Software updates make applications more functional and secure. Due to its decentralized nature, changes to the blockchain code require the consent of all participants responsible for security – miners, validators, holders of full nodes. If part of the community does not agree with the updates, the network splits – there are 2 cryptocurrencies that work according to different rules. In the review we will tell you what types of Bitcoins exist. Some forks of the first cryptocurrency (Bitcoin Cash, LTC) are in the top 100 popular coins.

Types of Bitcoin

Bitcoin came into existence in 2009. A community of crypto-enthusiasts formed around the first cryptocurrency and they certainly supported the technology. However, programmers later started making changes to the BTC code to improve its performance. Satoshi Nakamoto initially envisioned updates to the blockchain, so he released the first client under version 0.1.0.

Code changes were not a problem when the community consisted of a small group of enthusiasts. But as capitalization grew, major upgrades became impossible to make without full agreement.

Any developer can make suggestions to modernize the network (BIP – Bitcoin Improvement Proposal). After the vote of miners, the initiative will be included in the next release. Forks (forks) can differ significantly from the original network in their characteristics – have a different block size, consensus algorithm, greater scalability or transaction speed.

Hardforks

Most updates fix minor bugs, so they don’t require large-scale transformations in the blockchain. But sometimes hardforks – critical changes to the code – are made. To accept them, you need to update the software of all participants in the network.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

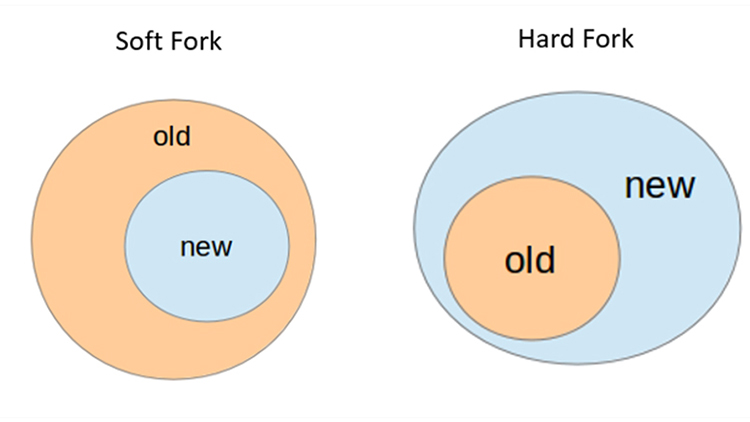

Hardforks are backwards incompatible – the new version does not accept transactions supported by the old one.

Nodes that have not accepted the changes cannot handle transactions under the new rules. This is how 2 versions of the blockchain are formed – one supports the update, the other does not. Usually, most miners and validators move to the new network. This allows the stability of the protocol to be preserved. The original chain is not exposed to the risk of failures when updating.

Softforks

This change is characterized by backward compatibility – updated nodes can handle transactions on the old version of the network. Softfork does not affect the basic parameters of the underlying blockchain. Therefore, support for most nodes is sufficient for stable operation. This distinguishes a softfork from a hardfork, which requires 100% acceptance of the new rules by miners and validators.

Popular BTC hardforks

Over the 13 years of bitcoin’s existence, developers have constantly strived to improve the original blockchain. There have been hundreds of attempts at BTC hard updates. Most of them were unsuccessful.

In 2023, several dozen hardforks of the first cryptocurrency support work.

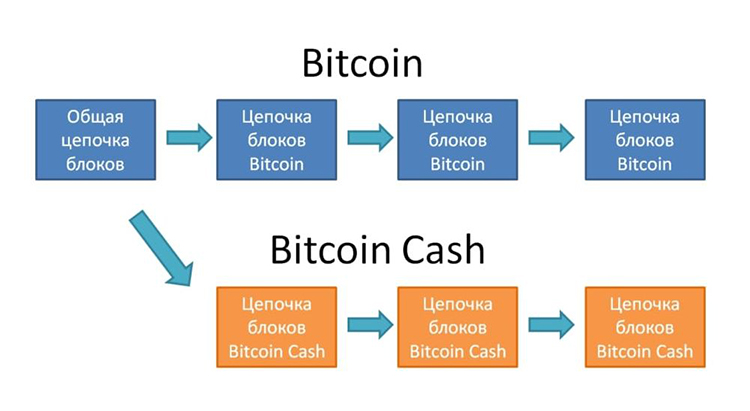

Bitcoin Cash

In 2023, it is the most famous Bitcoin hardforks, although far from the first. The new chain appeared in 2017. Bitcoin Cash has these advantages over BTC:

- Higher transaction processing speed.

- Lower transaction fees.

