Amid the cryptozyme, digital assets are losing investment appeal. However, cryptocurrency mining is still relevant. According to Arcane Research, in September 2022, the bitcoin network hashrate is growing due to the influx of new users. CryptoQuant analysts note: large miners have returned to the accumulation strategy and sharply reduced coin sales. Such dynamics predicts a rapid market reversal. If the forecasts come true, the fall of 2022 may be a good time to enter. But before purchasing equipment, you should make a business plan, study the market, and evaluate the pros and cons of mining. This will reduce risks and increase potential profits.

What is mining in simple words

The blockchain consists of chains that contain all user transactions. Once transactions are confirmed, the blocks cannot be deleted or changed, they are cryptographically protected. This work is done by miners. As a reward, they receive a certain amount of cryptocurrency.

The task of a miner is to find the correct solution (hash) before the other participants. For calculations they use equipment – processors, video cards, hard disks or ASICs. Participants with more powerful equipment get an advantage.

Pros and cons of mining

Like any business, mining digital coins has strengths and weaknesses. Due to the peculiarities of the code, the cryptocurrency market is cyclical. For example, in the Bitcoin network, the reward per block is halved every 4 years. Experienced miners believe: if you enter the business after a big correction, you can claim high profitability.

Additional profit will be brought by the rise in prices for professional equipment. But in this case there is a possibility of working without income or at a loss for several years with unpredictable results. Therefore, before launching the farm, you need to determine the goals, weigh the pros and cons of cryptocurrency mining. Calculations should be formalized in the form of a business plan.

Pros

In 2023, mining remains a popular way of passive earnings. To get started, you need minimal knowledge of the blockchain and the device of the pc. Experience is optional, but will be an advantage. Mining does not require time, so it attracts users.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

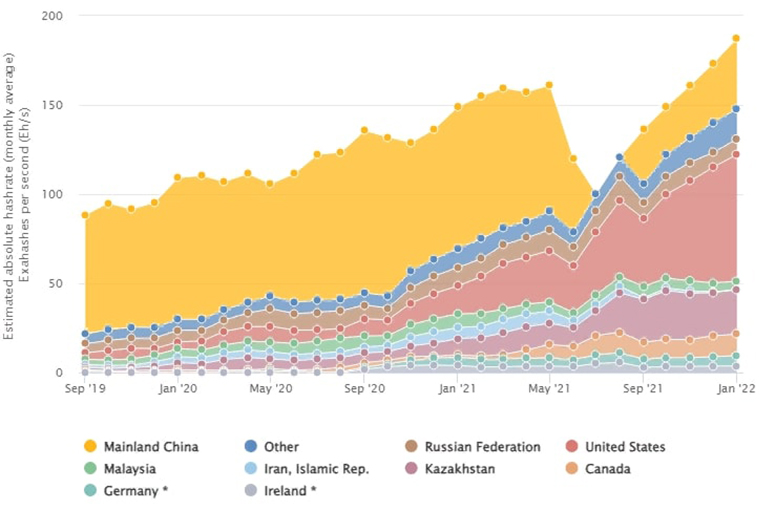

After the ban on crypto mining in China, market participants are redistributing capacity. Many miners are moving farms to Russia because of the cool climate and cheap electricity.

According to the University of Cambridge, the share of the Russian Federation in bitcoin mining has doubled since 2019 (from 5.9% to 11.2%). Experts cite other reasons for the popularity of mining – the proliferation of cryptocurrencies and easy startup.

No special skills are needed

In the early days of cryptocurrencies, setting up equipment required specialized knowledge. Therefore, coin mining was mostly handled by programmers who loved novelty. To connect to the pool required skills to work with applications in console mode.

In 2023, the process is maximally simplified. Miner programs have a simple graphical interface. On thematic forums and blogs it will be possible to find detailed instructions for setting up the equipment. Now users without special knowledge and skills can start mining.

Miners do not even need to perform complex calculations of payback and profitability of devices. This is done by special calculators.

Anonymity

In mining, it is possible to maintain privacy. Most pools offer formal account registration without specifying personal data. All you need to report for work is a computer address (IP) and a cryptocurrency wallet. Industry monitors do not track the coins that have been mined. If you cash out funds through services without verification, such as exchangers, for example, it will be extremely difficult to establish the user’s identity by indirect data.

Profitability

The profit of miners depends on many facts. In short – it is necessary to calculate the average price of coins and the cost of each TH/s capacity. It is also necessary to take into account:

- Equipment maintenance. On average, the costs are about 10 thousand rubles per year for each rig of 6 video cards or asics (without taking into account the prices for the services of service engineers).

- Monthly expenses. Miners have to pay for electricity and hosting.

- Increasing network complexity. To maintain the level of income, you will have to buy up capacity or overclock the equipment.

In 2023, due to a significant market correction, the profitability of mining has decreased. In the current conditions, you need to continuously mine cryptocurrency for 2-3 years to return your investment. The situation may change when the market reverses.

