Traders use different ways to make money from tokens and coins. Some buy assets and store them on their wallets, while others conclude futures contracts with the expectation that the price of digital currency will rise or fall. In addition, exchanges use other instruments for profit: options, swaps. But spot trading in cryptocurrencies is the basic type of trading. This is the easiest way to earn money on tokens and koins, since the participant of the operation becomes the full owner of digital assets.

The concept of spot cryptocurrency trading

The word spot translates from English as “place”. Spot trading of cryptocurrencies is a type of transaction, the result of which is an instantaneous settlement between the parties and the buyer immediately becomes the owner of the digital asset. Usually, the transaction is carried out according to the following algorithm:

- A cryptotrader puts out an application (order). It specifies the conditions under which the user is ready to conclude a transaction.

- The order is added to the cryptocurrency exchange’s order book. This is a register in which all customer bids are entered.

- The second party to the transaction (counterparty) fills out and sends a counter order. If the conditions match the offer available on the market, an exchange between the parties to the transaction takes place.

- Each party immediately receives the required assets to a fiat account or cryptocurrency wallet on the exchange. The bid is paid instantly (“on the spot”).

Features of the spot market of cryptocurrencies

The main difference between this type of transaction and others is the crediting of tokens and coins to the trader’s balance. Spot transactions are similar to settlements in an exchange office or a bank branch. If the user bought dollars or euros for rubles, he can deposit them, hide them in a safe or give them to another person. The same principle applies to crypto exchanges. Purchased digital currencies can be withdrawn to a wallet or used for settlements on the Internet.

Advantages and disadvantages

The main advantage of spot transactions is the trader’s full control over cryptocurrency. Trading participants buy real assets, which are immediately credited to the exchange deposit. But spot trading in cryptocurrencies is not without disadvantages. This way of earning is not designed to get instant profits. The size of the cryptotrader’s income is limited by the dynamics of changes in the rate of change of the digital currency. In general, there are such pros and cons of trading on the spot.

| Advantages | Disadvantages |

|---|---|

| Availability on most crypto platforms | Profit depends on the magnitude of fluctuations in quotes |

| Low requirements for the size of the starting capital | Crypto traders cannot use leverage – borrowed funds provided by exchanges to buy tokens and koins. |

| Accessibility of the methodology for beginners due to the fact that it is easy for beginners to understand the principles of trading on the spot. | If hackers or fraudsters gain access to the exchange account, they can withdraw assets directly to personal wallets |

Buying cryptocurrency on the spot market

The process of exchanging assets for immediate delivery depends on the type of order chosen. On most crypto exchanges, the following types of orders are available:

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

- Market (market). The order is executed instantly at the most favorable rate.

- Limit. The order is entered into the order book and activated if the price reaches the level desired by the user.

- Stop. The purchase of cryptocurrency will occur only after its rate increases by the value set by the trader. The sale of the asset is carried out if its price has started to fall.

- Stop Limit. As soon as the quotes of the crypto asset have reached the value set by the trader, a limit order is entered into the order book.

Choosing an exchange for spot trading

The profitability of speculative operations is affected by several factors. One of them is the choice of crypto exchange. A good platform should meet such criteria:

- Low commission rates.

- Account security.

- A wide choice of deposit and withdrawal methods.

- High liquidity.

- Availability of bonuses and additional ways of earning (staking, lending, crypto-loans).

Spot type transactions are available on most crypto exchanges. But, depending on the level of the platform, the list of traded digital currencies may differ. Bitcoin, Ethereum and other crypto assets from the top of the rating are available on almost all exchanges. The wider this list is, the easier it is for a trader to find a currency with a favorable exchange rate.

In addition to real cryptoplatforms, there are also fraudulent projects on the Internet. Such sites imitate a real exchange, but block the victim after making a deposit. Therefore, when choosing a trading platform, you should evaluate its reputation, avoiding cryptoplatforms with negative customer reviews.

Best spot exchanges

In January 2022, the CryptoProGuide.com portal ranked 571 crypto platforms. The projects with the best reputation and trading conditions made it to the top of this list. The compilers of the rating took into account such indicators:

- The number of available trading pairs and cryptocurrencies.

- Customer reviews.

- The average daily volume of transactions.

- The possibility of depositing fiat.

Bithumb

An international platform founded in 2014 in South Korea. On Bithumb, users can make transactions in 296 directions. In addition, crypto exchange clients have access to such services:

- Margin trading.

- Transactions with smart tokens.

- Staking.

- Steading (analog of initial coin placement).

The disadvantages of the crypto platform include the company’s focus on clients from South Korea. Foreign citizens have problems with account creation and verification.

EXMO

A trading platform focused on speculative operations. Spot transactions are available, as well as margin trading. According to the management, the number of active users reached 1.96 million in August 2021. The second advantage of EXMO is the company’s registration in London. The crypto exchange operates in accordance with the British legislation and is under the supervision of local regulators.