- More memory than bitcoin.

- Uninterrupted network operation.

- SigHash consensus algorithm is implemented, which avoids double-spending coin attacks.

In 2023, Bitcoin Cash is traded on major crypto exchanges (Binance, Huobi, Coinbase and others). The asset can be stored in bitcoin wallets (Blockchain, Coinomi).

Bitcoin Gold

The Lightning ASIC mining group (Hong Kong’s largest pool, led by Jack Liao) was concerned about the ever-increasing complexity of the Bitcoin network. The community believed that users should have the ability to mine Bitcoin on a home PC. Developers realized this idea in the Bitcoin Gold (BTG) coin.

The cryptocurrency uses an ASIC-protected Equihash hashing algorithm, so Bitcoins can only be mined on video cards. Due to the availability of mining, developers managed to provide the highest level of decentralization.

Bitcoin Diamond

The creators of the fork sought to make Bitcoin more anonymous, as well as to solve other problems of the blockchain – slow and expensive transactions. To do this, the developers implemented the following solutions:

- Changed the base of the encryption algorithm.

- Increased the block size to 8 MB.

- Increased coin issuance by 10 times.

- Increased the speed of block creation.

To support the project, the team created DeFi marketplace. Participants can trade using the BTD cryptocurrency.

Popular Bitcoin softforks

“Soft” updates to the blockchain do not require a software reboot. Therefore, some users who do not follow the news of the crypto market may not be aware of the next change to the network. A few of the biggest updates to BTC functionality can be highlighted.

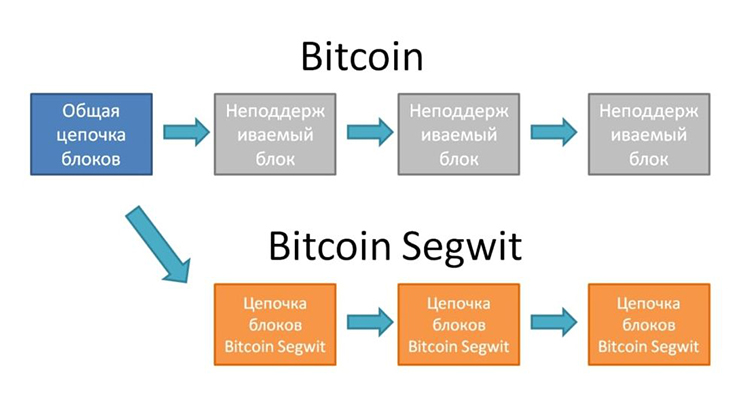

Segwit

This update to the Bitcoin protocol is launched to solve the problem of malleability and increase the speed of transactions. For this purpose, the developers increased the number of transaction records, but kept the block size (1MB). Signatures were separated into a separate segregated witness structure. This allowed to increase the network capacity by two times at once.

Segwit introduced two new types of scripts for sending and receiving coins and the bech32 encoding scheme. Transactions became faster. The activation of softfork caused controversy in the community. Some users still have not accepted it. However, full support for all nodes is not required. In 2022, 90% of wallets and platforms have adopted Segwit.

Lightning Network

A test version of the protocol launched in 2018. Lighting Network is a layer 2 solution that represents a network of payment channels between clients. The developers aimed to increase the bandwidth of Bitcoin. This was achieved by deploying smart contracts in the add-on.

With Lightning, Bitcoin users can make micropayments with a commission of 1 satoshi. This data is not recorded in the public registry until the participant decides to close the channel. After that, all transactions are merged and confirmed on the main network as one. This reduces the amount of information stored.

The Lightning Network is a necessary compromise to reduce fees, increase transaction speed, and preserve the decentralization and security of the underlying blockchain. Theoretically, there is no limit to the scaling of a second-level blockchain. Its developer Joe Kenjiki is confident that the blockchain can process millions of transactions per second.

In the fall of 2022, Lighting Network works with Blue Wallet, Wallet of Satoshi, Muun, and Phoenix. Microtransfers are supported by Kraken, Bitfinex, OKX, OKCoin exchanges. According to the 1ml service, the network is managed by more than 17k nodes and has a capacity of 4.9k BTC.

Lighting Network is being integrated into their platforms by large companies. For example, MicroStrategy has included in its plans to develop an authentication wallet using the protocol.

The main types of cryptocurrencies

In the fall of 2022, more than 13 thousand coins are traded on the market of digital assets. With the development of technology, this list will continue to grow. Cryptocurrencies can be divided into several groups:

- Decentralized and pseudo-decentralized.

- Depending on the generation.

- According to the type of appearance.

- Depending on function.