Ready-made business

Before launching the farm, you need to carry out preparatory work. On average, it can take about 2-3 months to find components, purchase, assemble and customize the equipment. In 2023, miners can buy a turnkey farm. Such a deal significantly saves time and resources. Equipment suppliers will give free advice on the choice of cryptocurrency and calculate a business plan. The buyer will receive a warranty (usually up to a year) on components and assembly.

Large data centers and pools also provide capacity for rent. The advantage of such services is a low entry threshold (you can start with $100-200). But there is a risk of encountering scammers who work on the principle of a pyramid scheme. For remote mining you need to:

- Choose a reliable service – capacity provider.

- Calculate the potential profit on an online calculator.

- Buy a contract.

Profit will be received daily on the investor’s cryptocurrency wallet or the balance of the service. In the second case, you will need to withdraw coins after accumulating the minimum amount manually.

Passive income

The plus of mining is in automatism. The process is managed by special programs. The user only needs to set up the technique 1 time. In the future it will only be necessary to monitor the stability of work and conduct preventive maintenance. With a competent approach, mining can become the main source of income.

The possibility of income growth

In the current conditions (September 2022), it is possible to pay off the equipment in an average of 1.5-2 years. Beginning miners usually collect a rig of 6-8 video cards or 1-2 asics. In the future, the farm is expanded at the expense of the profit earned.

The advantage of this approach is a small initial investment. The disadvantage is a long payback period. Along with the daily income, the costs of farm support (equipment maintenance, electricity, hosting) grow. Therefore, experienced miners recommend investing in the expansion of 80% of the profits, the rest of the money should be spent on operating costs.

Availability of information

In 2023, mining is a common way to earn money from cryptocurrencies. Large companies, pools, equipment suppliers are striving to simplify coin mining for users. Such platforms place recommendations on the choice of cryptocurrency, detailed instructions for setting up equipment. Users can get an answer to a question in text or video format. On thematic forums it will also be possible to communicate with more experienced miners.

Cons

Before launching mining, it is necessary to assess the risks of the business. Beginners often make these mistakes:

- Use outdated equipment. To save money, beginner miners take used video cards, which quickly fail almost immediately after purchase.

- Buy or rent capacity at below-market prices. Such offers are often posted by scammers. Buyers receive faulty equipment or lose money altogether.

- They take out loans to buy equipment. In case of market correction, newcomers have to sell equipment at a reduced price to pay the bills.

- Neglect the safety of storing cryptocurrencies. You should not accumulate profits in an exchange account. If hackers break into a centralized service, customers will lose money. It is worth choosing non-castodial storage – desktop or hardware. In such cases, private keys are held by users, and network access is connected when necessary.

No legal framework

Since 2021, the law “On Digital Financial Assets” has been in force in Russia. But the status of mining is not defined in the document. Due to the lack of a legal framework, the risk of corruption is growing (you need to get permission to use electricity).

Large miners who pay tax on their profits correctly face difficulties in converting coins. According to the Central Bank’s instruction, banks regard transactions with cryptocurrency as dubious. Card accounts of users can be blocked. To resolve the issue, it will be necessary to prove the rightness in court.

Possible bans by the state

In 2023, Russia became the third in the world in terms of the volume of mined cryptocurrencies. However, mining is not yet legally regulated. The President of the Russian Federation proposed to the government to eliminate shortcomings in the field of mining digital coins.

Officials have already prepared a draft law that will equate cryptocurrency mining to entrepreneurial activity. The document may come into force in 2023.

However, not all officials agree with this position. The Central Bank believes that cryptocurrency mining in the Russian Federation should be banned, up to the introduction of criminal liability. Similar measures in China led to a complete stop in the process of obtaining coins.

There is no base of specialists

Mining equipment operates at peak loads in a 24/7 mode. The warranty service period is 3-6 months for asics, 12-15 months for video cards. With careful use, you can extend the operating time of miners up to 5 years.

To increase the service life of the equipment, you need to regularly carry out preventive maintenance and troubleshooting. Careless use will lead to premature failure. For example, video cards can burn out if not properly connected to the motherboard.

Self-maintenance requires skills in electrical engineering and special equipment, such as a soldering station. If you do not have such experience, you will have to use the services of service centers. In 2023, there is a shortage of skilled labor. For the construction of industrial farms in low-cost regions (near hydroelectric power plants in Siberia, Armenia, Kazakhstan), engineers from different cities of Russia are attracted.

Payback risks

At the peak of the market in 2020-2021, miners could pay off the equipment in 6-8 months. Prices for equipment depend on coin quotes. In the summer of 2021, the average asic cost $15-17 thousand. In the fall of 2022, new equipment can be bought for $7-10 thousand.

Participants who started the business at the peak lost in the value of the equipment. Daily income fell due to a strong market correction and increased complexity of networks. Users from Europe and the U.S. have seen an increase in electricity rates. These factors are increasing the payback period of the equipment.