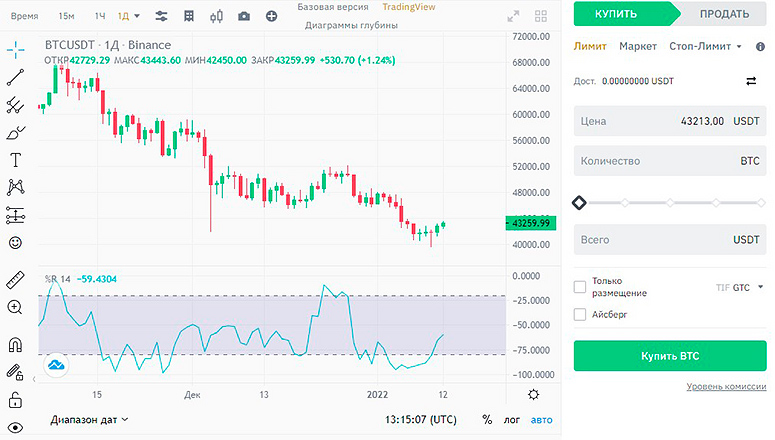

Binance

The largest crypto exchange by transaction volume in January 2022. On an average day, the platform’s turnover reached $20 billion. In addition, Binance offers users different ways to earn money with tokens and coins. Customers can:

- Carry out spot type transactions.

- Trade with leverage.

- Invest digital currency in lending and staking.

- Make money on futures and options.

OKEX

A crypto platform launched in 2017. OKEX is under the jurisdiction of Malta. The company offers customers to conduct transactions on the spot. In addition, the list of services includes margin trading and derivatives transactions.

Huobi

International trading platform. In 2021, Huobi had offices in 12 countries, and the total number of employees exceeded 1,300 people.

The developers call their project one of the safest. Up to 98% of customers’ savings are stored in cold wallets. In addition, the creators take active measures to counteract hacker attacks.

Strategies of spot trading

To make a profit, the trader needs to act according to the following algorithm:

- Choose an exchange direction or a specific crypto asset.

- Conduct a market analysis, determining in which direction the quotes are likely to change.

- Buy cryptocurrency by filling out the order form.

- Wait for the growth of quotes.

- Conduct an exchange in the opposite direction by selling the asset that has gone up in price.

The most difficult stage in this list is the market analysis of cryptocurrency. There is no single method for determining the dynamics of quotes.

Some traders rely on fundamental analysis, while others use indicators or customize trading robots. In general, all strategies of transactions on the spot can be divided into such categories.

| Type | Method description |

|---|---|

| Trend Trading | The user determines the dominant mood of other market participants. For this purpose, trend lines and techanalysis indicators are suitable. Buying a cryptoasset is carried out at the moment when its rate is steadily growing. |

| Analyzing patterns and figures on the chart | The trader tries to determine the dynamics of the price by the history of quotes. If characteristic figures are formed on the chart, the analyst can understand whether the trend will continue. |

| Indicator strategies | Most crypto exchanges have tools for technical analysis. Each indicator is based on a mathematical formula. By entering past quotes into it, you can understand how much the current price of the asset differs from the average value. |

Summary

Spot trading of cryptocurrencies is a type of transactions with tokens and coins, the execution of which involves the immediate delivery of purchased assets.

The main advantage of this method is the trader’s control over his savings. Purchased crypto-assets can not only be stored, but also used for purchases or investments.

Frequently Asked Questions

🏢 Are there any exchanges where spot is not available?

Yes, some platforms specialize in derivatives transactions. It is better to find out about spot availability on the crypto exchange’s website or through the support team.

❓ What is the difference between trading and investment strategies?

Spot trading is categorized as speculative trading. The user purchases assets in order to sell them once the price increases. Unlike traders, investors hold tokens and coins for a long time, counting on the constant growth of their quotes.

💡 Which is easier for a beginner – spot or futures transactions?

Derivatives trading can be complicated for beginners. Users have to understand the terminology and features of futures contracts. Transactions on delivery terms do not require such in-depth knowledge and experience.

✅ Can cryptocurrency be traded outside of exchanges?

Yes, buying tokens and coins is available on P2P platforms and through exchange services. But the rate may be unfavorable for the trader, and the commission may be too high.

❗ Are all crypto exchanges organized in the same way?

No, in addition to classic platforms, there are also decentralized platforms. On them, traders do not fill out an order form, but change assets through liquidity pools. But if the user receives the purchased digital currency on the wallet, then such an operation is also considered spot.

Error in the text? Highlight it with your mouse and press Ctrl + Enter.

Author: Saifedean Ammous, an expert in cryptocurrency economics.