South Korea, Japan, Germany and other countries follow with a big lag. Russia lags behind the developed countries of the world in the implementation of blockchain in the economy.

At the same time, the most promising areas for the Russian Federation to apply the technology may be:

- Extraction, processing and transportation of fuel and energy resources.

- Electricity production.

- Logistics.

- Banking sector.

The financial segment of the economy is the most advanced in implementing blockchain. Various structures are engaged in the development. For example, the FinTech Association has created the Masterchain platform. Sberbank, Tinkoff, Alfa-Bank and others are active participants in the integration into the banking environment.

Economic implications of blockchain development

According to research conducted by PricewaterhouseCoopers (PwC), by 2030, the application of new technologies can provide growth in the global economy by $1.76 trillion. The greatest rise is expected in such sectors:

- Public Administration.

- Education.

- Health care.

Among countries, the advantage will go to:

- China ($440 billion).

- USA ($407 billion).

- Japan, Germany, UK, France, France, India ($50 bln growth in each country).

In different states, the development of blockchain technology is associated with certain sectors of the economy. For example, for China or Germany, it is the manufacturing sector and supply tracking.

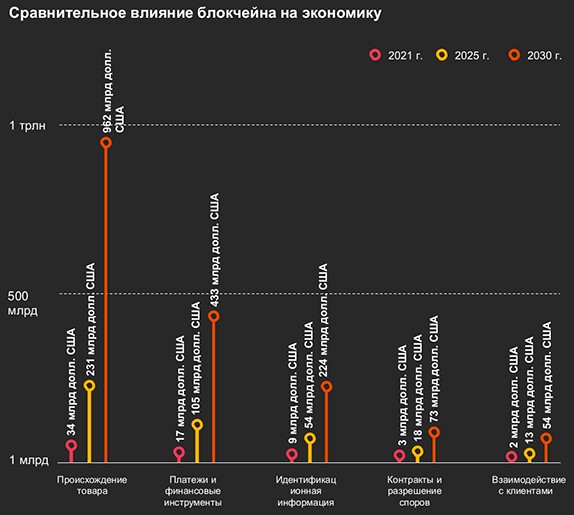

Also in the PwC report “Time to trust: trillion-dollar reasons to look at blockchain in a new way” there are 5 areas of technology application.

| Direction | Amount of expected benefit, $ mln | Description |

|---|---|---|

| Monitoring and tracking of goods | 962 | Blockchain in the economy will provide control over production, quality, environmental component |

| Making payments and other financial services | 433 | Technology enables creation of national digital currencies, fast and inexpensive cross-border payments |

| Personal information management | 224 | Control of professional qualifications, certificates, diplomas |

| Contract formalization | 73 | Resolution of disputable situations is much easier and faster than in a traditional system |

| Attracting clients | 54 | Use in loyalty programs |

According to a PwC survey of CEOs, 61% of respondents have planned to spend on blockchain implementation.

Summary

Every industry can benefit from the use of digital technology. A big challenge is the low awareness of decentralized databases, their capabilities and benefits among executives at various levels. In the opinion of many, distributed ledgers are mostly cryptocurrency. Therefore, blockchain is stronger in the financial and banking sectors.

The concepts of distributed ledgers and cryptocurrency are indeed closely related. However, the possibilities of blockchain do not end there. Over the past few years, the scope of distributed databases has expanded and the economy is transforming. Especially since the benefits of blockchain implementation are obvious. This is confirmed by the research of analytical companies.

Frequently asked questions

❗ Is data immutability an advantage or disadvantage?

The assessment depends on the situation. The immutability of information makes it possible to fight fraudsters. However, it is also impossible to make changes to the register in case of an error.

💻 Is it possible for data to be leaked through one of the users’ computers?

Information is stored in the blockchain without a security clearance. Therefore, a leak will not lead to consequences for the owner of the data. Users have access to public information and are of no interest to attackers.

🏦 Why is the banking sector leading the way in implementing distributed ledger?

Cryptocurrencies were the first to be implemented on blockchain. Therefore, representatives of financial structures have turned to the technology.

🧾 Who controls smart contracts?

The program automatically monitors the fulfillment of pre-determined conditions.

💡 Are distributed ledger and blockchain the same thing?

They are different definitions. Blockchain is a type of distributed ledger. It represents a peer-to-peer network. Information in it is grouped into packets and recorded sequentially. A block of data cannot be changed or deleted.

Is there an error in the text? Highlight it with your mouse and press Ctrl + Enter.

Author: Saifedean Ammous, an expert in cryptocurrency economics.