Since 2009, digital currencies have gone from an obscure instrument to a promising investment. Initially, investments were made by private market participants who believed in the technology – individuals. However, more development is given by the arrival of money from large institutional investors. They invest their money, among other things, in Grayscale Bitcoin Trust, an over-the-counter product from the Grayscale Foundation. Accredited investors can invest in it.

What is Grayscale

The cryptocurrency asset management company was founded in 2013. Its full name is Grayscale Investments. It is part of the parent company Digital Currency Group, which also owns the well-known American media publication about digital currencies Coindesk.

Founder

The position of CEO at Digital Currency Group (DCG) is held by Barry Silbert. In 2013, he became the founder of Grayscale Investments. The specialist received his higher education at Emory University’s Goizueta Business School (located in the American city of Atlanta), graduating in 1998.

Before founding his own business, Barry worked for several years as an investment banker in New York. Then he founded a technology company with venture capital SecondMarket. In 2015, it was acquired by the NASDAQ exchange.

The position of CEO since January 2021 is held by Michael Sonnenstein. In the track record of the specialist – work in American banks Bank of America, Barclays, J.P. Morgan. Michael started his career at Grayscale in January 2014 as Chief Financial Officer. The specialist has two degrees in economics:

- Goizueta Business School of Emory University.

- Stern School of Business, New York University.

DCG deals with investments in the cryptocurrency sector. Its investment portfolio includes more than 150 companies in 30 countries, including Coinbase, Ripple, BitPay and Chainalysis. Digital Currency Group’s asset list includes full-service digital currency broker Genesis Trading. DCG is also involved in crypto coin investing.

5020 $

bonus for new users!

ByBit предоставляет удобные и безопасные условия для торговли криптовалютами, предлагает низкие комиссии, высокий уровень ликвидности и современные инструменты для анализа рынка. Поддерживает спотовую торговлю и торговлю с плечом, а также помогает новичкам и профессиональным трейдерам с помощью интуитивного интерфейса и обучающих материалов.

Earn a 100 $ bonus

for new users!

Крупнейшая криптобиржа, где можно быстро и безопасно начать путь в мире криптовалют. Платформа предлагает сотни популярных активов, низкие комиссии и продвинутые инструменты для торговли и инвестиций. Простая регистрация, высокая скорость операций и надежная защита средств делают Binance отличным выбором для трейдеров любого уровня!

Brief History

Important development milestones include:

- 2013 – establishment of the cryptocurrency company.

- March 2017 – the amount of assets under management in bitcoin amounted to $208 million.

- June 2018 – the number of investment funds in cryptocurrencies reached 8.

- November 19, 2019 – an application was filed with the Securities and Exchange Commission (SEC) to recognize Bitcoin Investment Trust as a reporting company. August 2020 – similar action taken for Grayscale Ethereum Investment Trust.

- October 2021 – Application is made to convert all crypto funds into ETFs. BNY Mellon Bank is involved, with an agreement signed in July.

- February 2022 – launch of an ETF on the New York Stock Exchange for shares of companies that deal with bitcoin and other cryptocurrencies.

Fund Features

Grayscale Bitcoin Trust is one of the instruments that is tied to the price of bitcoin. The company has crypto funds with other digital coins. They are listed in the table. The data is current as of February 2022.

| Fund with a digital asset | Amount invested |

|---|---|

| Bitcoin | $25.7 billion |

| Bitcoin Cash | $98.1 mln |

| Basic Attention Token | $4.52 mln |

| Chainlink | $4.76 million |

| Decentraland | $59.95 mln |

| Ethereum Classic | $347.23 million |

| Ethereum | $8.64 mln |

| Filecoin | $2.22 mln |

| Horizen | $23.66 mln |

| Litecoin | $179.27 mln |

| Livepeer | $15.43 mln |

| Solana | $8.44 mln |

| Stellar | $15.08 mln |

| Zcash | $36.68 mln |

| Decentralized finance (multiple assets) | $6.97 mln |

| Coins with the largest capitalization | $406.72 mln |

Principle of operation

The organization of the crypto fund and the interaction of participants with it are as follows:

- The company attracts investors’ money, with which it buys cryptocurrency. The purchased coins are stored with the help of Coinbase Custody, the activity of which is regulated by the New York State Department of Financial Services (NYDFS).

- The issuance of crypto fund shares is made.

- Investors purchase securities in the over-the-counter system OTCQX. The instrument is not represented on trading platforms, as such crypto funds are not subject to the SEC.

The number of digital assets per share is calculated daily based on the Coindesk index or the benchmark rate. The pegging is done to the real price. However, the value of GBTC may vary. The sale is made:

- At a premium. In this case, a premium is placed on the GBTC price compared to the net asset value (NAV). Investors buy the stock at a higher price.

- At a discount. In this case, the stock is offered cheaper than the face value.