Expensive equipment

One of the main disadvantages of mining is the high price of components. In 2023, due to the growing complexity of top networks, coin mining is effective only on the latest models of asics and GPUs. To maintain profitability, the equipment should be updated in 3-4 months after the release of the next model.

In the context of cryptozyme, prices for mining equipment have decreased, but are still high. In the fall of 2022, an average rig of 6 video cards costs 280-350 thousand rubles, an asic – 500-800 thousand rubles. It is also necessary to pay for electricity and hosting, if the farm can not be assembled at home.

Fluctuations in the exchange rate of cryptocurrencies

Miners receive income in those coins that are mined. It is difficult even for professional analysts to make a long range forecast of quotes.

The prices of coins are unstable. In the history of the market, Bitcoin has adjusted by more than 80% three times. This was followed by periods of consolidation, which lasted 2-3 years. During such periods, miners suffer losses. Large market participants continue mining as long as they manage to earn money for electricity. Users who do not have a stock of resources are forced to stop working due to high costs.

Possible problems with premises and electricity

Many miners start working at home. But for a significant income, you need powerful equipment that gets very hot and noisy. The electrical wiring of a typical apartment is not designed for such consumption, so the risk of fire is high. In this regard, in 2022, lawmakers are preparing a project to ban mining in apartments.

The room for cryptocurrency mining should be well equipped:

- Install cooling (water or air conditioning).

- Create heat and noise insulation.

- Conduct quality wiring with power reserve.

Modernization of communications is a complex and costly undertaking. For the duration of the work, it is necessary to stop mining. Equipping the room for mining will cost 1-2 million rubles. For the installation of farms can not be used:

- Bomb shelter – in case of emergency, it will have to be released in less than 24 hours.

- Office – vibrations will spread throughout the building.

- Basement – due to humidity and risk of flooding.

Also, do not install equipment on floors above the first floor because of the heavy load on the floor and difficulties with the installation of cooling. The best option is a garage or a separate storage room. It should be borne in mind that retrofitting a building for a powerful farm will cost at least 1 million rubles. Only large miners can afford such expenses. Beginners are easier to rent cells in data centers.

The noise level of an asic is up to 100 dB. This can be compared to the volume of a vacuum cleaner and a perforator. Such equipment should be kept in an isolated room.

Conclusions

Mining digital currencies is a risky business. The success of the enterprise is influenced by a large number of factors (network complexity, hash rate, the possibility of overclocking equipment and others). Before working, you need to assess the risks. Without a detailed business plan, there is a high probability of losing money. The main advantages and disadvantages of mining are collected in the table.

| Pros | Minuses |

|---|---|

| Simple start: you can rent capacity with minimal investment or buy a ready-made business. | High volatility of cryptocurrency rates. The prices of coins affect the income and the cost of equipment. Make an accurate forecast can not even professionals. During periods of strong corrections, miners work only to pay for electricity. |

| Passive income: the equipment operates in automatic mode. It is only necessary to carry out preventive maintenance | High prices for equipment. The complexity of mining is constantly growing, so miners are forced to constantly update components. |

| Opportunity to increase income: it will be possible to overclock the equipment, to mine 2 coins at once or to purchase additional capacity. | Lack of legal framework may lead to a ban on crypto mining in Russia |

| A separate room or hosting is required to set up a farm |

Even in the bear market of 2023, cryptocurrency mining remains a profitable business. Many miners see the fall of bitcoin to $18-20 thousand as an opportunity to increase capacity. Since the start of the cryptozyme in October 2021, the Bitcoin network hashrate has increased by 54.6% (from 159.3 E to 246.3 E).

Frequently Asked Questions

⏳ Should I start mining in 2023?

You need to evaluate the pros and cons of mining digital assets. Some miners believe that the cryptocurrency market is collapsing. This means that in 2022-2023 there will be minimal prices for equipment.

🏠 Is it possible to mine cryptocurrency in an apartment?

Many professionals started with garage mining. But a large income requires powerful equipment that is very warm and noisy. Installing equipment in a room without power cables is an increased risk of fire.

💸 How much can you earn from mining coins in 2023?

According to the calculations of 2CryptoCalc, a rig of 6 powerful video cards in RVN mining brings $9-11 per day. The payback period of the technique will be 1.5-2 years.

📚 Do you need special knowledge for mining?

It is desirable to understand the basics of blockchain and understand electrical engineering, but it is not necessary. Data centers sell equipment with accommodation and service.

❓ What is the minimum investment required for mining?

In 2023, tech prices have dropped. A farm of 6 video cards costs on average 280-310 thousand rubles, 1 ASIC – 500-800 thousand rubles. The minimum threshold for renting capacity in cloud mining services is $100.

Error in the text? Highlight it with your mouse and press Ctrl + Enter

Author: Saifedean Ammous, an expert in cryptocurrency economics.