Decentralized and pseudo-decentralized

In a traditional banking system, all monetary transactions are under the control of a regulatory authority. Funds in the account can be blocked for violating the rules. In a decentralized ecosystem, restrictions cannot be imposed due to the absence of a controlling server. Bitcoins exist on the principle of a distributed network. Each user has a copy of the register – this ensures that the network is independent from the actions of individuals.

Decentralized cryptoassets have these features:

- Any user can obtain information about the transactions performed.

- Transactions cannot be canceled or adjusted.

- More than 50% of the computing power must be possessed to attack the network.

However, these characteristics do not apply to all cryptocurrencies. For example, some tokens (the most popular is BNB) operate on the Proof-of-Stake Authority (PoSA) consensus algorithm. Transactions are validated by trusted validators rather than regular users. The algorithm selects 21 nodes. Theoretically, validators can collude and modify transactions. Pseudo-decentralized varieties of BTC have other features:

- Controlled issuance. Mining is not available, only developers can issue new tokens.

- It is possible to cancel transactions. The chain is managed by a group of individuals who adjust transactions if necessary.

- There is a risk of account blocking. The most liquid stablecoin – USDT is managed by Tether Limited. The user’s wallet address can be added to a blacklist at the request of law enforcement.

Depending on the generation

As decentralized assets evolved, the technology improved. In 2023, several generations of digital currencies can be distinguished. More details about each are described in the table below.

| Generation | Commentary |

|---|---|

| Blockchain 1.0 | Cryptocurrencies issued in 2011-2013 (BTC, LTC) belong to this group. Users were already able to transfer coins without the involvement of banks. But the application of tokens in everyday life was limited by the low bandwidth of blockchains. For example, Bitcoin performs 7 transactions per second. |

| Blockchain 2.0. | A new stage in the development of blockchain technology was the emergence of smart contracts in 2015. The terms of the transaction are prescribed in advance by the developer. After their fulfillment, coins are transferred automatically. This type of Bitcoin includes all cryptocurrencies running on the etherium EVM (Polygon, Near) virtual machine. |

| Blockchain 3.0. | Blockchain technology can be used in other areas as well. For example, to host information (instead of cloud storage). The development of this direction will require high transaction speed and low commissions, protection of user privacy, compatibility of different projects. The most promising coins of this generation are ADA, DOT. |

Varieties of tokens

Unlike fiat money, records in a distributed registry can perform different functions. Digital assets can be divided into such categories:

- Currencies Coin. These coins are used for settlements. The most famous cryptocurrencies are BCH, XMR, LTC, BTC.

- Platforms Coins. This type includes coins that play a central role in decentralized projects (ETH, ATOM).

- Cryptocurrency Exchanges. Cryptocurrency exchanges issue native tokens that give holders benefits (bonuses, commission discounts, participation in new coin giveaways, and others). The most popular in 2023 are BNB, HT, and UNI.

By type of appearance

Cryptocurrencies are distinguished by the method of issuance. Coins are issued in these ways:

- Mining. To get digital currency, you need to perform complex cryptographic calculations. Bitcoin, Litecoin, Bitcoin Cash and other assets are mined in this way.

- Staking. New tokens are accrued in proportion to the validators’ shares. This is how Solana, Cardano, Toncoin work.

- ICO. Developers release the entire volume of the asset at once. Coins are distributed among investors and partners. Through ICO tokens THETA, EOS, MINA, ICP and others are released.

Frequently Asked Questions

✅ Where to store Bitcoin forks?

You can use multi-currency wallets that support several versions of BTC at once. Exodus, Trust Wallet, Ledger Nano, and Coinbase are popular in 2023.

💰 How to get coins after BTC update?

The easiest way to do it is on the major exchanges. You need to look at the list of platforms that support the upgrade and keep the coins in your account until the fork. New coins will be credited to the account at a 1:1 ratio.

🤔 What is a layer 2 network?

L2 (superstructure) technology is an additional blockchain built on top of the main blockchain. Layer 2 networks extend the capabilities of the main chain and work in parallel with it. L2s cannot exist separately from the main protocol.

😎 Who benefits from Bitcoin forks?

Developers of all kinds of Bitcoin are people who disagree with the policies of most programmers of the main cryptocurrency. Some seek to improve the technology, others – to capitalize on the growth of the coin, if the initiative gets the support of the community.

❔ Why do users oppose the modernization of Bitcoin, since the blockchain is becoming more functional?

Some community members believe that the coin should remain as Satoshi Nakamoto created it, without significant changes.

Is there an error in the text? Highlight it with your mouse and press Ctrl + Enter

Author: Saifedean Ammous, an expert in cryptocurrency economics.