How to buy and sell

Since the financial instrument is not registered with the SEC, only accredited investors are allowed to invest in the securities. For this purpose, they need to pass a background check. Annual income for the last 24 months must be at least $200 thousand, or the savings in the bank account are from $1 million (in the case of a legal entity – more than 5).

The minimum entry amount into the fund for investors is $50 thousand. An annual commission of 2% is deducted from each thousand dollars.

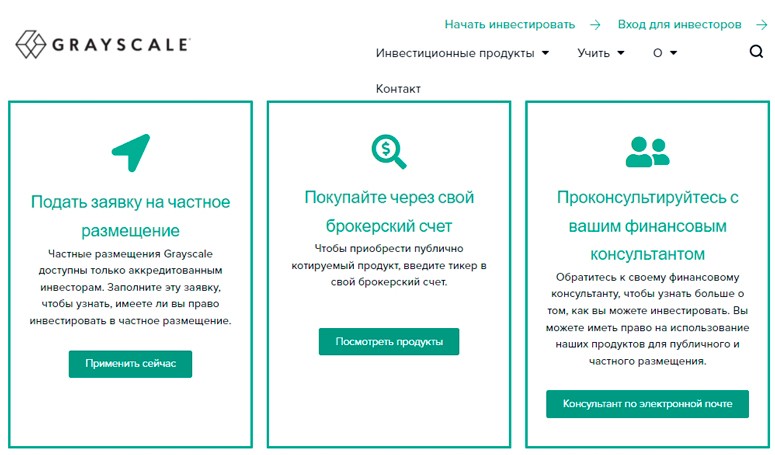

To invest in products, the company’s clients are offered the following methods:

- Private Placement Application. Available only for accredited investors.

- Purchase through a brokerage account using the OTCQX system. To search for an investment instrument for the selected coin, you need to enter the corresponding ticker.

- Consultation with a financial analyst, which is conducted via e-mail.

Since Grayscale Investments reports to the SEC, it is not allowed to sell its personal funds for 6 months from the date of acquisition. Retail investors have the option to exchange GBTC on secondary markets.

How the bitcoin-ETF differs from the Grayscale Bitcoin Trust

Both instruments are similar in nature. However, an ETF fund is approved by the Securities and Exchange Commission. It is then added to trading platforms like NASDAQ. As a result, more traders get access to investment products. Only accredited investors can work with GBTC and similar funds for other cryptocurrencies.

Since the second half of 2021, Grayscale Investments has been working on transferring its instruments into ETFs. In October, it filed a corresponding application with the SEC. As of February 2022, it is under review.

Benefits of GBTC

Sometimes traders have to overpay up to 20% to enter the fund because of the set premium. Another thing to keep in mind is the 2% commission. However, investing in Grayscale Bitcoin Trust is still beneficial to fund participants for the following reasons:

- There is no need to go through the process of converting digital coins into fiat currencies on exchanges. Profit is immediately withdrawn in dollars.

- The issue of storing cryptocurrency is solved. Coins are placed at the custodian partner Coinbase Custody.

- The risks of fraud and hacking are reduced, since the company is accountable to the SEC.

- Payment of taxes is simplified. Plus, participants can get some benefits.

Risks of investing in Grayscale Bitcoin Trust

From its launch in 2013 until February 2022, the total return of the fund’s participants exceeded 26,428%. However, GBTC has posted a negative 24.5% over the past 12 months. While buying shares, participants may overpay due to the presence of premium, the value of which reaches up to 20%. Therefore, the profitability of investments largely depends on the current state of the cryptocurrency market. In the case of a drawdown, traders will have to wait for some time to get to the plus side.

Conclusions

GBTC is a tool with which investments in digital coins can be made by traders from the traditional market. Participation in the fund solves the issues with the storage of cryptocurrency, as it is taken over by the company. However, not every user will be able to become an investor. By law, only accredited participants from the United States can invest in the crypto fund from $50 thousand.

Frequently Asked Questions

❌ Can Russian citizens invest in GBTC?

The fund is only available to Americans.

❔ What are the ways to enter GBTC?

Accredited participants can leave an application for a private placement. Buying shares is also available through the OTCQX OTC trading system and receiving personalized advice from financial analysts via e-mail.

💵 With what amount can investors enter GBTC?

Deposits from $50 thousand are accepted.

❓ Why does the crypto company want to convert its funds into ETFs?

This transition will make investing in digital assets accessible to more institutional investors.

❕ What is Grayscale Future of Finance?

It is the company’s first ETF fund, which was approved by the SEC in February 2022. With it, investors can invest in stocks of companies that are involved in cryptocurrency technology and digital assets. The fund has the ticker symbol GFOF on the New York Stock Exchange.

Is there a mistake in the text? Highlight it with your mouse and press Ctrl + Enter

Author: Saifedean Ammous, an expert in cryptocurrency economics.